Will Bitcoin See Another Leg Down?

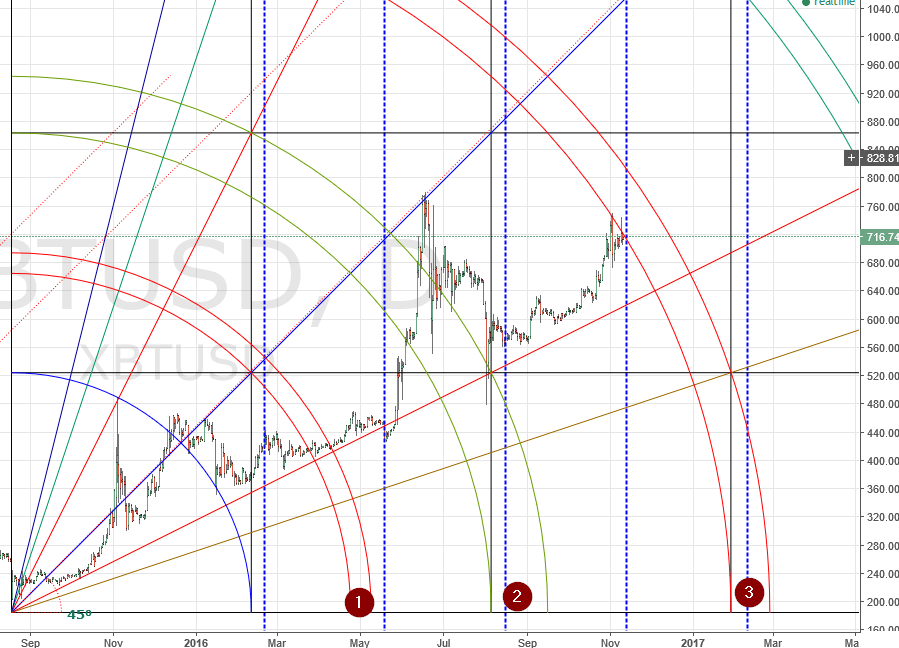

I remain long-term bullish on Bitcoin as I have been for some time now. But I am of the opinion that a final leg of the correction from the $750 high will likely commence in the near future. See this daily chart:

As you can see the recent rally was stopped by the 3rd arc pair on this bull setup. This is hardly unusual. 3rd arcs are tough as a general rule. The question is, will it get through these arcs without another pullback?

As you can see the recent rally was stopped by the 3rd arc pair on this bull setup. This is hardly unusual. 3rd arcs are tough as a general rule. The question is, will it get through these arcs without another pullback?

Let’s take a closer look at this chart in a close-up of the more recent candles:

As you can see, despite a brief penetration of the arc, price has been unable to close on the sunny side of this resistance since it first encountered the arc more than a week ago. There have now been five unsuccessful attempts to breach the arcs. Sooner-or-later, I believe, price will get through, and a new rally will commence. But when?

There is a warning on the chart in the form of blue vertical lines. They are spaced 90 degrees apart, so the next daily bar will be almost exactly 180 degrees from the start of the bull rally in mid-May (see the first chart above to see the start of the rally, and the blue vertical line just to the right of the 1st arc pair).

Now, it goes without saying that this could mark the beginning of another acceleration upwards. But it would be much easier for me to believe that an acceleration was about to happen if price were sitting on solid support, rather than obstructed by firm resistance. I hope that makes sense.

While I anticipate another down leg to commence soon I don’t expect it will last forever. I don’t generally short a market that has long-term upward trend, as surprises usually happen in the direction of the larger trend. So I will likely wait this (anticipated) correction out. But more aggressive traders may take a different path. Either way, stay sharp…

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.

Image from Shutterstock.