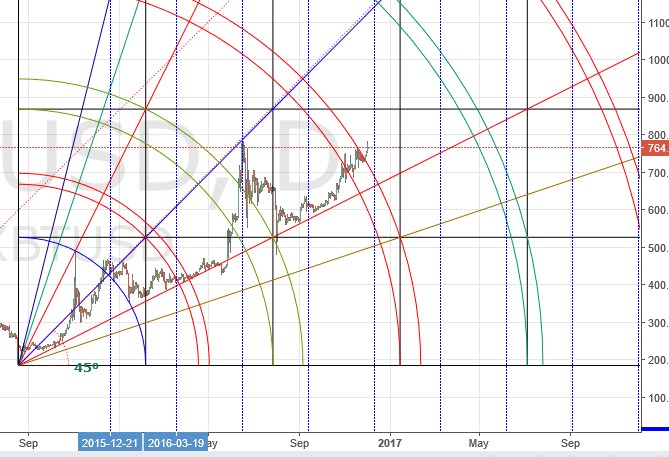

Bitcoin Hit Resistance at Recent Swing High

Since issuing a buy signal the other day, Bitcoin quickly jumped $40/coin. There it met resistance at $780, which was predictable given that the recent swing high was stopped there. $780 was discussed in our last update as a likely place of profit-taking. This has come to pass. The question is: What is next?”

In my opinion, while of course there will be lots of profit-taking and turbulence along the way, there is little (long-term) resistance before ~$860. There, price will hit the top of the square and could (perhaps) make a swing high there. If price breaks above the top of the square, the 4th arc pair is a little above $1,000.

In my opinion, while of course there will be lots of profit-taking and turbulence along the way, there is little (long-term) resistance before ~$860. There, price will hit the top of the square and could (perhaps) make a swing high there. If price breaks above the top of the square, the 4th arc pair is a little above $1,000.

Like counting cards, one can never be 100% certain if the next candle will be red or green. However, I can’t shake the expectation that a close above $780 will see a very quick rise that I for one wouldn’t want to miss.

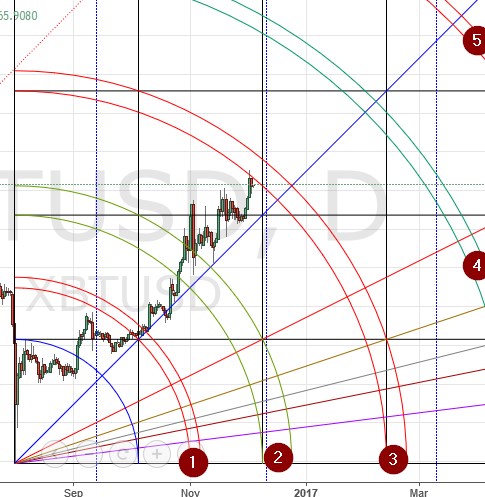

Here is a shorter-term setup of the same daily chart, starting at the Aug 1 panic low. Here you can see that pricetime was stopped by the 3rd arc pair. The end of the square, in time, is 12/8. End of a square is often a time of accelerations or reversals. Will we see one here? The charts are a mixed bag. The longer-term setup referenced first, suggests this market is going UP. The shorter-term chart is not so unambiguous. The fact is, we are still on the dark side of the 3rd arc pair there. Technically, hitting that arc pair was a sell signal. If we get to the end of the square (12/8) before getting a close above at least the first of the arcs in the pair, I might consider taking profits and waiting until we get to the sunny side of the pair to re-enter the market.

Here is a shorter-term setup of the same daily chart, starting at the Aug 1 panic low. Here you can see that pricetime was stopped by the 3rd arc pair. The end of the square, in time, is 12/8. End of a square is often a time of accelerations or reversals. Will we see one here? The charts are a mixed bag. The longer-term setup referenced first, suggests this market is going UP. The shorter-term chart is not so unambiguous. The fact is, we are still on the dark side of the 3rd arc pair there. Technically, hitting that arc pair was a sell signal. If we get to the end of the square (12/8) before getting a close above at least the first of the arcs in the pair, I might consider taking profits and waiting until we get to the sunny side of the pair to re-enter the market.

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.

Image from Shutterstock.