Will Valentine’s Day End in Heartbreak for Bitcoin Bulls?

Should Bitcoin investors prepare themselves for a post-Valentine's Day heartbreak? | Source: Shutterstock

The cryptocurrency market held above $120 billion heading into Thursday evening, but could Bitcoin be setting up investors for a post-Valentine’s Day heartbreak?

Bitcoin and the rest of the top 5 cryptocurrencies had a pretty boring 24-hour period. The notable moves happened at the opposite end of the market cap spectrum, with Steem gaining 3% and NEM, 2%. Of the top 10 non-stablecoins, only Bitcoin Cash saw any positive movement, with a less than 0.2% global gain.

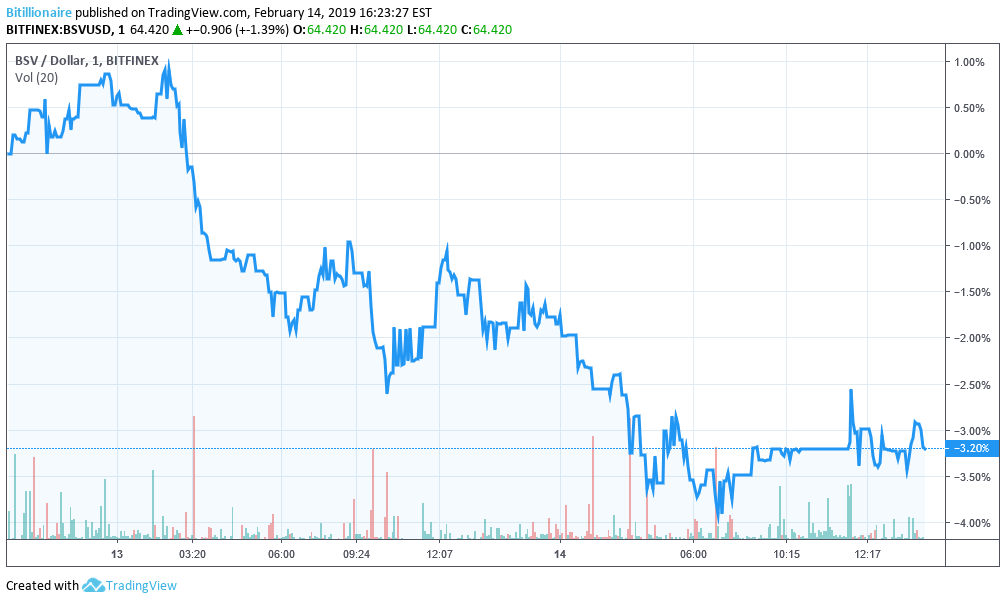

As we reported earlier today, Bitcoin SV is now available for withdrawal at Coinbase. In a related note, Waves Platform is making Bitcoin SV balances available and will be adding a trading market as well. The question is whether the newly available Bitcoin SV poses a risk to the coin’s price.

Bitcoin Cash believers at the time of the hard fork who held BCH in either place have been waiting some time for their Bitcoin SV. They’ve long since missed the peak of more than $200. The market at large has advanced into scarier and scarier bear territory.

While the Bitcoin Cash price has occasionally dipped under $100, it’s largely comfortable in some type of competition with Ethereum. Bitcoin SV, on the other hand, has experienced a classic wind-down. Now millions of new holders have the ability to dump on BSV. Will they do it, or will the greater availability of the token have an opposite impact on its trading?

Let’s look at the coins individually.

Bitcoin Price Remains Disturbingly Quiet

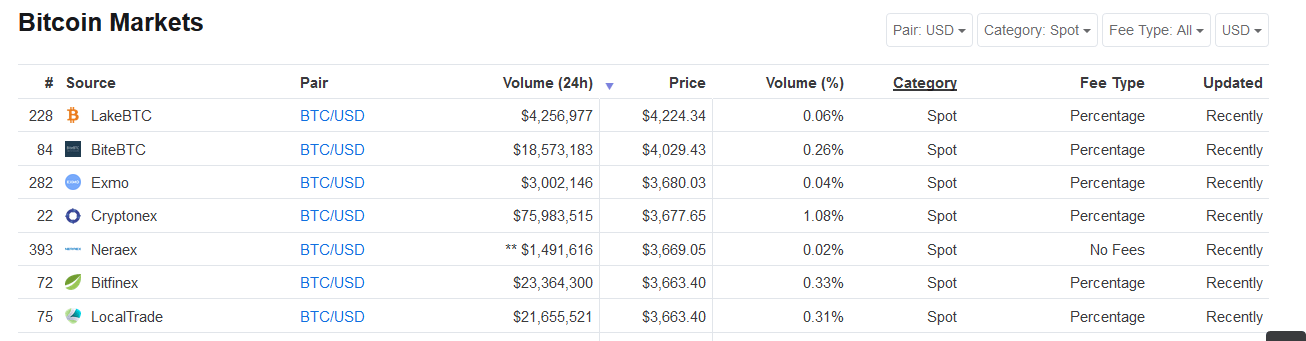

Bitcoin held onto a global price above $3,600 by press time, but Coinbase had it well into the $3,500s. The divergence between markets can be seen in the following chart, which shows both Coinbase and Bitfinex. We like to study both. Coinbase is good to measure the sentiment of retail investors, while Bitfinex is a preference of many “pro” traders.

As we see, although Bitfinex is posting a higher per-token price for Bitcoin, its percentage-wise losses have been greater over the same period.

The global price was floated by some extremely higher prices, all the way up to greater than $4,200. Bitfinex was far down the list, not nearly the highest. Out of touch with reality? A bit.

And we must warn: markets that deliberately list extremely higher prices for Bitcoin or other crypto assets are often suspicious, to say the least.

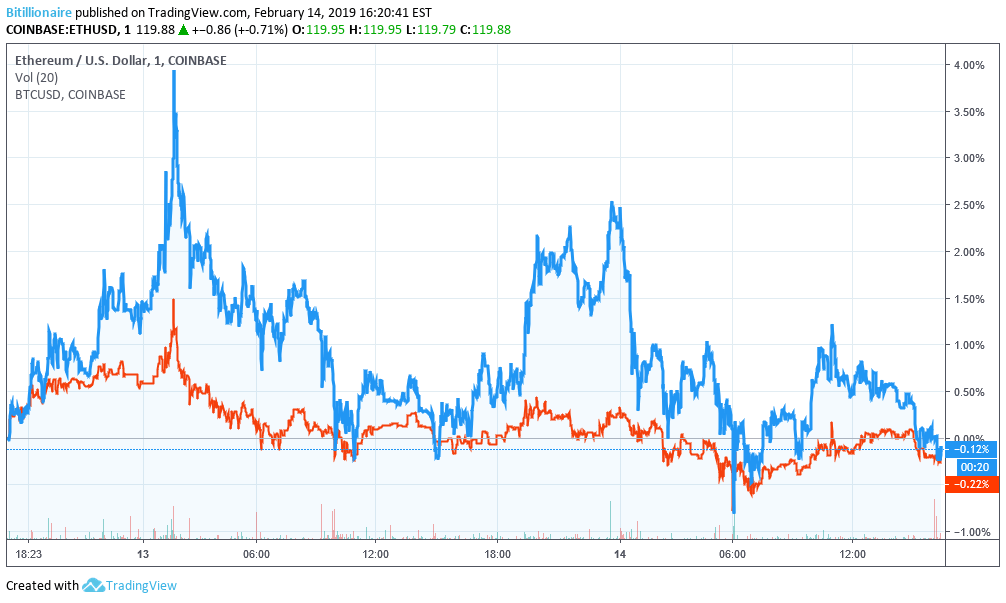

Ethereum Pares Earlier Gains

Ether did a bit better than Bitcoin on Coinbase, gaining almost 4% early in the day.

It lost it moving into mid-day trading, but holders probably aren’t upset just yet. Overall daily volume topped $3 billion. One wonders what a bull run will look like for Ether in terms of volume. If Ether can sustain its current levels until the next shake-up in the crypto markets, and propel from there, it will make a lot of holders who anchor its economy happy.

Bitcoin SV Faces Potential Dump

Bitfinex offers one of the few reputable fiat markets for Bitcoin SV. It’s early to tell, as millions of Coinbase users have day jobs and haven’t even accessed their BSV balances yet, but a big dump could be on the horizon.

For its part, Craig Wright’s pet coin had only lost a little more than 3% in the 24-hour period.

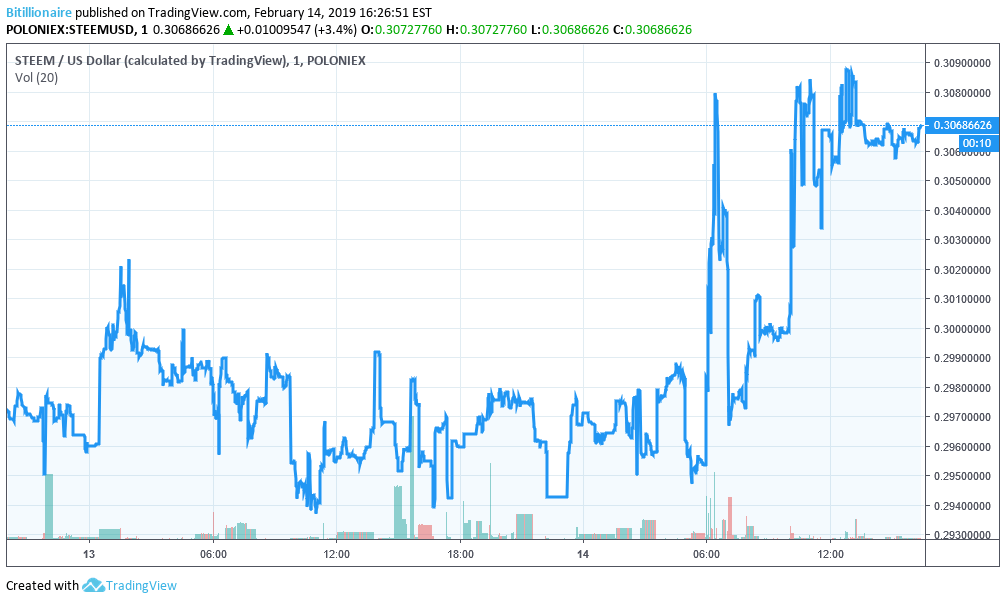

Steem Outperforms the Crypto Index

While BSV lost 3%, Steem gained about that much. Steem is one of the tokens that isn’t often traded against the dollar, although it arguably should be, given its high exposure to “regular people” via the Steemit blogging platform.

Morning trading steamed ahead into a price of over 30 cents for Steem. If Steem had a supply anywhere near the size of Ripple (XRP), it would be in competition for XRP’s place on the market capitalization chart.

Featured Image from Shutterstock. Price Charts from TradingView.