Bitcoin Price Hits $2,900 After Market Correction, $3,000 imminent

Bitcoin price surpassed the $2,900 mark in most major bitcoin exchange markets after recovering from a minor market correction earlier this week.

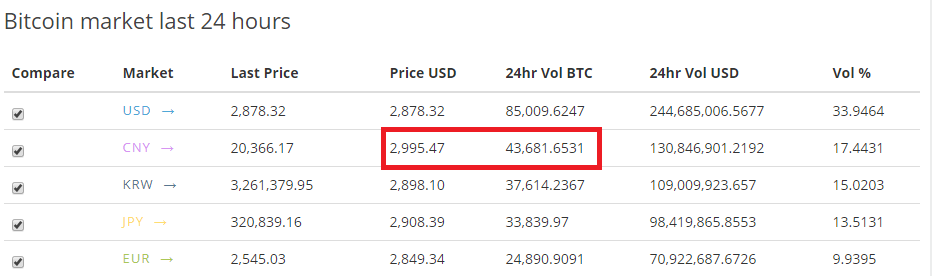

Chinese and Japanese bitcoin exchange markets are trading bitcoin at above $2,900 while US and South Korea are moving toward the $2,900 region. Chinese bitcoin exchanges have already reached the $3,000 mark, recording a new all-time high price for bitcoin.

Over the past few weeks, bitcoin has received more mainstream media coverage than it ever did. Interests peaked higher than 2013, when various measures such as Google Trends showed that demand and interest toward bitcoin were at an all-time high.

Mainstream media outlets including the Wall Street Journal, Financial Times, CNBC, Bloomberg, Australia’s ABC news, Germany’s largest newspaper Suddeutsche Zeitung and South Korea’s leading newspaper Chosun have started to offer extensive coverage of the recent rally of bitcoin price and intricacies of the technical aspect of bitcoin, such as scaling.

CNBC analysts including Jim Cramer told millions of viewers that bitcoin price could reach $1 million in the future while Wall Street Journal has been frequently featuring bitcoin on its front page, comparing bitcoin price to that of gold and USD.

More importantly, the Wall Street Journal also has been printing full-page bitcoin coverage on its front page, attracting conventional investors and the public to bitcoin.

https://twitter.com/iamjosephyoung/status/872907523631611904

In a more technical sense, the recent rally of bitcoin price can be attributed to the stabilization of the Chinese bitcoin exchange market. When China’s central bank the People’s Bank of China temporarily suspended bitcoin withdrawals on major bitcoin exchanges, bitcoin price in China sharply dropped. Traders and investors began to trade bitcoin at a value $500 lower than most exchanges.

However, as the Chinese market recovered and became the second largest bitcoin exchange market by surpassing the trading volumes of Europe, Japan and South Korea and secured a 17 percent market share, bitcoin price started to bounce back and the global market stopped demonstrating high premium price for bitcoin.

Specifically, the South Korean exchange market demonstrated extreme premiums prioir to the recovery of the Chinese market. When bitcoin was being traded at around $2,600, bitcoin price in South Korea surpassed $4,000. Now, South Korea and Japan, the two markets that previously showed premiums, are trading bitcoin at the global average price.

In a previous coverage, CCN.com reported that chief information officer of Korbit told Adamant Research editor in chief Tuur Demeester that bitcoin price premium exists in South Korea due to strict anti-money laundering (AML) policies and capital controls.

“Talked to the chief information officer of [the South Korean exchange market’s] 2nd largest exchange, says that capital controls are making price arbitrage difficult,” said Demeester.

As the global bitcoin exchange market stabilized, bitcoin price premium in South Korea gradually dematerialized, bringing more stability and liquidity to major markets.

Currently, the community is anticipating on bitcoin scaling talks led by Bitcoin Core developers and the group of 58 companies led by Barry Silbert’s Digital Currency Group (DCG). Bitcoin’s short and mid-term price trend will likely be affected by progressing scaling talks.

Bitcoin Core developers and experts including Eric Lombrozo and Adam Back have stated that the community and industry have seen more progress in scaling talks than it did in the past few weeks.

For a real-time Bitcoin price chart, click here.

Featured image from Shutterstock.