Bitcoin is Cheap Until April, We’ll Never See Price at $3,000 Again: Trader

Despite a lack of confidence among investors recently, bitcoin could be headed upwards without ever looking back again. | Source: Shutterstock

Despite being down 80 percent from its all-time high, a fairly large number of investors are still cautious and shorting bitcoin in a low price range.

Bitcoin shorts achieved a 3-week high earlier this week, demonstrating a lack of confidence of investors in the cryptocurrency market in the near-term performance of bitcoin.

But, according to a trader known to the cryptocurrency industry as “Galaxy,” bitcoin at $3,000 may be a rare opportunity that does not come again in the future.

Why $3,000 For Bitcoin is Rare

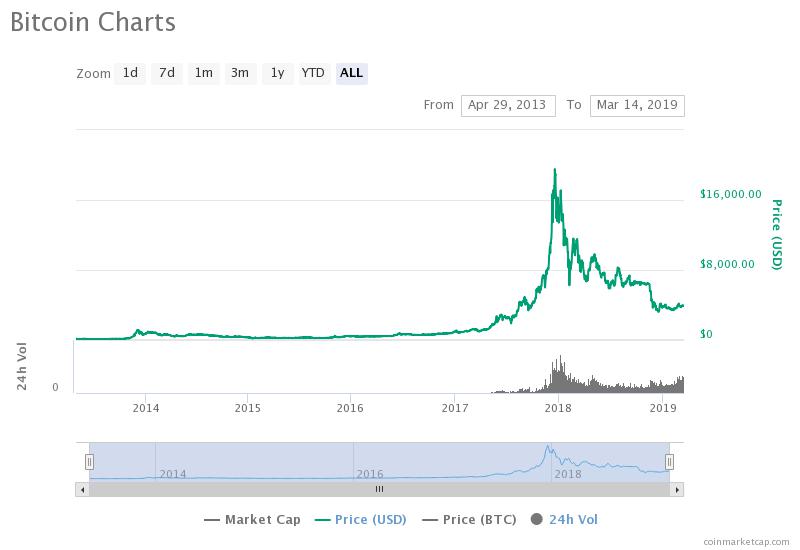

According to Galaxy, since its inception, bitcoin has established a trend of reaching a new all-time high, enduring a steep decline in price, initiating an accumulation, and recovering to a new high.

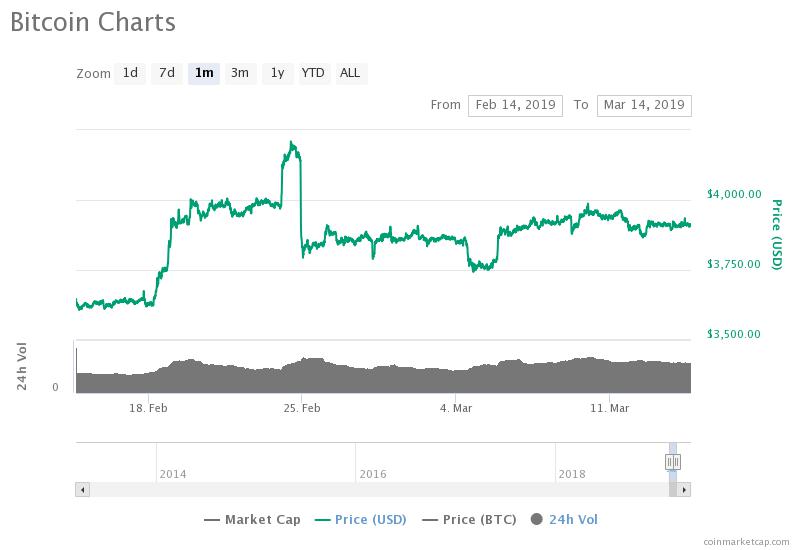

Based on that trend, the trader said that investors will likely never see Bitcoin at $3,000 once again after April and the dominant cryptocurrency is en route to recovering in 1 to 2 months.

He said:

Although prices may appear to be random (to some), they actually create repeating patterns and trends.

Observing this pattern makes April the last month of cheap BTC. And now, of course it will be cheap multiple times in the future, but never $3,000 cheap.

There are several traders and technical analyst who foresee bitcoin replicating its price movement in November wherein it experienced three months of stability and fell by nearly 50 percent in the following month.

https://twitter.com/MoonOverlord/status/1105995823551299585

If bitcoin fails to cleanly break into the $4,000 region and surpass key resistance levels at $4,200 and $4,300, analysts have said that a retest of lows at $3,300 and $3,122 is a possibility.

“Unless we break new local highs ($4,300), trend is still bearish. Expecting at least a dump back down to the green support level, maybe lower,” a trader said .

However, the trend in which bitcoin experiences an extended period of stability and then plunges in price right after by a large margin was portrayed once in November.

In contrast, the trend in which bitcoin hits a new all-time high, endures an 85 percent correction, initiates an accumulation phase, and recovery has been around for 10 years of bitcoin’s existence.

On a macro level, traders like Galaxy expect bitcoin to begin its recovery the second to third quarter of 2019, a similar time frame in which industry executives expect institutions to come into the market.

One concern of analysts in the cryptocurrency space has been the risk of a sudden sell-off due to the relatively low volume in the digital asset exchange market.

Will Institutional Investors Fuel Bitcoin Momentum?

Last month, Blocktower chief investment officer Ari Paul said that while he has been too optimistic about the rate of institutional adoption in the cryptocurrency market, he expects institutions to arrive in Q3 of 2019.

Paul stated:

I’ve been too optimistic about the pace of institutional adoption in the past. It’s coming, but I can’t estimate which quarter (Whether that’s this year or 2022) that we’ll see a big spike. As a humble guess, something like Q3 2019.

Less than a month after Paul’s statement, the first two public pension funds in the U.S. invested in Morgan Creek Digital’s cryptocurrency fund, officially marking the entrance of institutional investors into the cryptocurrency sector.

Although uncertain, depending on the pace of institutional adoption, the inflow of capital from institutions over the upcoming quarters could fuel the momentum of the asset if it begins its accumulation phase in 1 or 2 months as some traders predict.

Click here for a real-time bitcoin price chart.