Bitcoin and Fibonacci Spirals

Today was a lackluster day for both ethereum and for Bitcoin. Each of the various cryptocoins I follow had such a boring day. This leaves me in a bit of a pickle, because all I can really write is: “Read yesterday’s column. Nothing has really changed.” This is not the sort of column likely to garner much interest.

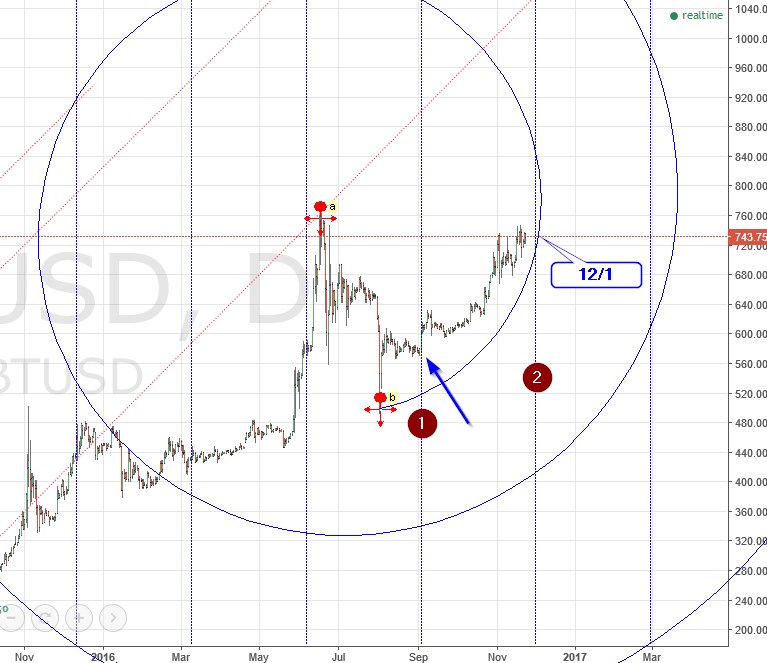

I will show the updated charts for reference, and then we will take a cruise down a path we have not looked before. Let’s start with bitcoin’s daily chart:

As we can see, pricetime is working it’s way through the 3rd arc pair. It is making progress, but if it continues moving sideways it will not clear the arc pair for another week.

As we can see, pricetime is working it’s way through the 3rd arc pair. It is making progress, but if it continues moving sideways it will not clear the arc pair for another week.

Next is Ethereum’s daily chart:

Here I have drawn a pitchfork on the Aug 2015 low, the June 2016 high, and Aug 2016 low. As these words are being written price is bouncing off the 1.272 extension of that pitchfork. I don’t expect that support to break, but I would of course recommend a stop-loss below that support, just in case.

Here I have drawn a pitchfork on the Aug 2015 low, the June 2016 high, and Aug 2016 low. As these words are being written price is bouncing off the 1.272 extension of that pitchfork. I don’t expect that support to break, but I would of course recommend a stop-loss below that support, just in case.

For the purposes of this column I typically rely on Gann Squares and Pitchforks. Today I want to demonstrate a few Fibonacci tools. Let’s start with a Fibonacci spiral:

Centering the spiral on the high and beginning the spiral from the Aug low, we see that pricetime will likely encounter the spiral in about a week, which is the same timeframe we hypothesize that price will encounter the 2nd of the 3rd arc pairs seen in the first chart above. Could be a coincidence… But note also that the blue vertical line marked ‘2’ is 90 degrees from a sharp one day spike at line ‘1’, and that is about the same point in time the spiral will be met. Coincidence? Perhaps.

Here we have a single point Fibonacci spiral centered on the Jan 2015 low. Amazingly, pricetime will likely encounter THAT spiral at about the same place.

Here we have a single point Fibonacci spiral centered on the Jan 2015 low. Amazingly, pricetime will likely encounter THAT spiral at about the same place.

Is this proof of an impending reversal or acceleration in a week’s time? No, but these sorts of clusters of geometric phenomenon should be enough to make one pay attention.

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.