Bitcoin Price Bleeds to Low $6,300 as Investors Carefully Observe Market

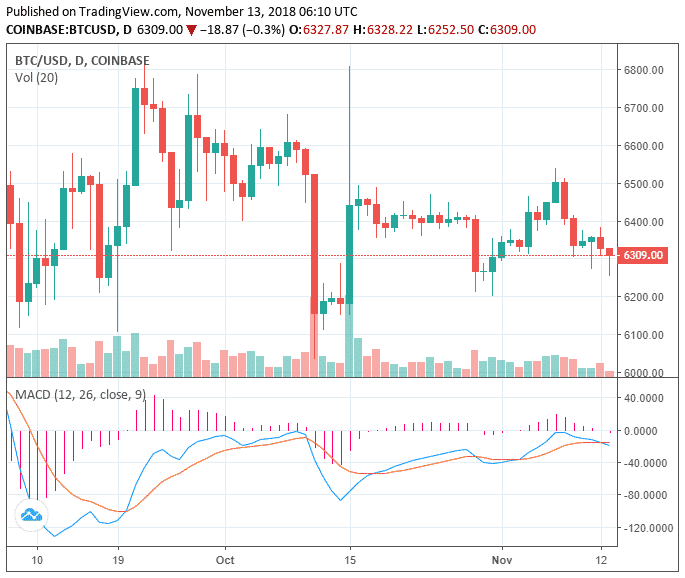

Over the last 24 hours, the price of Bitcoin has fallen from around $6,400 to $6,300, recording two consecutive sell candles on its daily chart.

Although the volume of Bitcoin remains above $4.4 billion, up more than 46 percent from earlier this month when the daily trading volume of the dominant cryptocurrency averaged at around $3 billion, BTC is struggling to sustain momentum in the mid-$6,000 region.

In the short-term, it is highly likely for BTC to retest the $6,200 region unless it swiftly bounces above the $6,450. Given the stability in the crypto market at the $211 billion mark, a breakout above the $6,450 mark within the next 24 to 48 hours is not likely.

“Looking for $6,275 (at least) on this slow bleed, ideally seeing a try to upside after. Resistance at $6,375 region continuing to hold us back on several time frames. Supports at $6,000, $6,200, & $6,275. Resistances above $6,450, $6,650 & $7,400,” Thies, a managing partner at UTR, wrote .

What Happens if BTC Drops to $6,200

Since November 8, BTC has continued to bleed out from the $6,500 mark, unable to secure momentum in the lower region of $6,000. Throughout the past three months, since August 9, BTC has demonstrated stability in mid-$6,000 but in the past two weeks, BTC retested support levels below the $6,300 mark several times, due to high sell pressure.

Often, in a sideways Bitcoin market, small market cap cryptocurrencies and tokens tend to outperform major cryptocurrencies and record decent gains in the range of 5 to 20 percent.

However, as a technical analyst explained , even low market cap cryptocurrencies have started to show a lack of correlation with BTC, possibly because of poor market conditions.

“High cap alternative cryptocurrencies starting to look bearish and not enough low caps are decoupling with BTC. This is by no means an ‘alt season.’ Better setups will likely come on 90% of alts out there, don’t rush into trades right now”

If BTC drops below the $6,300 mark and makes its way towards the $6,100 to $6,200 range, tokens are expected to suffer from short-term downtrend, especially during a period in which the U.S. Securities and Exchange Commission (SEC) is actively cracking down on initial coin offering (ICO) projects considered as security offerings.

NEM Surges 25%

The world’s fifteenth most valuable cryptocurrency NEM, which has performed poorly against both Bitcoin and the US dollar over the past several months, has increased by more than 25 percent fueled by Coincheck’s new opening.

In January, Coincheck was shut down for losing more than $500 million worth of NEM in the largest hacking attack in the history of the cryptocurrency industry. The exchange struggled to obtain a license from the financial services agency (FSA), due to the government’s newly established policies regarding security measures, internal management systems, and anti-money laundering.

Within the past 24 hours, the price of NEM rose from $0.09 to $0.116657, as the best performing cryptocurrency of the day.

Featured Image from Shutterstock. Charts from TradingView .