Cryptocurrency Adopters Turn to Bitcoin during Market Downturn

The dominance index of bitcoin, which calculates the dominance of the cryptocurrency over the global market, has increased over the past 48 hours amidst one of the worst corrections the market has experienced since June 2017.

Is Bitcoin Reserve Currency of Crypto Market?

Since 2016, upon the emergence of digital tokens and alternative cryptocurrencies, many investors have started to consider bitcoin as the reserve currency of the cryptocurrency market. While it often does not return the high profitability of alternative cryptocurrencies, it has a lower volatility rate than most of the cryptocurrencies in the market.

Throughout 2017, both Ripple and Ethereum outperformed bitcoin in annual returns. Ripple led to a 330x return, while Ethereum recorded a 100x increase in price. Bitcoin ended the year with a 15x increase in value.

On January 15, a major correction hit the cryptocurrency market and the vast majority of cryptocurrencies in the market plunged in value. The valuation of all cryptocurrencies in the market declined from $700 billion to $420 billion, by more than $280 billion.

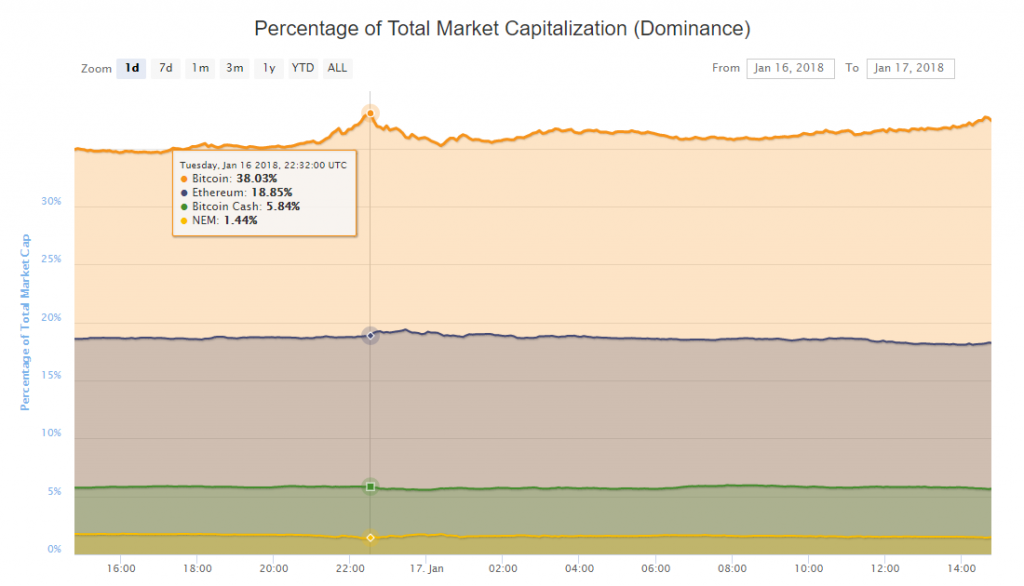

Throughout the correction, the dominance index of bitcoin, which declined to an all-time low in early January, surged from 32 percent to 38 percent, as alternative cryptocurrency investors reallocated their funds into major cryptocurrencies like bitcoin and Ethereum.

Consequently, bitcoin and Ethereum experienced a relatively small decline in value, in contrast, other cryptocurrencies in the market.

Mati Greenspan, senior market analyst at eToro, stated:

“The action we’re seeing may seem dramatic but is really quite normal for this market. All in all, this drop has brought us back to the prices that were traded about a month ago for most cryptocurrencies.”

Was a Correction Good for the Market?

During an interview with CNBC, Greenspan stated that the major correction of the market was beneficial for the global market, especially for Japan and South Korea, because it led to the decline in premiums in certain regions.

Previously, within the South Korean cryptocurrency market, bitcoin, Ethereum, and many other cryptocurrencies were being traded with a premium of around 30 to 40 percent. Traders within the South Korean market were paying 30 to 40 percent more to invest in cryptocurrencies.

One of the major concerns of the South Korean government which triggered the entire cryptocurrency trading ban fiasco was the premiums in the local market and the high prices South Korean traders have had to manage. Greenspan stated that given the premiums in Japan and South Korea declined, and the global market will likely stabilize after the correction, the recent drop in the price of virtually every single cryptocurrency in the market was a positive movement for the global market.

“The premiums that were being paid by Japanese and South Korean crypto traders is also coming down, so that’s a good sign as well, said Greenspan.

It is also important to acknowledge the fact that Ripple, Ethereum, and Dash along with other cryptocurrencies increased by more than 100x in 2017. Economists were calling off cryptocurrencies by describing the market as a bubble due to such returns. But, it would no longer be accurate to call the market a bubble because it suffers major corrections on a regular basis.

Featured image from Shutterstock.