Bitcoin Recovery Supercharges Crypto Funds to $1 Billion+ Valuations Again

Crypto investment and venture capital firms are benefiting from crypto's latest rally.| Source: Shutterstock

By CCN.com: In the past 24 hours, the bitcoin price has increased by just over 1 percent against the U.S. dollar, extending its year-to-date (YTD) gain to 44.27 percent and leading the crypto market to recovery.

Despite the controversy around Tether, which understandably intensified when Stuart Hoegner, the general counsel to Tether and major bitcoin exchange Bitfinex, disclosed in an affidavit that Tether is only backed 74 percent by its cash reserves, bitcoin has rebounded strongly in the past week.

“As of the date [April 30] I am signing this affidavit, Tether has cash and cash equivalents (short term securities) on hand totaling approximately $2.1 billion, representing approximately 74 percent of the current outstanding tethers,” the affidavit read.

The momentum of bitcoin that led the dominant cryptocurrency to surge from $3,150 to over $5,300 within 2 months has allowed major crypto investment firms to achieve $1 billion+ in assets under management again.

Grayscale Taking the Lead in Crypto

On May 1, Grayscale, an investment firm which operates as a subsidiary of Digital Currency Group, arguably the most influential venture capital firm in the crypto industry, said that it has achieved $1.3 billion in assets under management.

Grayscale oversees regulated products and investment vehicles such as the Bitcoin Investment Trust and Ethereum Classic Investment Trust that enable investors in the public market to invest in crypto assets in a regulated and protected environment.

The assets under management of Grayscale represent the inflow of capital from accredited and institutional investors into the firm’s crypto asset investment vehicles, most of which are traded on OTC Markets.

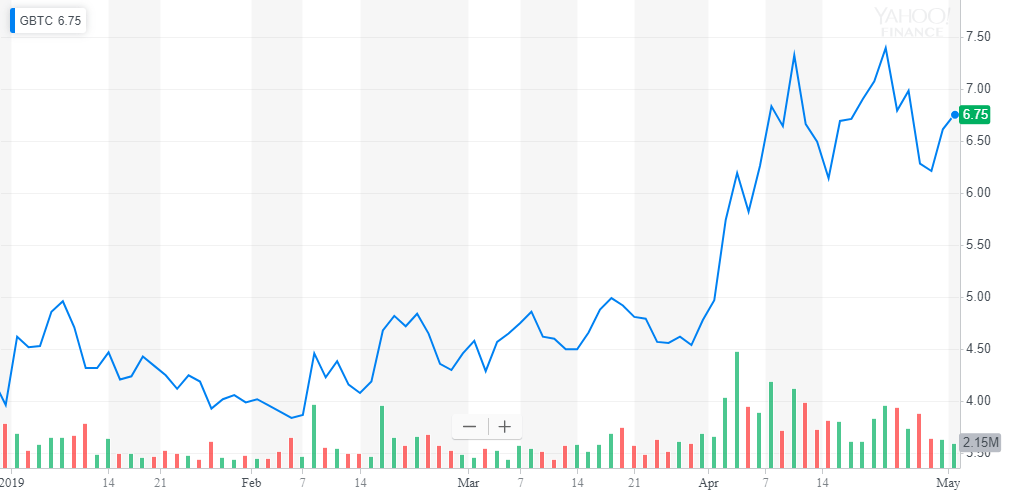

The Bitcoin Investment Trust, for instance, which is traded with the ticker GBTC, is often utilized by accredited investors in the U.S. market to invest in bitcoin without having to worry about the risks of storing bitcoin.

Due to the elimination of most risks, GBTC is typically traded with a relatively large premium. As of May 2, GBTC is traded on OTC Markets at $6,631, around 25 percent higher than the spot price of bitcoin on exchanges.

The large premium on GBTC suggests that while the growth of the crypto market had noticeably slowed down in 2018 following an 80 percent drop in the bitcoin price, the demand for the asset class is beginning to rise once again.

Pantera Capital, the first billion-dollar crypto asset investment firm, has also raised new capital to near the completion of a new $175 million fund, the third venture fund for the firm.

In March, Pantera Capital said that the firm has already raised $160 million of the $175 million and has invested in 11 portfolio companies with an average deal size of $3.5 million.

The firm said :

We have raised $160mm of the $175mm target for Venture Fund III. We’re wrapping up the final close this month.

The Fund has already invested $38 million into 11 portfolio companies. We project making a total of 35 investments, with an average deal size of $3.5 million, and an 11% target average equity stake. Pantera has led five of the investments so far. Two of the deals have been follow-on rounds in existing portfolio companies.

Confidence is Rising, Will Bitcoin Continue to Perform?

Amidst a 17-month bear market, investment firms are quite aggressively funding emerging projects, companies, and infrastructure-building teams to strengthen the crypto market.

The confidence may have arisen from the solid recovery of bitcoin since January and if the asset continues to show momentum throughout 2019, the inflow of capital into the industry is expected to increase.