Binance to Burn Over $2.5 Billion of Its BNB Stash. Guess Who Benefits?

Binance announced that from now own it will burn its entire BNB allocation. CZ says that "the team is not money-driven." Is this 100% true? | Source: Shutterstock

Binance yesterday completed its eighth quarterly “burn” of BNB. With this move, the exchange follows its commitment to reduce the total token supply periodically. However, along with the obligatory token burn, Binance CEO Changpeng “CZ” Zhao announced that his company would relinquish its entire BNB allocation as part of its efforts to promote the growth of the ecosystem. He said:

“Today, on behalf of the Binance team, I am announcing that we will give up all of our BNB allocations and contribute towards our commitment to burning a total of 100 million BNB. This commitment starts during today’s quarterly burn, during which 808,888 BNB (currently worth US$23,838,000) is being burned.”

That is to say, 40% of the total BNB supply that belonged to the Binance team from now on will become part of the cycle of periodic token burning that the company maintains. In other words, the company won’t allocate any BNB for itself starting today.

In his most recent ask-me-anything event, CZ emphasized Binance’s commitment to burn over $2.5 billion worth of BNB which belongs to the Binance team

“We are not going to cash a penny of that out… we’re going to burn it all.”

BNB Is Performing Extremely Well Thanks to Binance’s Smart Decisions

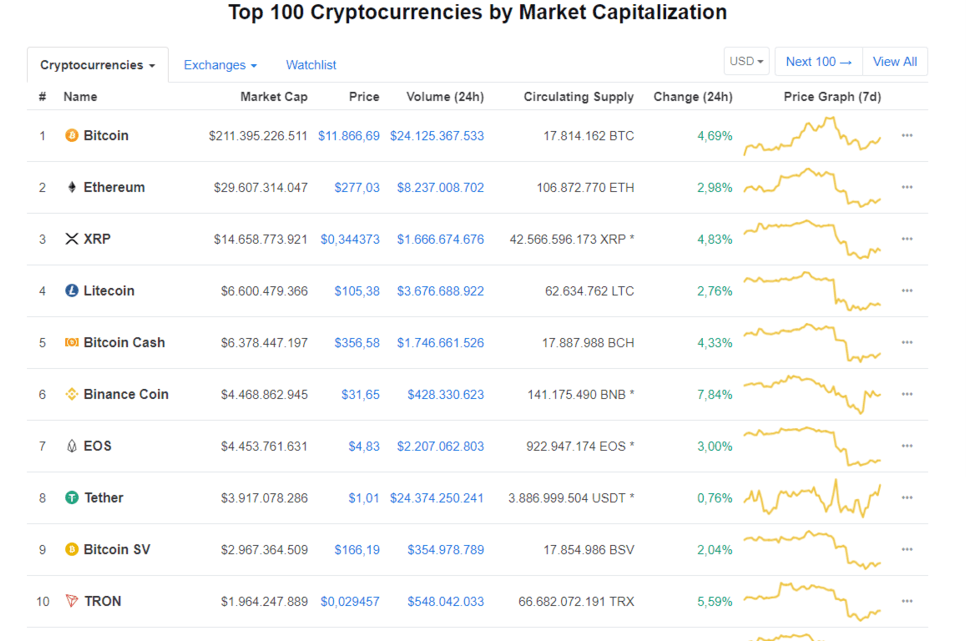

The immediate effect of this news was quite predictable. A strong enthusiasm in the trading community led the token to outperform any other crypto in CoinMarketCap’s top 10.

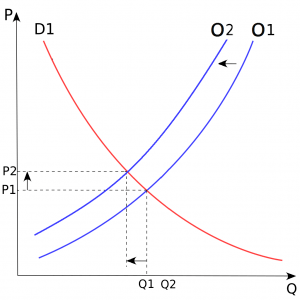

Expectations about a decrease in the total supply of a currency always generate an increase in the value of its token. This effect is also seen in other cryptocurrencies as cuts of this type approach (a kind of “halving effect” similar to what many expect to happen soon with Litecoin and next year with bitcoin.)

CZ Focused on Building a Better and Profitable Future

Of course, this decision could play an important role in the growth of the BNB ecosystem. But it is not enough to make CZ’s statement that “this shows that the Binance team is not money-driven” 100% accurate.

No one denies that Binance is on a mission to “increase the freedom of money,” but this effort is not purely altruistic. It is a business strategy with a win-win approach that has led Binance to become the world’s top exchange by trading volume.

Even though Binance is burning tokens, the market cap for BNB stays the same as the value of all burned coins is redistributed among the circulating tokens. This ensures a higher price per token while stimulating a reduction in liquidity that, in theory, drives prices.

This graph shows what happens to BNB after a token burn. If the demand for BNB keeps stable, but the supply is reduced — going from O1 to O2 — because of a token burn, then the standard equilibrium price “P1” moves up to “P2”, going bullish for a while.

Likewise, it is possible that if Binance completes its path toward complete decentralization, the native token of the most important exchange in the crypto-verse will also become one of the most used currencies in the whole ecosystem.

Binance knows very well how to play its cards, and having its token in the No. 6 spot of the global market cap is proof of it. Of course, its customers benefit from it, but without a doubt, the house also wins… a lot.