Bitcoin Price Targets $100,000 in ‘No Sweat’ Rally: Max Keiser

Crypto bull Max Keiser says that the price of bitcoin could hit his $100,000 target easily. In fact, six figures is "no sweat." | Source: Shutterstock

Max Keiser is well-known for his bullish, and sometimes outrageous, bitcoin price predictions.

It was only a few days ago that the self-described “tweet poet” endorsed John McAfee’s $1 million bitcoin price prediction, and now he is doubling, or rather tripling down on his own $100,000 estimate.

Max Keiser believes bitcoin can equal gold

Max Keiser has been calling for a $100,000 bitcoin price for a long time, telling everyone to stack the flagship cryptocurrency as it is on track to beat all asset classes thanks to its massive upside potential. The good news is that Keiser’s price prediction is based on a solid plank that a few others on Wall Street will agree with.

Keiser believes that bitcoin will continue running higher because it has the potential to take market share away from gold.

This is not the first time that a crypto bull has said that bitcoin has the potential to replace gold as a safe-haven asset.

Backers such as Fundstrat’s Tom Lee say that the fact that the cryptocurrency has shot up remarkably this year despite the global economic turmoil and the trade wars that the US is waging shows that investors are willing to park their funds in bitcoin to protect capital.

Others, including Block.One’s Brendan Blumer argue that the ease of transfer of bitcoin from one person to another, its divisibility into smaller units, and the fact that one can make both small and big payments using the cryptocurrency make it a good alternative for gold.

Hedge fund chief Mark Yusko estimates that bitcoin could go on to hit a price of $500,000 in the long run.

His prediction is based on the gold market’s capitalization of $7.4 trillion and the fact that the supply of the cryptocurrency will be limited to 21 million coins at most.

But investors have reportedly lost the keys to 23% of the BTC in circulation, which will only aid the cryptocurrency’s rally in the future.

The Fed could be another catalyst

The bitcoin price rally could find another unlikely ally in the form of the Federal Reserve. The central bank’s dovish stance on monetary policy is debasing the dollar, according to Keiser, leading investors to pile into bitcoin.

If the Federal Reserve resorts to quantitative easing in order to meet its spending requirements, it could lead to hyperinflation . The value of gold rises in this scenario. Because bitcoin is supposedly capable enough of replacing gold, its value could keep increasing if the Fed keeps printing more money.

In that sense, BTC is a long-term play.

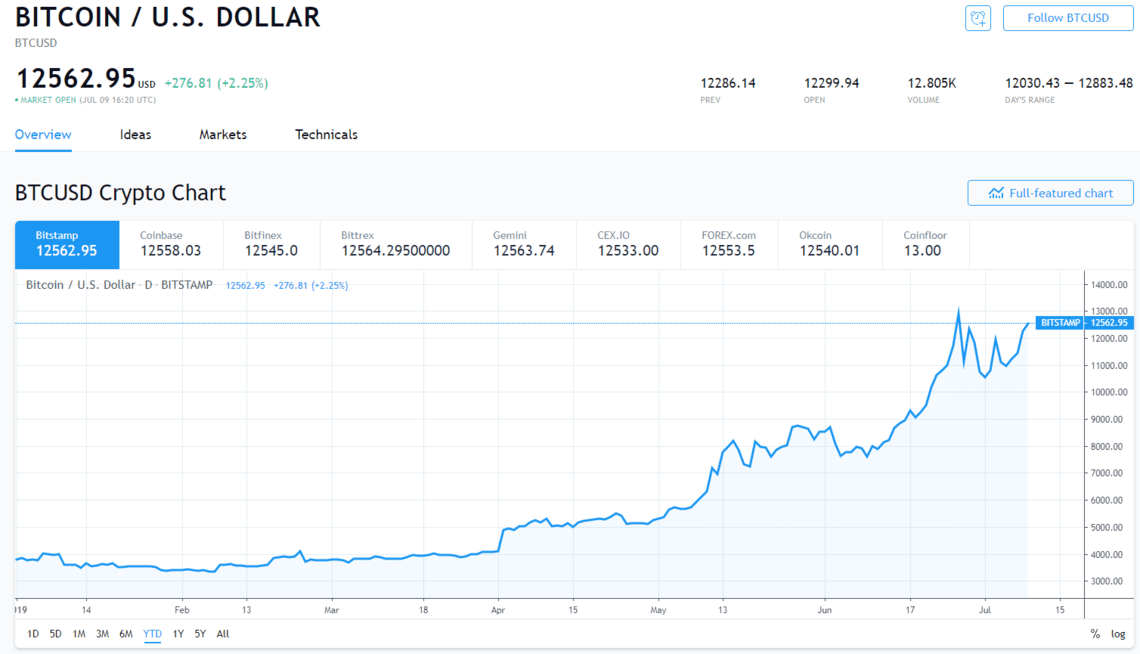

Luckily for present-minded bitcoin investors, the current rally isn’t showing any signs of slowing down. The cryptocurrency is rising once again following a period of volatility and is closing in on the $13,000 mark.

US-China trade tensions and Fed uncertainty could keep the stock market on its toes in the coming days, potentially leading to more crypto inflows.

Click here for a real-time bitcoin price chart.