3 Reasons Why This Week’s Oil Price Rally Is a Dead Cat Bounce

OPEC members' heavy reliance on crude revenues has limited their ability to adhere to strict output cuts. Combined with other factors, oil prices are likely to remain subdued for the foreseeable future. | Image: REUTERS/Leonhard Foeger/File Photo

- Oil prices climbed above $40 earlier this week, raising hopes that a recovery was underway.

- Several factors have conspired to keep oil demand and prices low, despite the best efforts of OPEC.

- Until the global economic climate improves, sustained growth in oil demand will remain a mirage.

Oil prices have rallied this week. Since re-printing June’s lows this month, Brent crude oil futures have surged by slightly more than 10% over the last couple of days.

But the rally is not sustainable, and oil prices are likely to fall once again.

Here is why the recent oil-price rally will be short-lived:

1. The World Has Already Reached Peak Oil

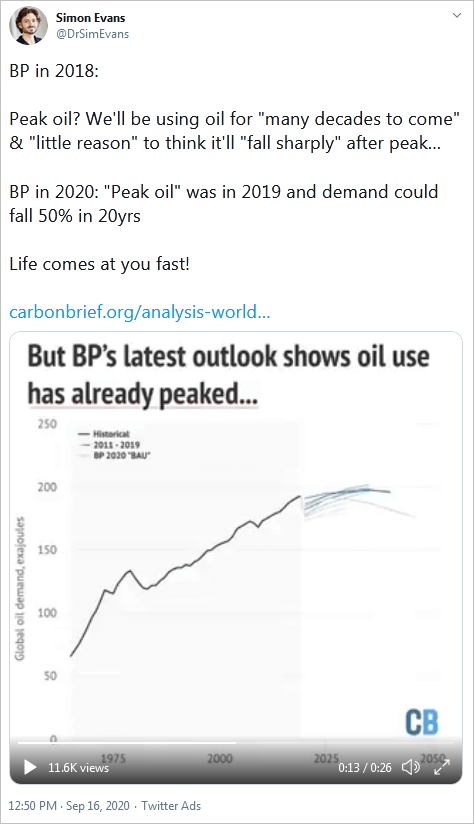

Global crude production was expected to reach the maximum level between 2035 and 2050 , per some modest projections.

But in its 2020 Energy Outlook report released recently, oil major BP said the world might have already reached peak oil . According to BP, oil demand has been permanently destroyed by the pandemic and may never recover.

This is a drastic departure from the scenario BP painted just last year. In 2019, BP said oil consumption, and by extension production, would continue to balloon into the next decade, hitting a peak in the 2030s.

According to BP’s 2020 Energy Outlook report, the growing demand for renewable energy will exacerbate problems caused by the pandemic-fueled demand destruction.

There are other indications too that the world may have already experienced maximum oil production. The International Energy Agency also reduced its global demand forecasts for this year, warning producers that the “path ahead is treacherous.”

2. OPEC Cheats Are Making It Hard to Keep Oil Prices Elevated

Currently, there are 18 countries where oil rents comprise over 15% of the gross domestic product , according to the World Bank. In 2018, oil rents comprised more than a quarter of GDP for ten countries, including Saudi Arabia, Kuwait, and Iraq.

Falling oil prices have a considerable impact on government spending in these countries. This has made it difficult for some counties to abide by the production cuts mandated by OPEC, which has undermined the cartel’s strategy to tame supply with a view of pushing up prices.

Among the OPEC member countries, the United Arab Emirates has been cited as one of the worst quota-breakers.

In August, the UAE only cut 10% of what it had pledged. As of 2018, oil rents comprised about 17% of the UAE’s gross domestic product.

In a recent meeting, OPEC warned members against flouting the quotas , promising dire consequences for the cheats. But with so many of these countries heavily dependent on oil revenues to provide services to their citizenry, OPEC will have a tough time ensuring they toe the line.

3. Global Economic Slowdown

Earlier this week, the Organization for Economic Cooperation and Development (OECD) published a report indicating that it will take at least two years before global economic growth recovers to Q4 2019 levels .

This year, OECD has forecast that global GDP will shrink by 4.5%. In the worst-case scenario, the world economy will fall by 7.6%. Most of the decline will be experienced by large industrialized countries, which constitute the lion’s share of oil consumption.

Reduced economic growth means a decline in global demand for oil. Falling demand will inevitably place downward pressure on oil prices.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.