Bitcoin Can Be a Hedge During Persistent Liquidity Crises: Grayscale

With global financial crises on the rise, Grayscale Investments says bitcoin is a potential hedge against liquidity risk. | Source: Shutterstock

By CCN.com: Global financial crises are on the rise, thrusting bitcoin into the spotlight. Legendary investor Warren Buffett called bitcoin “rat poison squared,” but it turned out to be nectar, nevertheless.

The world’s largest cryptocurrency’s valuation jumped approximately 47 percent between May 5 and May 31 to close the month nearly $8,500. The same period witnessed the U.S. market’s benchmark indicator, the S&P 500, drop by approximately 6 percent.

Analysts called the bitcoin price surge a net effect of the U.S.-China trade war and Chinese yuan devaluation. They now believe that the cryptocurrency became either a hedge or a tool to smuggle capital outside China.

Grayscale Investments, an asset management company, attempted to connect the same dots in its latest report.

Bitcoin Against the Economic Crisis

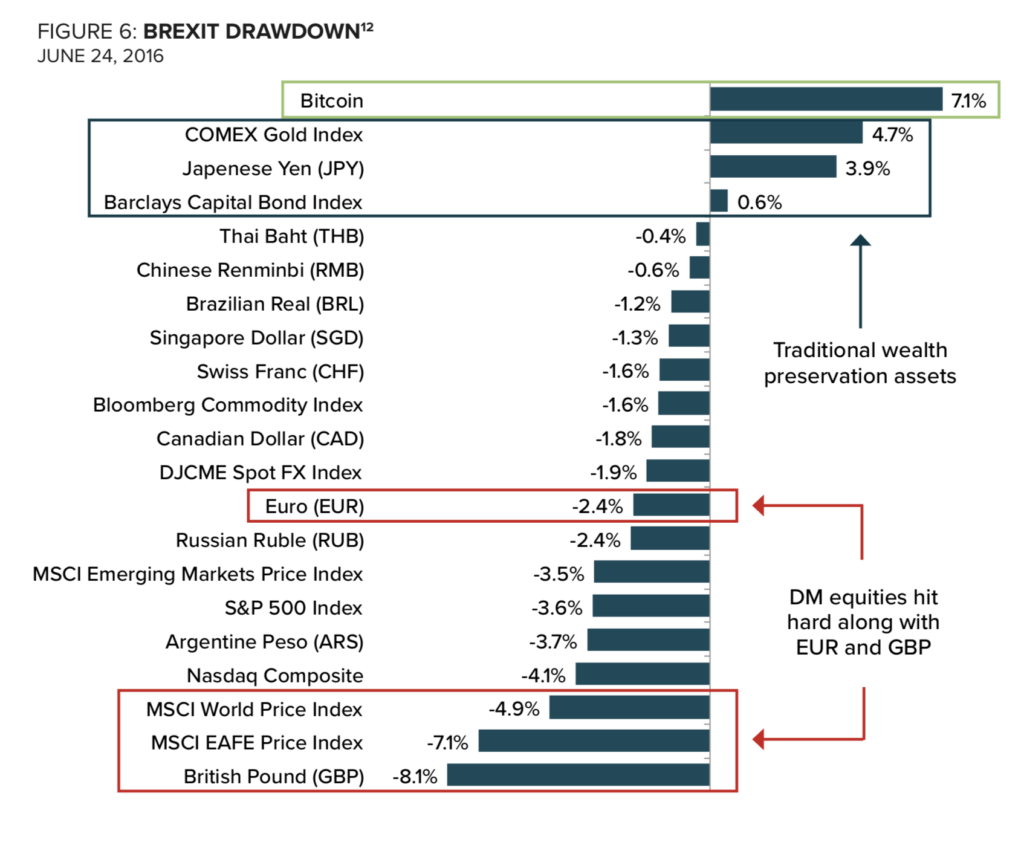

Grayscale’s research found that the bitcoin market benefitted the most whenever the mainstream financial industry faced economic epidemics. For instance, during the Brexit fears between June 2016 and December 2016, the bitcoin price impressed with 7.1 percent gains. The same period saw the euro slipping 2.4 percent and the pound by 8.1 percent. At the same time, the MSCI World Price Index dropped by 4.9 percent.

Similarly, in the period between August 2015 and December 2016, wherein economic concerns in China were scaring off regional investors, the bitcoin price noted a 53.6 percent appreciation. At the same time, the Chinese yuan dropped by 5.7 percent and the Emerging Markets Price Index plunged by 22 percent. Grayscale wrote:

“While it is still very early in Bitcoin’s life cycle as an investable asset, we have identified evidence supporting the notion that it can serve as a hedge in a global liquidity crisis, particularly those that result in subsequent currency devaluations.”

The firm also referred to the bitcoin price booms during the three-week Greek bank shutdown amid sovereign debt as well as throughout rising geopolitical risks and tighter financial conditions in the U.S.

Why Not Gold?

Prominent U.S. stockbroker Peter Schiff has regularly discarded bitcoin as a safe-haven asset, believing that investors would rather hedge into gold against liquidity risk. He said in an interview to RT:

“Bitcoin tries to pretend to be gold, but I think it’s fool’s gold. There is no value to store in bitcoin […] When you’re storing bitcoin you’re storing nothing.”

Schiff took a particular stance against Grayscale’s “Drop Gold” advertisement, which shows people dumping their heavy gold baskets for a digital — and lighter — alternative, bitcoin. The gold bull called the campaign “ridiculous” and a “farce,” arguing that the cryptocurrency has no intrinsic value.

Nevertheless, Grayscale treats the cryptocurrency as an exciting financial technology and investment opportunity. The firm wrote that bitcoin carries spending characteristics — a feature gold lacks — as it explored “real applications for blockchain technology” and “decentralized digital assets.” According to the report:

“With continued adoption, Bitcoin represents a transparent, immutable, and global form of liquidity that can provide both wealth preservation and growth opportunities. As a result, we believe it deserves a steady strategic position within many long-term investment portfolios.”

The BTC price was trading at $8,218 at the time of this writing, now up more than 120 percent in 2019.