Here’s Why Stellar (XLM) Price Jumped 11.20% in Three Days

Stellar (XLM) price is making gains this weekend. | Source: Shutterstock

Stellar’s crypto asset XLM is pursuing a steady uptrend since March 7.

As of 1100 UTC, the XLM-to-dollar rate was trading at 0.093, up 11.20-percent from its March 7 low. The pair today posted circa 4-percent gains, according to a 24-hour adjusted timeframe sourced at CoinMarketCap.com. At the same time, the Stellar XLM market recorded $155 million worth of trading volume, maximally against Tether’s stablecoin USDT, BTC, a mysterious dollar-pegged coin CKUSD, and South Korea’s KRW.

One should take notice that ZB.com, a China-based crypto exchange, hosted the maximum XLM trading volume. The trading platform has been alleged previously for wash trading activities. Other exchanges Exrates and Binance posted the second and the third largest daily XLM trading volumes. While Exrates is based out of a no-crypto regulation zone of Armenia, Binance holds a good track record.

Stake Acquisition

On March 7, the day XLM price initiated its uptrend, Germany-based media company Börsenmedien AG announced that it was purchasing stakes in SatoshiPay. The crypto startup, which has raised over $2 million in funding to this date, utilizes Stellar’s blockchain to enable its micropayment services.

According to Börsenmedien founder and CEO, Bernd Förtsch, the stake acquisition would allow them to integrate a pay-per-article scheme on their online portals. He said:

“There’s a gap in between inexpensive content that can be purchased on a pay-per-article plan, without hassle. SatoshiPay’s nano payment solution represents that missing link that fills the gap. We are excited about our stake in SatoshiPay, as well as the upcoming integration of their solution on our websites.”

Börsenmedien is a leading media house for financial information in German-speaking countries. The 1989-founded company issues Germany’s largest stock market magazine, dubbed as DER AKTIONÄR, and DER AKTIONÄR TV, a video portal for investors.

Börsenmedien’s acquisition of stakes in SatoshiPay, a startup which would use XLM tokens to run its services, points to an increase in demand for the Stellar asset. The case is reminiscent of xRapid, whose underlying asset XRP, moves majorly whenever a big financial firm integrates it. XLM is somewhat reacting in the same manner: bullish.

XLM Price: Up or Down?

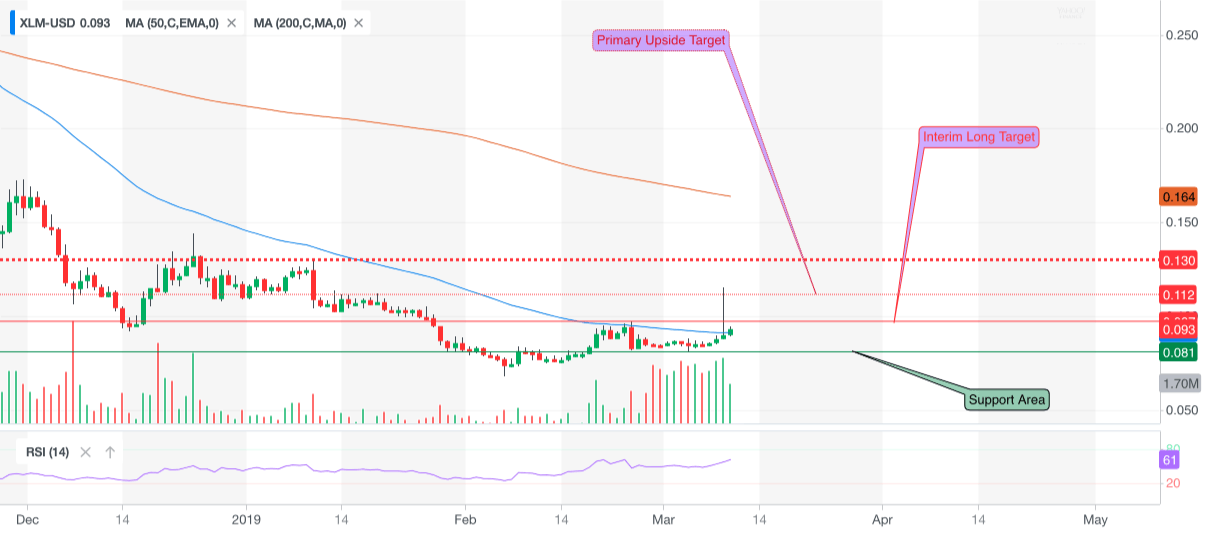

Per the technicals, the XLM price is still consolidating sideways in a range, defined by $0.093 as resistance and 0.081 as support. It would be less probable for XLM to break above its resistance area, but the same level certainly provides a decent interim Long opportunity. But if anyhow the price breaks above $0.093, then it would bring 0.112 in view as traders’ primary upside target.

At the same time, breaking below support at 0.081 could put XLM price on a path towards 0.067, its current bottom. The move could open a profitable Short opportunity.

Click here for a real-time XLM price chart.