Bitcoin’s Annihilating Every One of Your Favorite Altcoins

As Bitcoin dominance rises to its highest level in 28 months, the flagship cryptocurrency is annihilating the entire altcoin market. | Source: Shutterstock

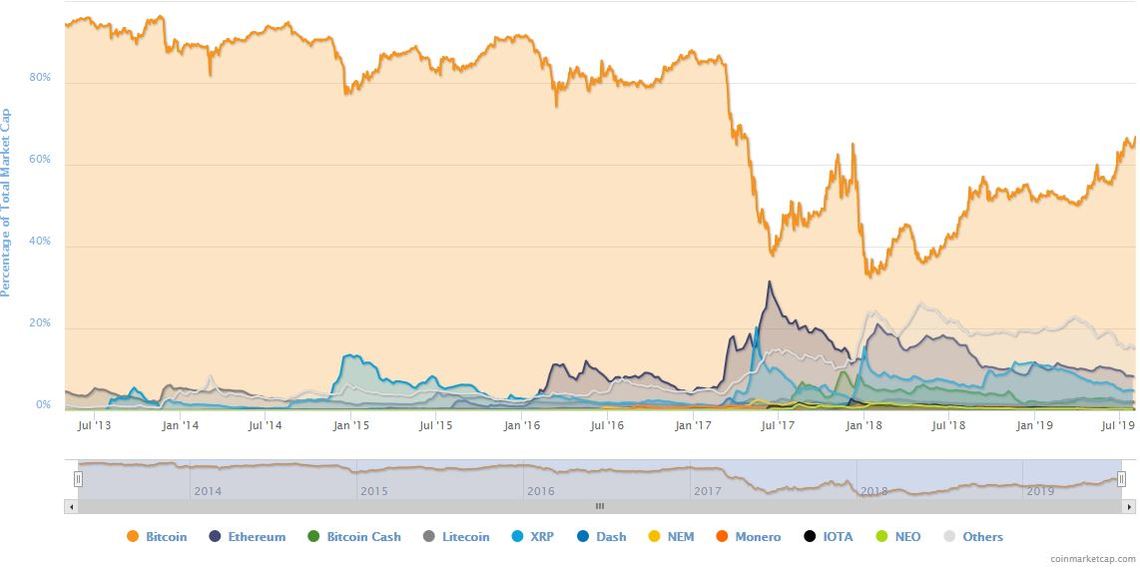

Bitcoin continues to crush its opposition as the leading cryptocurrency now enjoys a nearly 69% share of the entire crypto market cap .

This is the highest level of “Bitcoin Dominance” since April 2017 and marks an extremely frustrating period for altcoin investors.

Bitcoin Rises, Altcoins Stagnate

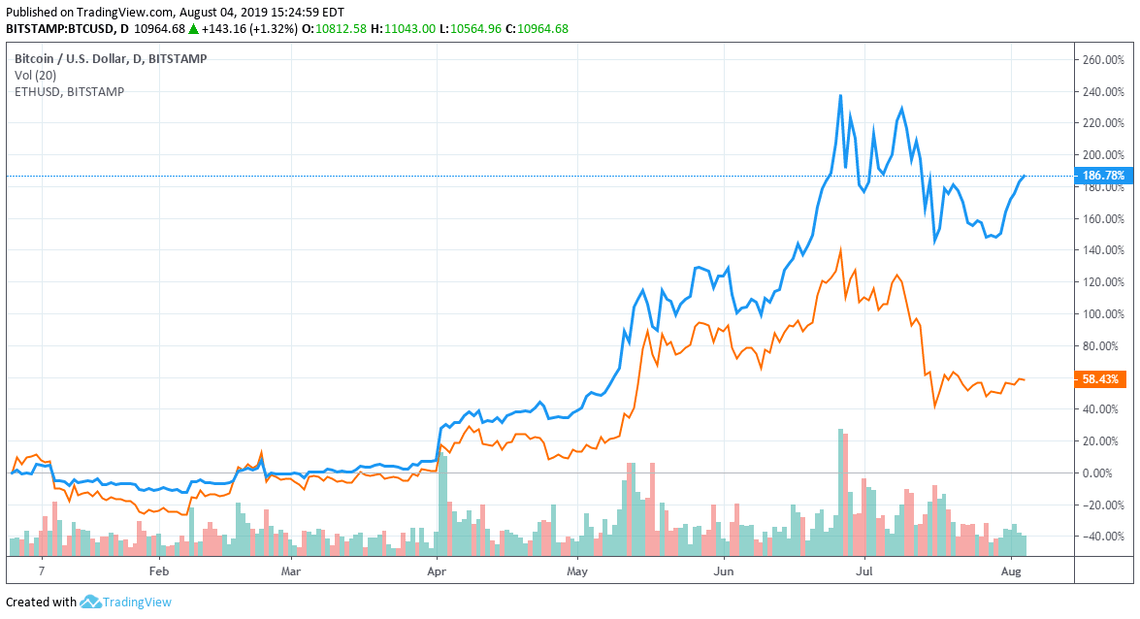

The Bitcoin price surged to just beneath $11,000 on Sunday after five straight days of gains have restored momentum in BTC/USD. In perhaps the perfect indication of what 2019 has been like for investors in altcoins, both Ethereum and Litecoin are lower on the day. This dynamic is what is driving Bitcoin’s rising dominance of the crypto market cap.

The historical dynamic where a 5% bounce in BTC meant a 15% rise in several smaller crypto assets has failed to materialize during the latest bull-trend. Unfortunately for altcoin bulls, the downside correlation appears to exist still, as losses in Bitcoin have still equated to heavy losses in most smaller coins.

Is BTC Improving Under The Hood?

If you invest purely on technological advancement, Bitcoin’s control of the crypto market cap might initially be quite baffling to you. While new altcoins have sought to improve in many ways on BTC’s underlying limitations, no new “advancements” have been compelling enough to convince the global investor population to park their money there instead of BTC.

Moreover, Bitcoin’s technical picture isn’t static – it’s improving under the hood all the time. The ultimate argument against “alt-season” materializing is that BTC can continue to increase its brand dominance, while also reducing its scaling limitations.

Regulatory Risks Subdue Crypto Speculation Beyond Bitcoin

But there’s at least one more factor at play. While institutional interest in cryptocurrency has increased, several risks have emerged subduing speculation in smaller coins.

The US government has been making noise about cracking down on illicit behavior, while another significant economic power, India, has been prepping a complete ban.

This has led to a different type of bull market, where the “everything’s going up” crypto euphoria of 2017 has failed to materialize.

For now, Bitcoin is extending its dominance, and it’s showing no signs of slowing down.

Click here for a live Bitcoin price chart.