Bitcoin Opinion: The Bulls Are Back In Town

On my last piece during the previous week, I analysed how the northern hemisphere summer time is usually kind on Bitcoin. Of course there was the 2011-2012 exception, when the entire market was bearish for almost 2 years in a row, but let’s ignore that for now. If we enter a dry season there is nothing to be done except patiently wait for the mercy of institutional money.

For obvious reasons, today we tell a different story.

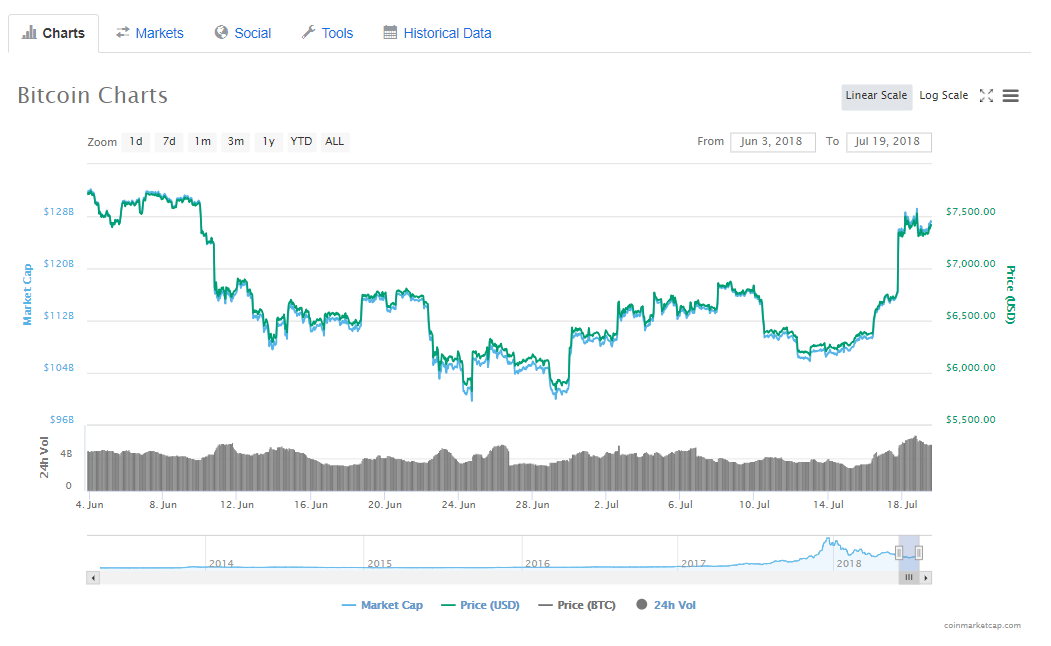

One month after the June mini-bull run, we’re finally starting to see some positive action. New, fresh money is coming into bitcoin and that has given the market a nice pump back into the USD 7400 price level.

Do you know what that means?

–this article shouldn’t be taken as financial advisement as it represents my personal opinion and views. I have savings invested in cryptocurrency so take whatever I write with a grain of salt. Do not invest what you cannot afford to lose and always read as much as possible about a project before investing. Never forget: with great power, comes great responsibility. Being your own bank means you’re always responsible for your own money—

Bitcoin Gone Wild

When the market turns around there are many signs you can check for, in order to have funds available to put into cryptocurrency. I won’t go into much detail about historical prices, as I’ve covered that already, but it’s worth mentioning again the two key factors for success:

- Timing, or better yet, buying/selling at the right time;

- Sentiment, as you need to understand market behavior in order to predict price movements.

If you master both, then you’ll have a fair chance at beating the market.

However, make the correct prediction at the wrong time, and it can cost you your hard-earned cash. Remember what almost happened to Michael Burry? He was absolutely correct when predicting the subprime mortgage crisis, except he thought it would start sooner than what it did.

That tiny miscalculation almost cost him his fortune.

Now, back to what matters.

What’s going on with Bitcoin’s price?

On July 17th, at its lowest, volume was around USD 4,242 Billion. Fast-forward a couple of hours and around USD 1 Billion was added to the market.

This drove Bitcoin prices to rise around 8%, from USD 6700 to USD 7300.

If you’re wondering what or who may have caused this, I really cannot be of much help. Most likely, we can blame the usual culprit: smart-money, so institutional investors, large hedge funds, banks, etc.

When we check some professional traders and investors, like Alessio Rastani, Mati Greenspan or Daniel Jeffries, we can see not only were they hedging in favour of Bitcoin, but also expecting a price movement like the one that just happened.

I’ll do my best to explain how this price action was predicted and how can you leverage that knowledge for the next bull-run.

Never follow dumb-money

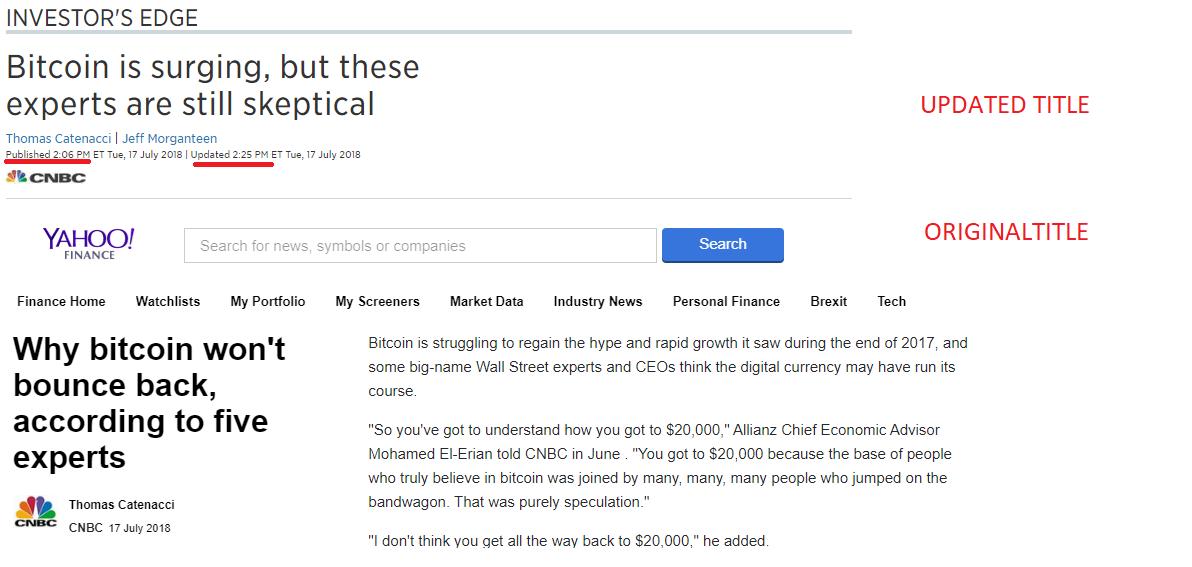

One of the most widely accepted facts is that, usually, traditional media channels provide completely inaccurate cryptocurrency market predictions. The reason being, their “experts” panels are generally composed by people who do not understand cryptocurrencies.

Sure, I really do not doubt for a second many of these panelists do possess a degree of financial knowledge it would put me in a corner. Except, if you use that knowledge and try to apply it to different fields, like cryptocurrency, your predictions an analysis might not be as accurate as you might think.

Ignoring the underlying technology mechanics, when comparing traditional financial markets vs modern cryptocurrency markets, is a problem too few people care about.

Mixing ignorance with power is a great recipe for disaster.

If you are one of those folk who usually listen to CNBC, Bloomberg, Reuters, etc you might end up having a bad time, when it comes to advise on how to invest in Bitcoin.

A key rule for any successful crypto-trader or investor is to never listen to the news.

Partnerships are usually bull-crap (look at the many examples of the recent past), most expert analysis is paid by companies, success is measured by funds raised and not product development, usefulness, nor market reach and, last but not least, traditional news-sites usually need to please a greater reach of readers, meaning, it’s much easier to have click-bait news than actual real news.

Like: “How Bitcoin Is Just A Scam”

Want another example of why you shouldn’t follow media advice?

Shorting Bitcoin: best advice ever

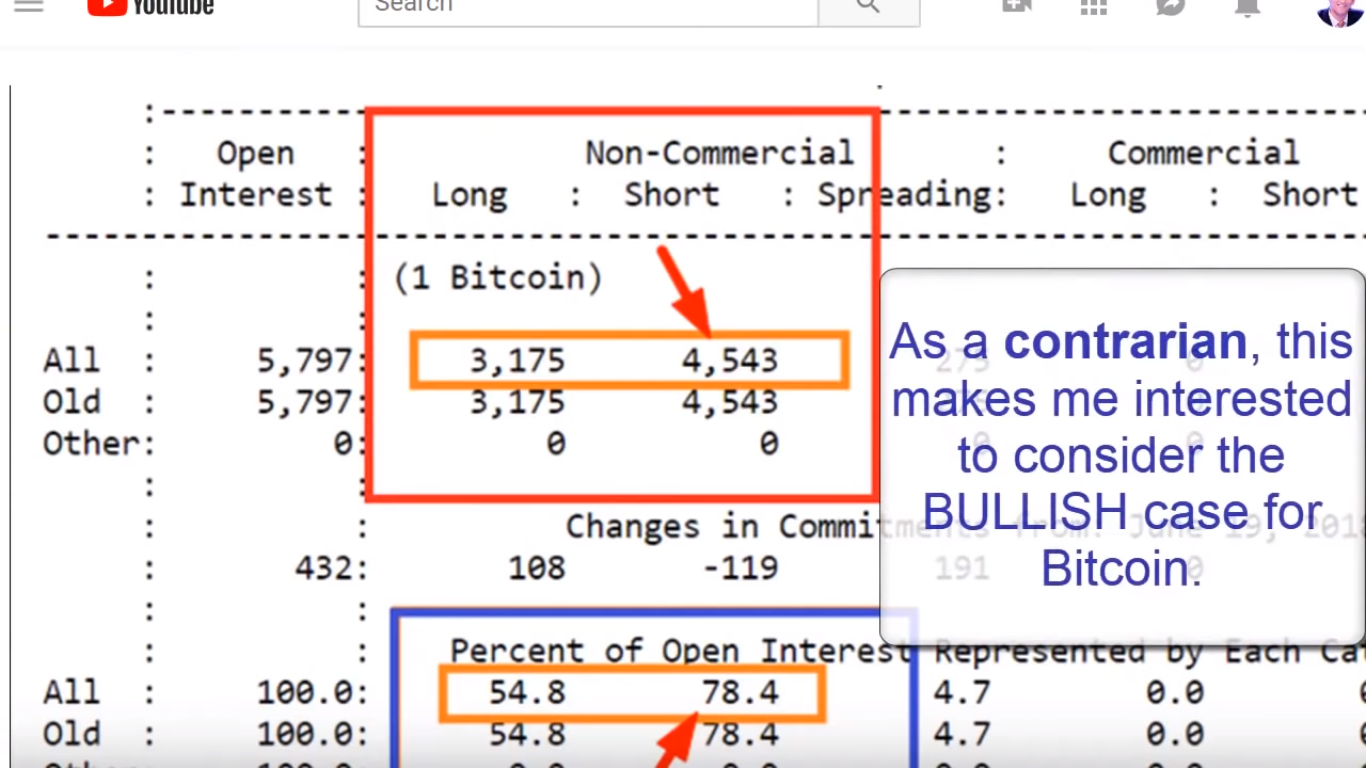

The image above, taken from one of Alessio’s latest youtube analysis , shows the volume of CBOE’s futures contracts. As you can see, dumb-money was betting heavily on shorting Bitcoin at the USD 4500 level (non-commercials).

I’m pretty sure the recent news explaining and why you should be shorting bitcoin had a little influence on this outcome.

Should you follow the herd, or bet against it? You already know the answer.

Enjoy the epic short-squeeze! This is, when short traders get destroyed by large quantities of fresh money coming into the market, pushing prices back up.

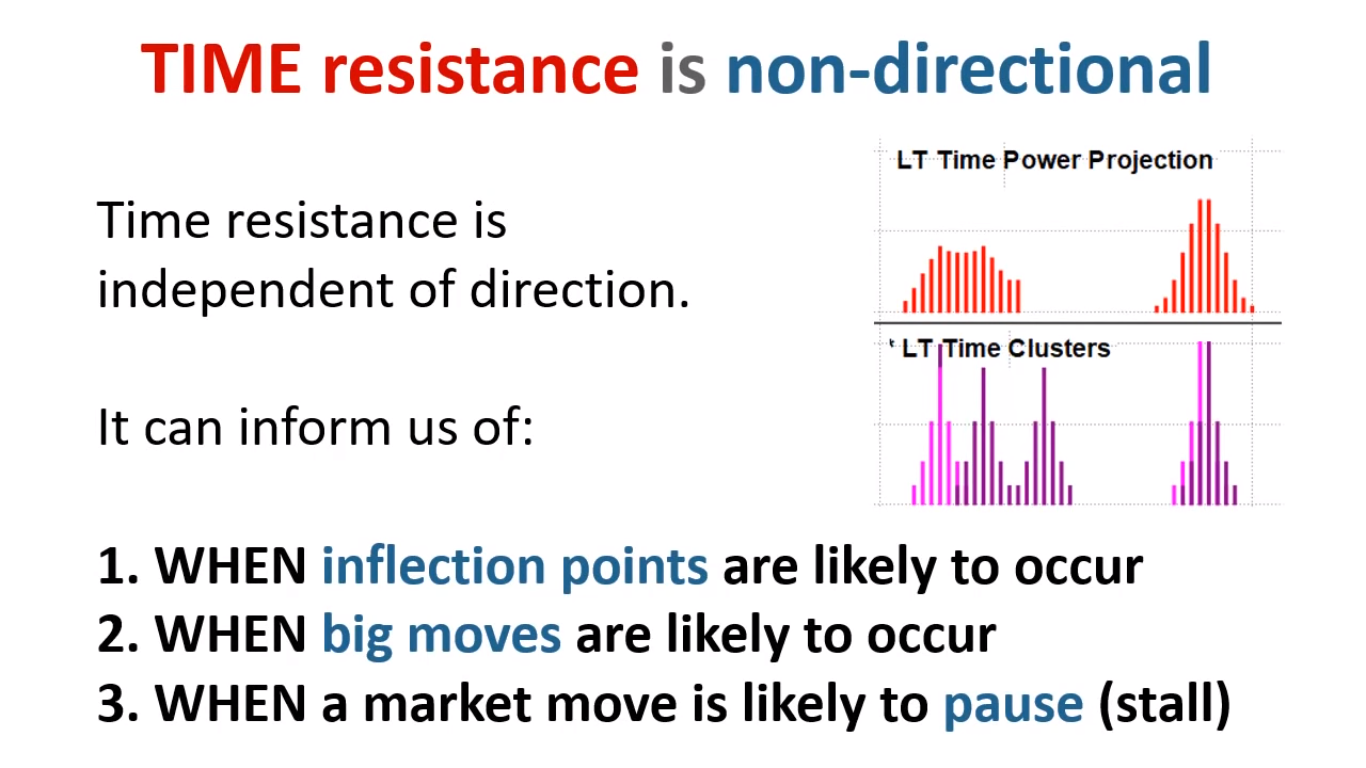

Another point that I would like to bring to your attention, is the importance of the time-axis.

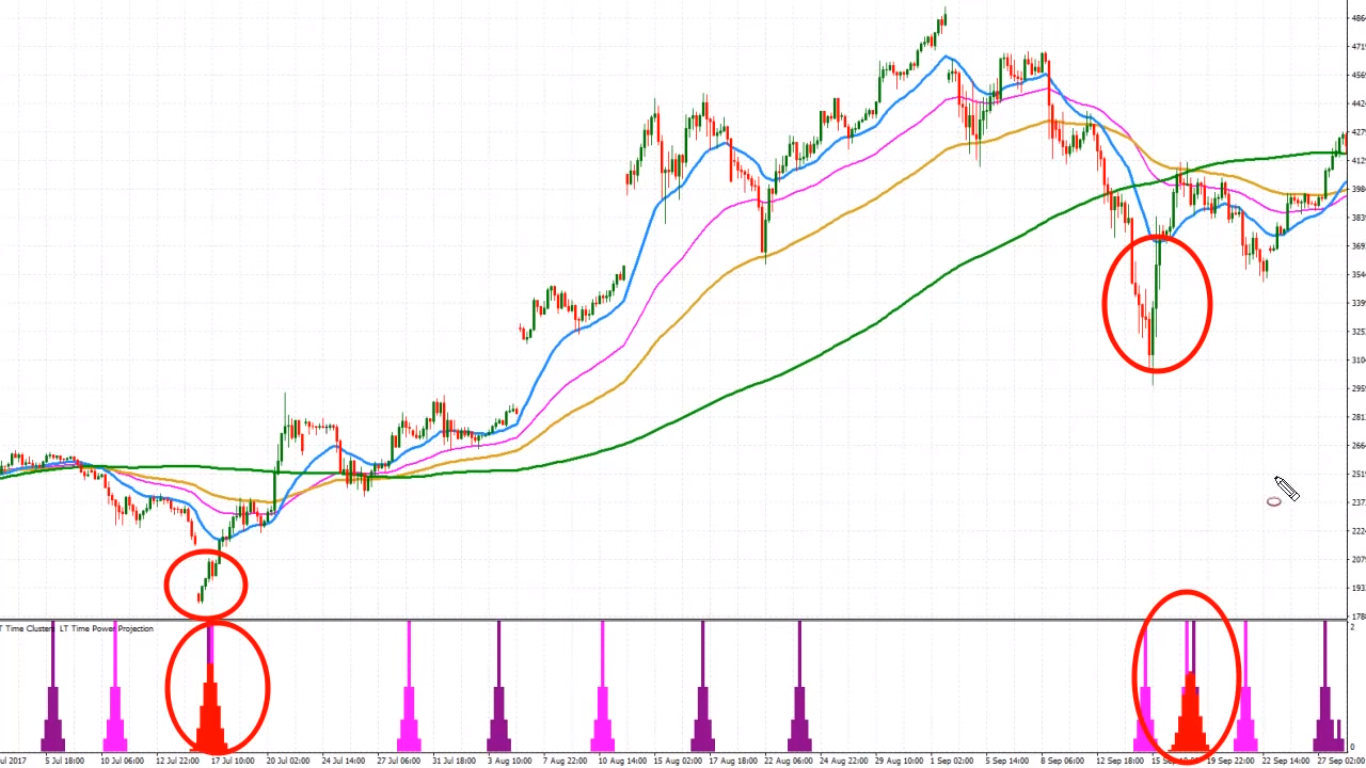

If we were looking for a trigger that could potentially help us learn when a big price movement was about to happen, a strategy that could be of use is the LT indicator .

I’m not saying this technique is always accurate – nothing is in fact – but it can let us know, with a high degree of certainty, when a shift is about to happen.

The LT analysis takes into account price walls and when they’re likely to be met, meaning, given a certain amount of time, the pressure of either sell or buy orders will push price downwards or upwards and the LT indicator measures when both walls meet.

What happened a few days ago was clearly a massive price wall pushing prices forward while eating away all bitcoin shorts.

In a sense, when buy orders pressure price upwards whoever is shorting bitcoin gets burned.

Is it so surprising the impressive 8% gains we saw last week?

I really don’t think so.

If you’re low on memory and don’t remember what happened, during December last year most leading traders and investors were warning us for an upcoming correction we’re currently experiencing. Just like with any other good bubble, sometimes it needs to burst so that a newer and more massive bubble can form.

Right now it feels like the market is gathering resources like people, knowledge and capital; soon the work of the past few months will bear fruit and new implementations like the Lightning Network, Segwit, side-chains and decentralized exchanges will help pushing prices higher up.

I believe this is just the beginning.

Keep in mind this bull-run won’t likely be hassle-free; there will be opportunities to make some small purchases, here and there, in the hopes price will continue to raise past the USD 20k level.

Historically, ups and downs are what keeps the market alive and how you can make some money, so take into consideration as many different analysis and indicators as possible.

In regards to Alessio’s LT analysis, when we see trading parameters on both the price and time axis come together at the same moment, we are looking at the highest probability, lowest risk trade setups in the marketplace.

This happens because there are both price and time walls which will collide in an epic pull/push of prices.

As you can see above, the date ranges are accurate with what happened, as the major price push was on the 17th July.

What else drives Bitcoin prices?

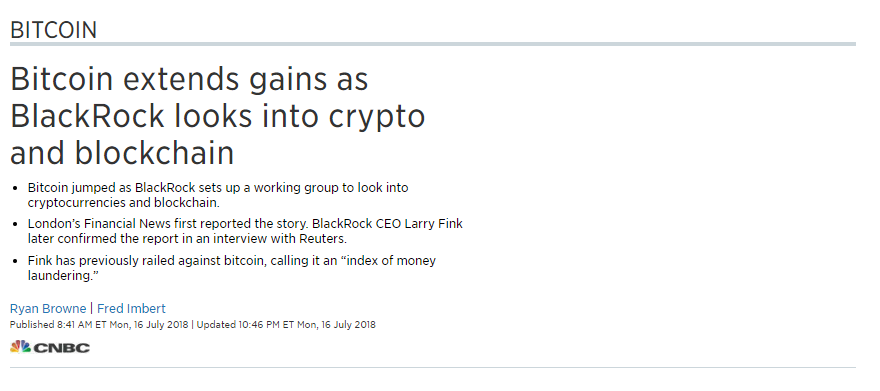

If you want to better understand the range of possibilities that can lead to wide price movements, it’s crucial you have an understanding of big players that can drive adoption forward. One of these players is, of course, BlackRock .

Being the world’s largest asset management firm, surely any allocation BlackRock makes into cryptocurrency will most likely be tied to bitcoin (via a bitcoin ETF, for example?). This will, in turn, bring not only institutional investors, but probably an insane amount of dumb-money as I wouldn’t expect anything less than a massive hype generated by media daily updates, pushing people to buy more bitcoin – like we saw in December, remember?

The hypothesis is as follows: smart-money attracts dumb-money. If BlackRock does end-up creating a Bitcoin ETF I would expect a massive rally to take place.

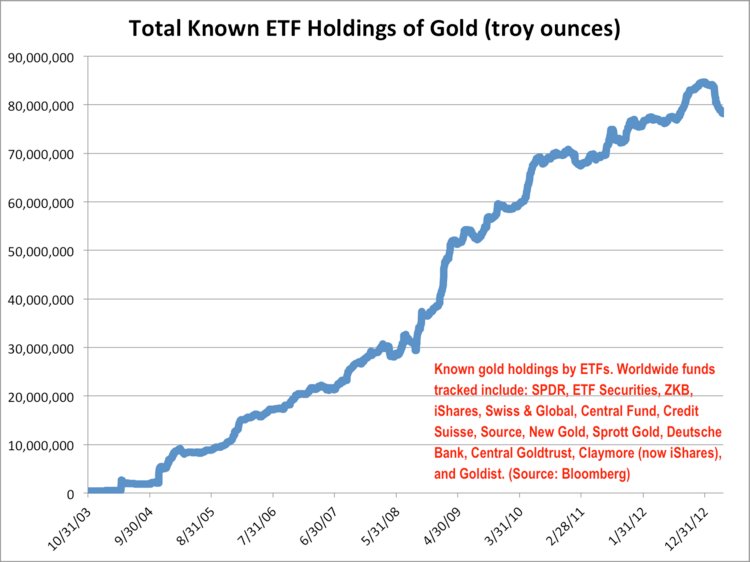

Will Bitcoin suffer the same fate as gold?

Hopefully! That doesn’t seem that bad at all!

Now, if we want to look from a different angle and forget about money for a second, to focus on regulation and political pressure, we can see the world is currently divided. In one side, we have people like Andreas Antonopolous talking to the Senate, explaining how cryptocurrency can make the world a better, fairer place; while in the other we have traditional lobbyists, who put their donors’ interests before people’s.

Of course my opinion is 100% biased, I’m much more of a libertarian than someone who loves control. A little bit of uncertainty is much better than blindly following rules for the sake of following rules.

Now, does it mean I shouldn’t listen to people who disagree with me?

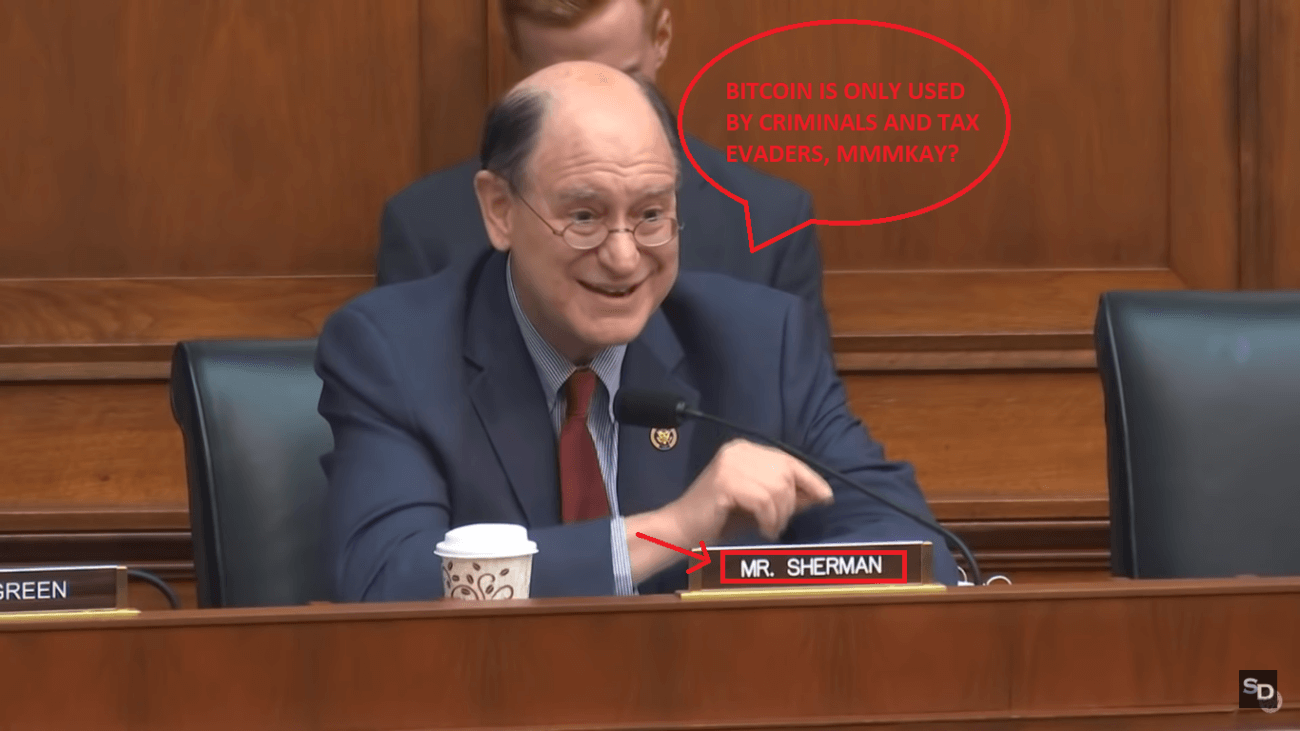

Well, it depends on the arguments. During one of the SEC’s latest hearings this guy, Mr. Brad Sherman, was extremely bearish on bitcoin, extrapolating the same-old boring conclusions that crypto is just for criminals and people who want to evade taxes.

Right. I thought we were pass that?

Interestingly enough, SunnyDecree published on one of his latest videos how this guy, a US Senator, despite heavily criticizing bitcoin – the safest currency out there – is actually accepting donations from Allied Wallet, a digital online payments business, kind of Bitcoin’s nemesis.

Want to know what the best part is?

These guys got fined a couple of years ago for money laundering .

Double-standards much, Mr. Sherman!

What will happen to Bitcoin’s price momentum?

We could think bad news like the above, or news sites reporting idiotic things like “Bitcoin is dead”, could be catalysts for people running away from cryptocurrencies.

Of course smart-money doesn’t care about trends – because it usually sets them – and dumb-money usually follows the wrong trend anyways.

What do I think it will happen? Well, right now, momentum keeps building and the good news do not stop there:

I wouldn’t expect Bitcoin price to go down, especially when the RSI being oversold doesn’t start the usual correction.

My conclusion is that Bitcoin will keep going for a few days or until we see less green volume, sustaining the latest positive price action.

Featured image from Shutterstock.