Bitcoin Price Rages Beyond $5,600 to Hit New 2019-High; New Rally Boom?

Bitcoin price has crossed the $5,500 milestone for the first time in five months. | Source: Shutterstock

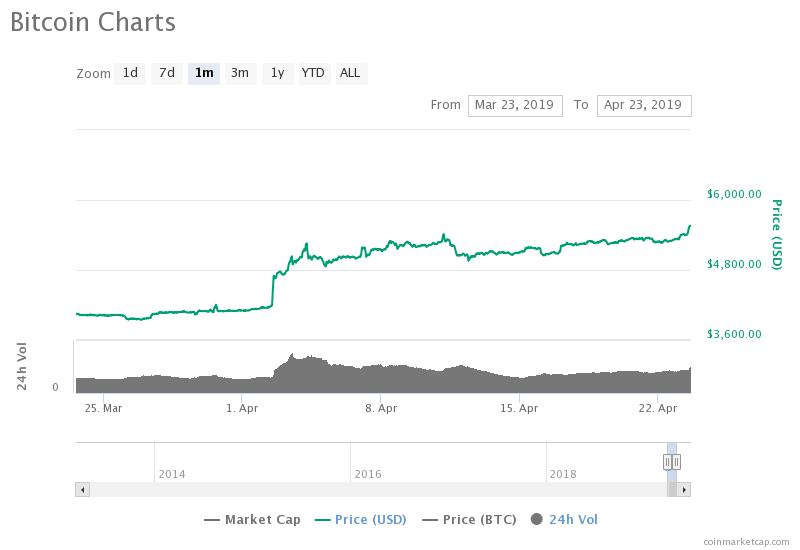

By CCN.com: Throughout the past 24 hours, the bitcoin price has recorded an increase of 4.3 percent, surging from around $5,280 to $5,630.

In the past month, in less than 30 days, the bitcoin price has surged from $3,900 to $5,630, by nearly 40 percent.

Various technical indicators including long-term indicators such as the moving average convergence divergence (MACD) and exponential moving average (EMA) have shown a trend reversal when bitcoin first crossed $5,000, further fueling the momentum of the dominant cryptocurrency.

Is a New Bitcoin Rally Inevitable?

On Monday, as CCN.com reported, a cryptocurrency trader known to the community as “Crypto Rand” said that a move for bitcoin to $6,000 is likely based on the short-term performance of bitcoin in April.

Throughout April, many traders were cautiously optimistic in regards to the price trend of bitcoin because of its strong rally during the first week of the month wherein BTC surged 20 percent against the U.S. dollar.

The majority of traders were uncertain whether the momentum of the cryptocurrency market can be sustained in the near-term, especially given that both bitcoin and the rest of the cryptocurrency market recorded large gains merely two weeks ago.

In March, exclusively speaking to CCN.com, cryptocurrency technical analyst DonAlt said that if bitcoin moves beyond $6,000, it would be a convincing signal that the dreaded 16-month bear market of cryptocurrencies is over.

“Volume isn’t what will convince me that the bear market is over, a bullish market structure along with a break of at least $4.6k (Favorably $6k) is. It’s interesting that we’ve had so many altcoin pumps while the general market cap hasn’t really changed. That makes me think there is very little new money coming in,” DonAlt said.

If the bear market comes to an end with bitcoin’s breakout of $6,000, it may trigger an accumulation phase and enable the market to climb gradually to 2018 levels.

But, for the cryptocurrency market to prevent from dropping to the $3,000 to $4,000 range once again, ProChain Capital president David Tawil explained that it is of the utmost importance for the market to move upwards slowly.

“It’s nice to see a positive move as opposed to a negative move, certainly. But at the same time, for investor purposes, it’s not a particularly comforting move. Certainly, an investor would much rather see a gradual rise with constant floors in terms of downside being established, as opposed to a very, very quick run-up. It could easily be easy come, easy go,” he added .

Real Volume is Rising Rapidly

In March, in a presentation to the U.S. Securities and Exchange Commission (SEC), Bitwise Asset Management estimated the daily spot volume of bitcoin to be at around $270 million.

As of April 23, the real volume of bitcoin remains above $692 million, up a staggering 156 percent since last month.

The real volume of BTC is calculated by evaluating the volume processed by exchanges with verifiable volumes such as Coinbase, Bitfinex, Binance, and Kraken, and it demonstrates real demand for and interest in the asset class.