81% of ICOs Are Scams, U.S. Losing Token Sale Market Share: Report

Initial coin offering (ICO) promoters have been widely successful with regards to the quantity of projects they have been able to at least partially fund. On matters of quality, perhaps not so much.

According to a report prepared by Satis Group Crypto Research, around 81% of the total number of initial coin offerings launched since 2017 have turned out to be scams. In dollar terms, however, only 11% of the approximately US$12 billion that has been raised in these projects went to these fraudulent ICOs.

The Big Three

Per the cryptocurrency research firm, most of what was raised in the scams went to only three projects, including Pincoin, which received US$660 million and Arisebank, which received US$600 million.

“Although ~1/10th of all ICO fundraising went to Identified Scams, the vast majority of the $1.3B was from just three projects, which were all relatively old school frauds by no means unique to ICOs (Pincoin ($660M), Arisebank ($600M), and Savedroid (~$50M)). These projects each did raise those amounts we believe but are subject to extensive regulatory action,” noted Satis Group in its report.

And despite the regulatory uncertainty and waning market performance, the report further states that ICO fundraising has been growing steadily. Year to date, approximately US$7 billion has been raised, and this is close to 50% of the amount that was raised in 2017. Since the inception of ICOs, the most active month was last year in December when more than US$1.4 billion was raised.

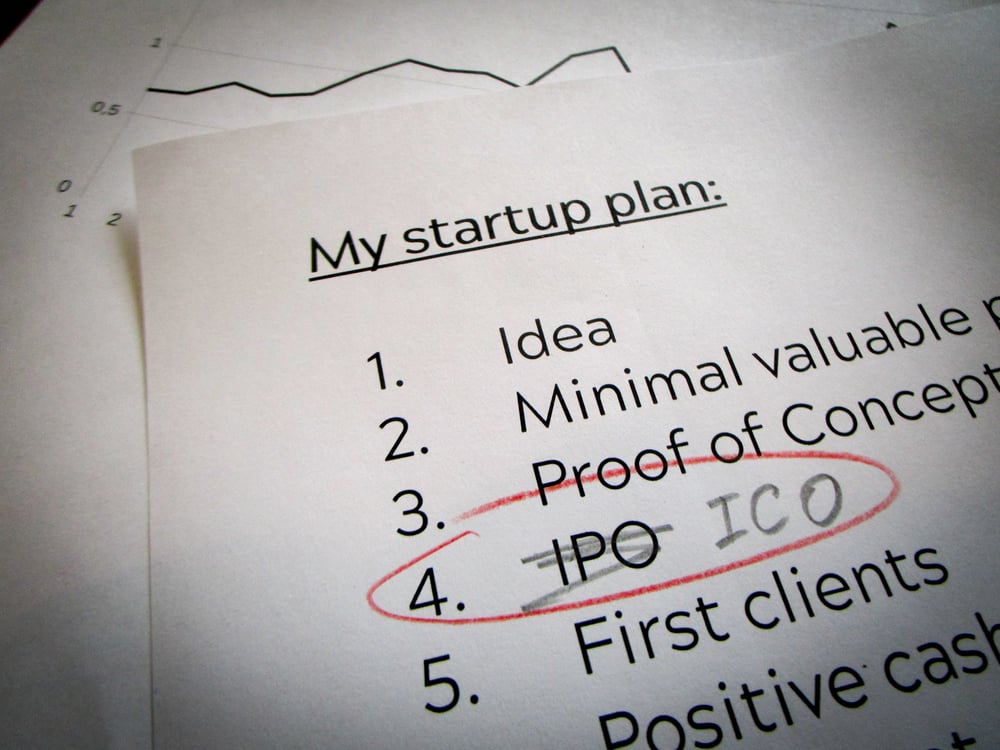

20% of the U.S. IPO Market

Satis Group further estimates that the worldwide ICO market is worth about a fifth of the initial public offering (IPO) market of the United States so far this year. And this is during a period when the U.S. IPO market has recorded the highest level of activity since 2014.

However, year-over-year growth in the ICO market has slowed, and this is attributable not just to regulatory uncertainty but also to reduced enthusiasm among retail investors. Additionally, there are concerns over the slated technical changes of the major networks on which most ICOs are built on, especially Ethereum.

U.S. Regulations Pushing out Projects

The prevailing regulatory regime in the United States has also been harmful to the sector. This has resulted in a lot of projects moving out of the world’s largest economy to launch their ICOs in more friendly jurisdictions. Some of the biggest beneficiaries of this state of affairs include the Cayman Islands, Virgin Islands, and Singapore.

Last year, for instance, the ICO fundraising market share of the U.S. compared to the rest of the world was 32%. In 2018, this has fallen to 10%. Cayman Islands had an ICO fundraising market share of 3% last year, but this year it has ballooned to 40%.

Images from Shutterstock