Bitcoin Price Still Massive 75% Away From Next Bull Peak, Squeals Analyst

Historical charts and trends show bitcoin's bull rally still has a long way up, an analyst has claimed. | Source: Shutterstock

By CCN.com: Since December 2018, within 168 days, the bitcoin price has increased by more than 130 percent year-to-date against the U.S. dollar, engaging in a powerful recovery following its crash to $3,150.

Based on the historical performance of bitcoin and the length of bull markets throughout the past eight years, cryptocurrency trader Josh Rager suggested the likelihood of the bitcoin rally being sustained throughout the next two years.

https://twitter.com/Josh_Rager/status/1134458358814203904

Although the bitcoin price briefly dropped to $8,000 as reported by CCN.com in an unexpected 11 percent drop, many traders have expressed their optimism towards the dominant cryptocurrency on a macro level.

What could push the momentum of bitcoin?

Historically, the bitcoin price has tended to perform strongly a year before and after a scheduled block reward halving.

A block reward halving is a mechanism on the Bitcoin blockchain network that reduces the rate in which new BTC is produced by miners every four years as the supply of the asset closes on its fixed supply of 21 million.

The growing awareness of the block reward halving as well as increasing institutional interest, retail demand, and improving custodial infrastructure could be considered as potential catalysts of bitcoin.

According to the Q1 2019 report of Grayscale, a subsidiary of Digital Currency Group with over $2 billion in assets under management, institutional demand for bitcoin and the rest of the crypto market picked up in the first three months of the year.

“Institutional investors comprised the highest percentage of total demand for Grayscale products in the first quarter (73%). This was also consistent with their share of inflows over the trailing twelve months (73%). As we have mentioned in previous reports, many institutional investors may view the current drawdown as an attractive entry point to add to their core positions in digital assets,” the report read .

Investors anticipate the clear increase in demand for crypto assets by institutions to refuel the interest in the asset class by retail investors, allowing the asset to potentially establish a foundation for a stronger upside movement.

As one trader said, the increasing efforts of bears to restrict the momentum of bitcoin in a clear bull trend demonstrate that the intent of bears is to prove a point that the asset’s bull run is not sustainable rather than evaluating the actual momentum.

“I’m convinced bears hate money, always trying to prove a point. When BTC was tanking yesterday, I sold my portfolio to Tether at $8,550. When it was clear we were bullish, I bought back in at $8,300. I have no prob being short, but we’re here to make money, not prove points,” the trader said .

Crypto market rebounding

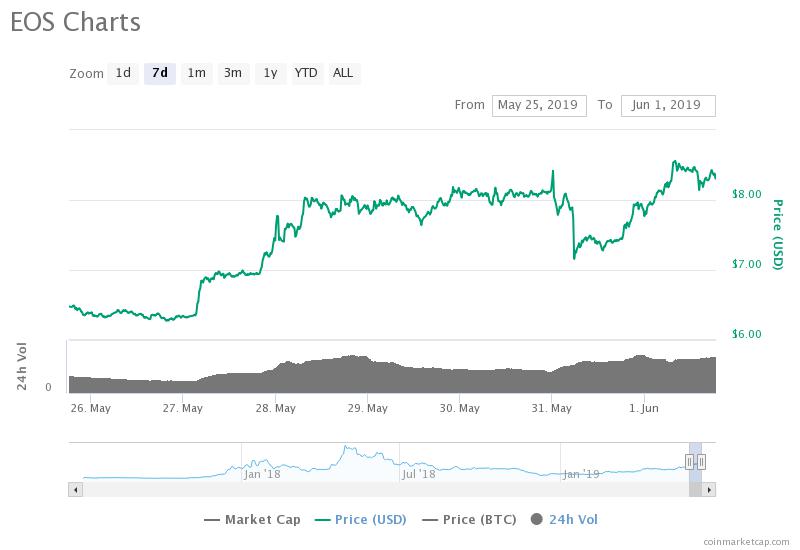

As the bitcoin price recovered to around $8,600 in the past 24 hours, major crypto assets in the likes of Ethereum, EOS, XRP, Bitcoin Cash, Litecoin, and Binance Coin recorded gains in the range of 4 to 10 percent.

Due to the momentum of crypto assets in recent months, industry executives such as Gemini co-founder Cameron Winklevoss have become more confident in the sustainability of the current market trend.

“We talk about going to Mars all the time. We have no limits to our imagination when it comes to space travel. But when it comes to the future of money, curiously many suffer from an acute failure of imagination. The Bitcoin rocket ship is fueling up, make sure to book your seat,” Winklevoss said .