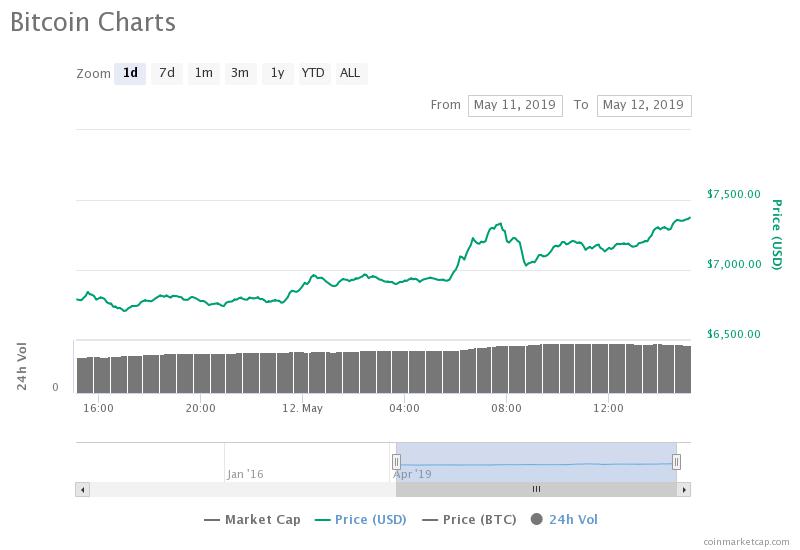

Bitcoin Price Smashes $7,500 With Spectacular Return of Bull Market

| Source: Shutterstock

By CCN.com: The crypto market has made a spectacular return as it added $28 billion in the past 48 hours. The bitcoin price surged past $7,400 and hit a new 2019 high, marking the start of a new bull market.

In many major markets, the volume of bitcoin has returned to the late 2017 level with the “real 10” daily spot volume of bitcoin surpassing $1.9 billion.

The “real 10” volume calculates the daily volume of BTC using ten exchanges that have more than $1 million in legitimate volume. In March, the “real 10” volume was estimated to be around $270 million.

Why is Bitcoin Rising so Rapidly?

Alex Krüger, a global markets analyst, said that the recent rally of BTC was initiated without the involvement of the mainstream.

The upward momentum of the crypto market in the past three days was likely caused by existing capital within the crypto market moving into major crypto assets, rather than new money flowing into the market.

In April, Three Arrows Capital CEO Su Zhu estimated the amount of fiat that exists within the crypto market ready to be allocated to crypto assets is hovering at around $6 billion.

“Theres an estimated $2B in cash sitting at crypto funds/holdcos. Theres another $2B+ sitting in stablecoins, and another $2B sitting at exchanges/silvergate/signature. This is $6B fiat already onboarded to crypto to buy your bags. Imagine thinking we need new money to hit $10k,” Zhu said .

Investors within the crypto market are likely to have triggered the recent run of bitcoin, which was further fueled by the liquidation of shorts on major crypto exchanges that led to a proper short squeeze.

Does the Market Have Fuel Left?

Following a staggering $28 billion recovery and a 30 percent rally by bitcoin in a span of a week, some traders have expressed concerns over the lack of clear stimuli that could sustain the current bull run of crypto assets throughout the near-term.

One cryptocurrency trader suggested that the CME bitcoin futures market, which closed at $6,290 on Friday, could further intensify the momentum of the market as it opens on Monday.

The trader said :

CME BTC bitcoin futures closed at 6290 on Friday. Tomorrow (Sunday) at 18:00est is the market open, mark your calendar, it will be lit.

Just so you have an idea, on every tick ($5) move is $25 for every contract you are holding. If you had an outright (no hedge) short at the close and we open at the price above you are down $4,300 for every contract you are holding. Friday volume was about 6,500 contracts.

For context, although the bitcoin futures market has been largely dismissed in the past year due to the presence of fake volumes in the crypto market, in March, Bitwise Asset Management estimated the futures market to account for around 35 percent of bitcoin’s volume in early March.

If the futures market opens with a strong fear of missing out (FOMO) from investors that observed the parabolic rally of the dominant cryptocurrency over the weekend, it may serve as a potential near-term stimulus for the asset.