Bitcoin Price Stabilizes in $11,000 Region, as it Recovers From Correction

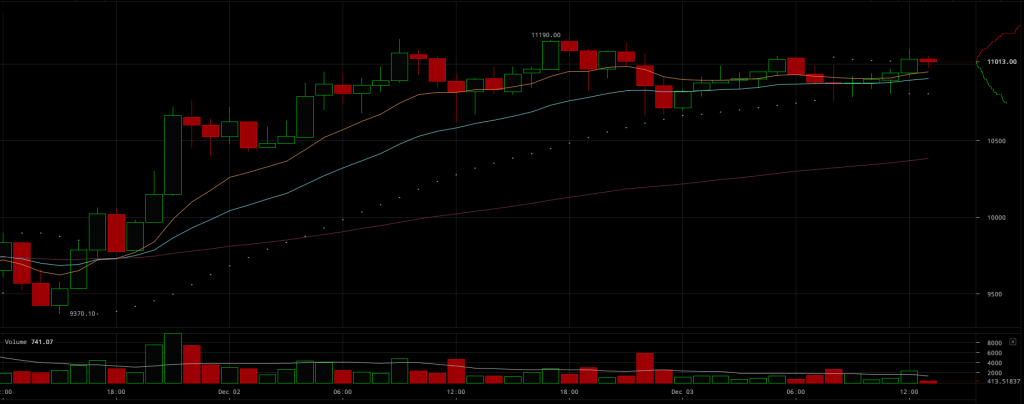

The bitcoin price has fully recovered from its most recent major correction in which it fell from $11,441 to $8,800.

Bitcoin Recovers to $11,000, Preparing a New Rally?

Given the tendency of the bitcoin price to endure a major correction after achieving a new all-time high and recovering back to its previous all-time high, the bitcoin price is currently in an optimal position to sustain upward momentum and gear towards a new rally.

Over the past few days, the daily trading volume of bitcoin has also stabilized in the $5 billion region. During strong rallies, the daily trading volume of bitcoin tends to spike up to over $10 billion and decline by more than 50 percent as the market becomes stable. The US market has also recently overtaken the Japanese bitcoin market, becoming the largest bitcoin exchange market with approximately 30 percent of the global bitcoin market share. Well regulated exchanges such as Coinbase’s flagship trading platform GDAX and Bitstamp have started to lead the global bitcoin market.

It is important to acknowledge that the demand for bitcoin from the US and its traditional finance sector is increasing at a rapid rate due to the announcement of the world’s largest financial institutions to engage in bitcoin trading in the upcoming weeks.

On December 2, JPMorgan global markets strategist Nikolaos Panigirtzoglou stated that bitcoin futures will add legitimacy to the cryptocurrency, which already has a market cap of over $186 billion.

“The prospective launch of bitcoin futures contracts by established exchanges in particular has the potential to add legitimacy and thus increase the appeal of the cryptocurrency market to both retail and institutional investors,” said Panigirtzoglou.

He further emphasized that bitcoin has the potential as a new asset class to transform the global finance sector by providing a robust store of value, an alternative to the fiat currency system and gold.

“In all, the prospective introduction of bitcoin futures has the potential to elevate cryptocurrencies to an emerging asset class. The value of this new asset class is a function of the breadth of its acceptance as a store of wealth and as a means of payment and simply judging by other stores of wealth such as gold, cryptocurrencies have the potential to grow further from here,” Panigirtzoglou added.

As Bitcoin Futures Launch, Bitcoin Volumes Will Increase

Upon the December 18 launch of CME’s bitcoin futures exchange, the trading volume of bitcoin will likely surge, along with its price. In the mid-term, analysts expect the price of bitcoin to surpass $14,000, as billions of dollars flow into the bitcoin market.

In the long-term, as CCN.com reported, investors like billionaire hedge fund legend Mike Novogratz see the bitcoin price surpassing $40,000 by the year’s end, as herds of institutional investors move into the bitcoin and cryptocurrency markets.

“There’s a big wave of money coming, not just here but all around the world. What’s different about these coins than other commodities … there is no supply response here. So it’s a speculator’s dream in that as buying happens there’s no new supply response that comes up,” said Novogratz.

Featured image from Shutterstock.