Bitcoin Cash Price Drops 12% to New All-Time Low at $190 — What’s Causing it?

Since November 7, the Bitcoin Cash price (BCH) has dropped from $640 to $190, by more than 70 percent.

Prior to the hash power war between Bitcoin Cash and Bitcoin Cash SV, a camp led by CoinGeek, Calvin Ayre, and Craig Steven Wright, the price of BCH plunged from $640 to around $450.

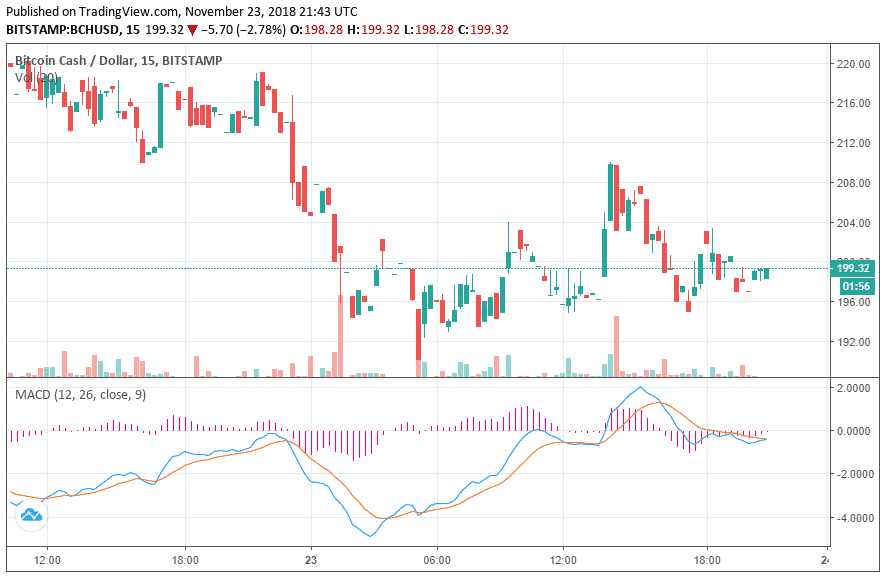

BCH has continued to extend its loss to the lower end of $200 in the past several days following the incident, finally dipping below the $200 support level in the last 24 hours.

Within a two-day span, BCH dropped by more than 25 percent from $242 to $190, leading investors to be concerned about the short-term trend of the cryptocurrency.

Why is the Bitcoin Cash Price Dropping?

The hash power war ended with a one-sided victory for Bitcoin Cash. Major cryptocurrency exchanges like Kraken and Coinbase provided Bitcoin Cash with the BCH ticker, officially recognizing BCH, also known as ABC, as real Bitcoin Cash.

Coinbase cited several reasons to support its decision to select ABC to remain as Bitcoin Cash with the BCH ticker, and one of the main factors was the large discrepancy in the hash power between ABC and SV.

The Coinbase team explained:

“Since the Bitcoin Cash fork on November 15, 2018, Coinbase has been closely monitoring the BCH network. We have observed consensus in the community that the BCH ABC chain will retain the designation of Bitcoin Cash (BCH). Coinbase will also adopt this designation for BCH. Coinbase has made this decision based on a number of factors including the fact that ABC has a higher hashrate and a longer proof-of-work chain.”

With the win and the acknowledgment from exchanges, BCH was expected to recover in price, possibly back to its previous support levels at $250 and $300. Yet, the asset continued to fall in the past several days, ultimately reaching a new yearly low at $190.

The weakness in the short-term price trend and momentum of Bitcoin (BTC) has led the majority of cryptocurrencies in the global market to drop by large margins as seen in the movement of Ethereum (ETH) and Ripple (XRP).

However, the particularly steep decline in the price of BCH suggests that investors still feel uncertain about the growth trend of BCH, with SV representatives constantly threatening both ABC and members of the Bitcoin Cash community.

In the weeks to come, the conflict between ABC and SV could subside significantly, as Calvin Ayre officially stated that SV no longer wants to be regarded as a fork of Bitcoin Cash.

Ayre said:

“CoinGeek now feels there is no point in negotiating. If ABC puts replay protection in to permanently split the chains we will ensure that nobody bothers them again. They can keep BCH as BSV is not the original Bitcoin Cash its the original Bitcoin.”

Can BCH Recover?

As the spectacle surrounding BCH stabilizes and the conflict between ABC and SV dematerializes, the cryptocurrency could find renewed momentum and a fresh start that may positively affect its mid-term price trend.

In the foreseeable future, due to the intensity of the sell-off and the weak volume of BCH, a quick turnaround is highly unlikely.

Featured Image from Shutterstock. Charts from TradingView .