Bitcoin Price Falls 5.5% to $4,030: Lack of Momentum Leads to Crypto Pullback

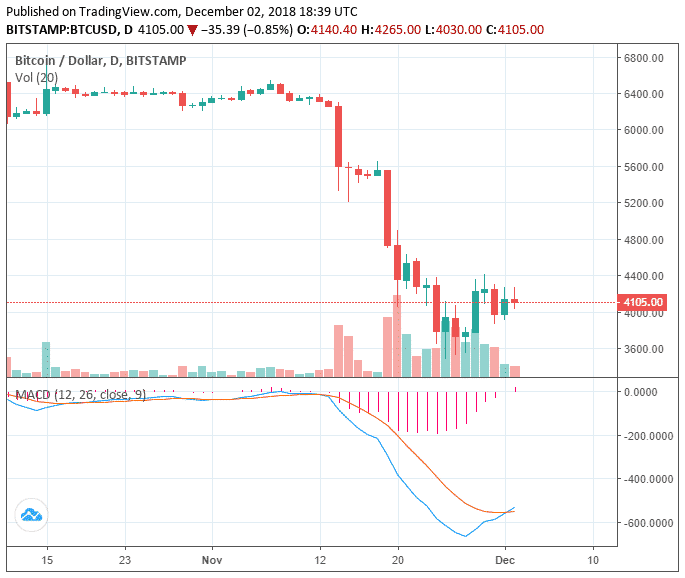

Over the past 24 hours, the Bitcoin price has dropped by more than five percent from $4,265 to $4,030, demonstrating a decline in daily volume.

On fiat-to-cryptocurrency trading platforms like Coinbase and Bitstamp, the dominant cryptocurrency was dangerously close to dipping below the $4,000 support level. A drop below the $4,000 mark could disallow a short-term corrective rally to the mid-$4,000 region in the short-term, several analysts said.

$4,000 is an Important Level

Throughout the past two days, Bitcoin (BTC) has shown some strength in the low range of $4,000 to $4,100, demonstrating the refusal of buyers to enable BTC to drop below a key level.

On December 2, BTC dropped to as low as $4,030 on the day’s lowest point but recovered relatively quickly to around $4,100.

A technical analyst with an alias “The Crypto Monk” stated that if BTC sustains the $4,000 support level in the next 12 to 24 hours, then a rebound to the $4,200 to $4,400 range is possible. But, if it falls below $4,000, and it was close to doing so earlier in the day, another short-term correction could be in play.

“As long as we keep $4,000 level alive, I’m targeting another retest of $4,000,” the analyst said .

Another prominent cryptocurrency trader and analyst, “The Crypto Dog,” added that the positive movement of BTC on December 1 was not a strong and bullish movement. He stated :

“Tread carefully – this pump wasn’t a ‘bullish’ move. The higher we go, the less likely we continue going higher. We’re at the end of a bear market. There is no hope or reason for any bullish moves outside of ranges. Bitcoin is not going to break 6k in the next couple months, period. Very limited upside to playing bull short term.”

Currently, the volume of BTC remains at around $5 billion, down more than $1 billion within a two-day span. As CCN.com previously reported, a decline in the volume of Bitcoin during the weekend was expected, as the entire asset class tends to see a drop in trading activity on Saturdays and Sundays.

Tokens Performing Poorly Again

As the Bitcoin price dropped by a relatively large margin, small market cap tokens suffered once again, recording a daily drop in the range of five to ten percent.

Steem (STEEM) lost more than 12 percent of its value overnight as various reports about the development firm behind the cryptocurrency laying off its employees were released.

Ned Scott, the CEO at Steemit, said:

“While we were building up our team over the last months, we had been relying on projections of basically a higher bottom for the market… Since that’s no longer there we’ve been forced to lay off more than 70% of our organization.”

With increasing regulatory pressure from the US Securities and Exchange Commission (SEC), tokens could continue to see losses against both BTC and the US dollar, despite their large losses in the third quarter of 2018.

Featured Image from Shutterstock. Charts from TradingView .