Bitcoin Price Falls 10% as Cryptocurrency Market Endures Another Big Correction

The bitcoin price has fallen by more than 10 percent over the past 24 hours, as the cryptocurrency market endured yet another major correction for the third time in December.

Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Dash, IOTA, and Others Fall

With one exception in Ripple, major cryptocurrencies in the market including bitcoin, Bitcoin Cash, Ethereum, Litecoin, Cardano, IOTA, NEM, and Monero have all demonstrated a substantial decline in value.

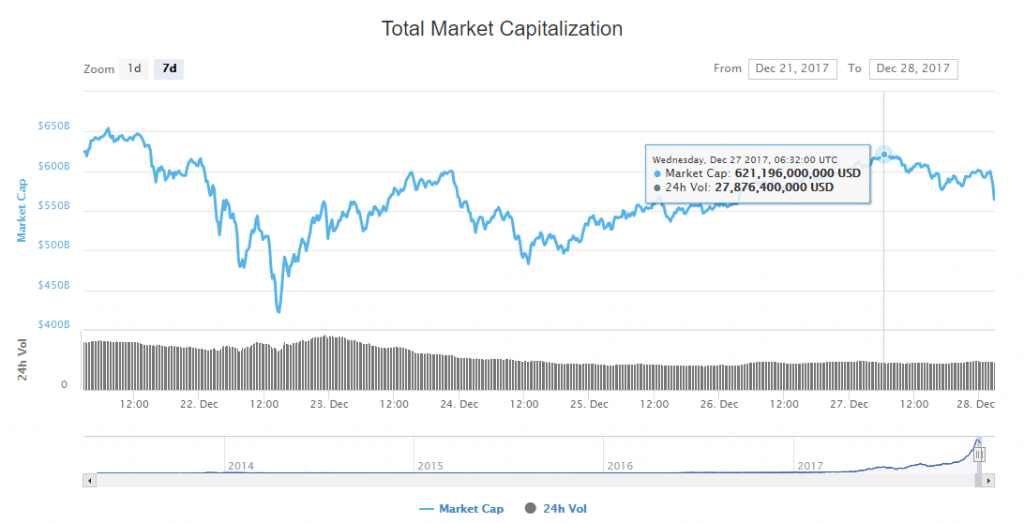

Since yesterday, December 27, the market valuation of cryptocurrencies has plummeted from $621 billion to $567 billion, by nearly $54 billion overnight.

While there was not a major event or driving factor that has contributed to the recent decline of most cryptocurrencies, analysts have attributed the correction to the sudden increase in the value of cryptocurrencies over the past few months.

Some cryptocurrencies like Cardano for instance, have gained over $10 billion in value within months after launch, and the abrupt surge in the valuation of cryptocurrencies in the market have led investors and the market to reconsider the cryptocurrency market’s current valuation.

It is also important to acknowledge that merely three months ago in early October, the market cap of every single cryptocurrency in the market combined was less than $145 billion. Today, bitcoin alone is twice as large as the entire cryptocurrency market cap in October.

Cryptocurrencies are also at an early phase in development and adoption. Inevitably, for many years ahead, digital currencies like bitcoin will remain as hyper volatile assets and for the high volatility rate of cryptocurrencies to decrease, the market will need to mature, develop, and evolve. Until then, 10 percent gains and losses on a single day will likely occur on a regular basis.

Earlier this month, Blocktower’s chief information officer and co-founder Ari Paul, confirmed with CNBC that it was Blocktower that placed a $1 million bet on the US Commodities and Futures Trading Commission (CFTC)-regulated bitcoin derivatives exchange LedgerX that the price of bitcoin will achieve $50,000 by the end of 2018.

During his interview, Paul noted that given bitcoin’s hyper volatile nature, investors should expect the price of bitcoin to fall by large margins, in the same way investors expect the price of bitcoin to surge after major corrections.

“If bitcoin settles anywhere below $50,000 next year, it will expire worthless. But if bitcoin goes to $100,000, it pays 30 to 1 [30-fold]. Bitcoin is volatile. This is a hyper volatile asset. Bitcoin is up more than 1,400 percent this year. It also falls 30 percent almost every other month. These calls are a bet that if its volatile to the upside we can easily see over $50,000 next year,” said Paul.

Where Does Bitcoin Go From Here?

At the time of reporting, even on futures exchanges like the Chicago Board Options Exchange (Cboe) and CME, which have demonstrated high premiums for bitcoin investment for weeks, bitcoin is being traded at below $14,000. That is, more than $600 lower than the global average price of $14,600.

Based on the trend of the cryptocurrency market, analysts expect the price of bitcoin to recover with rest of the cryptocurrencies in the market, as weak hands drop off and long-term holders remain.

Featured image from Shutterstock.