Why This Former JP Morgan Bitcoin Bear Says Crypto Could Make a Major Comeback

This JP Morgan analyst isn't ready to give up on bitcoin yet. | Source: Shutterstock

Less than two months ago, JP Morgan analyst Nikolaos Panigirtzoglou found himself firmly inside the crowded group of Wall Street’s bitcoin bears. Now, he’s predicting that the flagship cryptocurrency could be poised for a major comeback — at least in the long run.

JP Morgan Analyst Backtracks on Bitcoin

Speaking during an interview on CNBC’s Futures Now , Panigirtzoglou said that the cryptocurrency market’s recent struggles could set the stage for future institutional adoption, which many bulls predict will spur the next great bitcoin bull run.

“The stability that we are seeing right now in the cryptocurrency market is setting the stage for more participation by institutional investors in the future,” said Panigirtzoglou, whose official title at JP Morgan is global market strategist. “The cryptocurrency market was a new market. It went through a bubble phase [and] the burst.”

That’s a much more positive take then he had in mid-December 2018 when he wrote in a note to clients that the prolonged bear market had spooked crypto-curious firms on Wall Street and caused institutional interest to fade.

Panigirtzoglou said that increased regulatory clarity would give institutions more confidence in the legal status of cryptocurrency, adding that continuing adoption of blockchain technology in enterprise environments would pay dividends for bitcoin as well.

“The big obstacle is regulators right now,” he said, noting that government watchdogs are often “slow” to adequately address emerging technologies and that it may take several years for institutional interest to ramp up.

Bearish CNBC Trader Sets $3,675 Bitcoin Price Target

Back in 2017, Panigirtzoglou had identified bitcoin futures as a significant opportunity for cryptocurrency to establish legitimacy as an “emerging asset class,” though these days many analysts point to the launch of regulated crypto futures as the catalyst for bitcoin’s longest-ever bear market.

However, one crypto bear says that bitcoin futures are an excellent buy at their current level. Broker and CNBC contributor Jim Iuorio, a self-described “bitcoin hater,” said that the cryptocurrency should see a short-term recovery, even if it doesn’t have much of a long-term future.

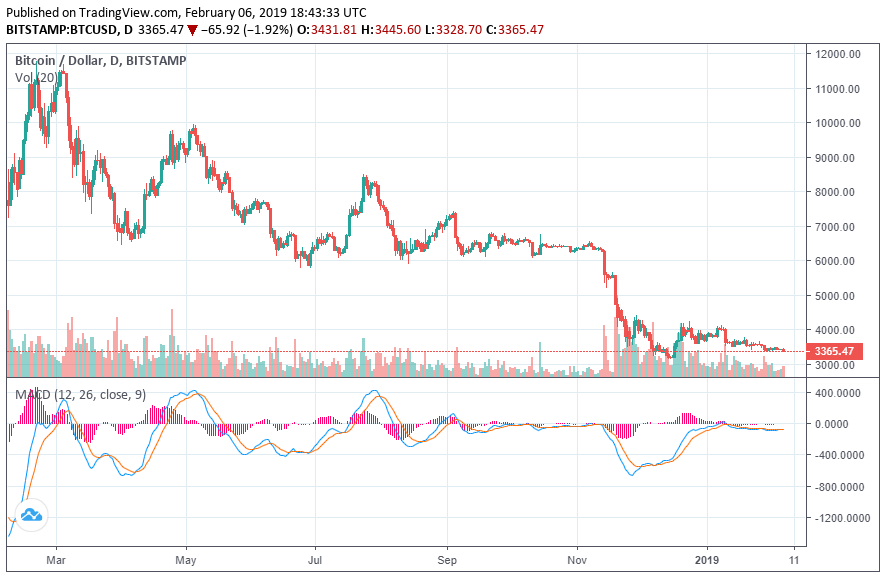

Iuorio said that he bought bitcoin futures at $3,425 and set a price target at $3,675. He also set a stop loss at $3,250, a mark toward which bitcoin has begun to creep on Wednesday. As of the time of writing, CME’s real-time index pegged the cryptocurrency at $3,360.

Featured Image from Shutterstock. Price Charts from TradingView .