Why Snap Stock Soared an Unbelievable 30% in Just 5 Days

Snapchat stock is on a tear. What's driving the rally? | Source: Shutterstock

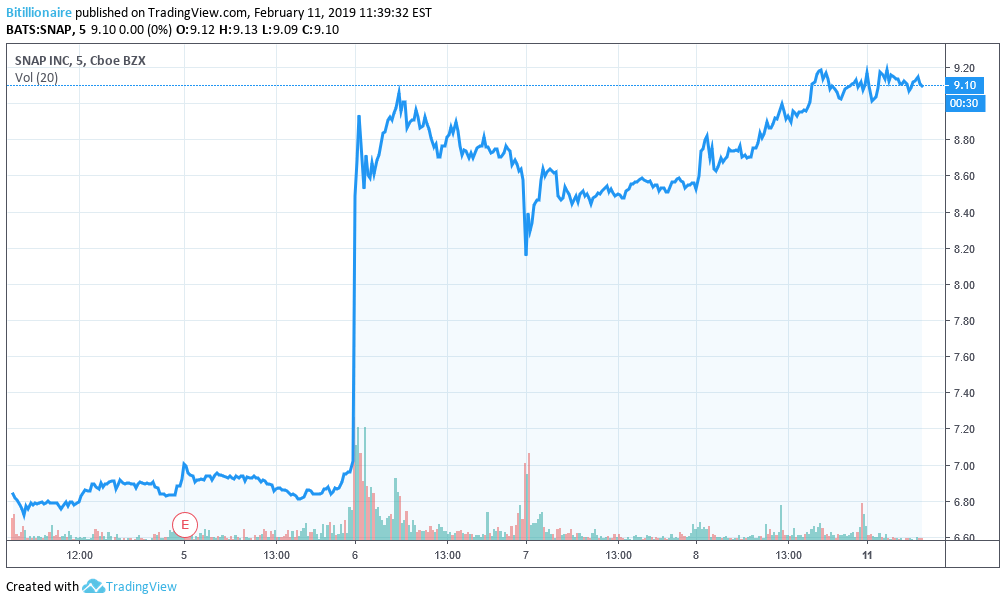

Snap stock has jumped 30% over the past week, from under $7 to over $9. Here in cryptoland, everybody’s mind is on big Bitcoin and the other top cryptos. However, if you pulled your money out of something like XRP five days ago and put it into Snapchat, you’d have made a killing. The five-day chart tells the big story. The chart from Monday shows these gains are here to stay.

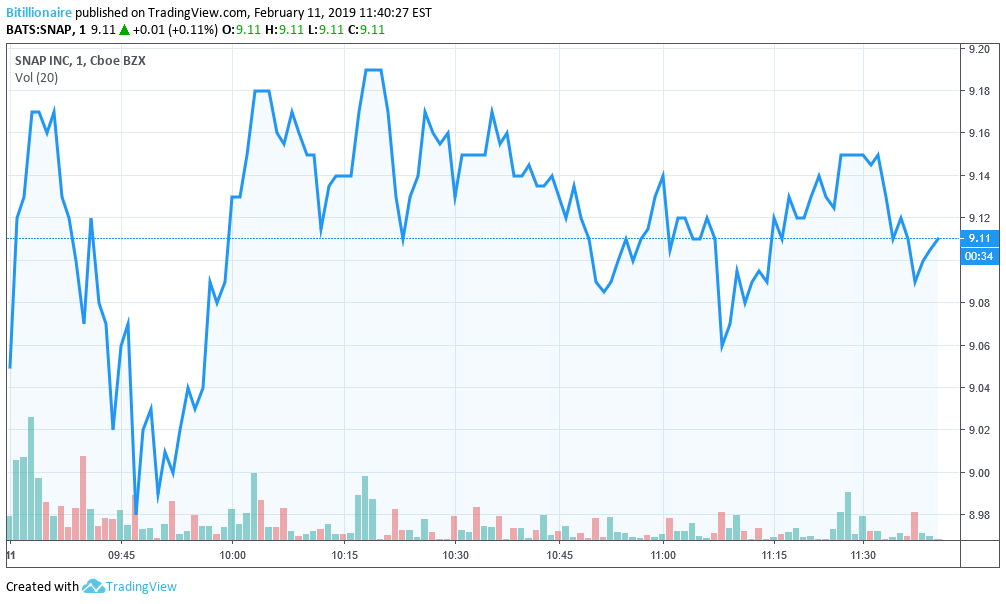

Monday trading opened up with a sell-off. Probably orders that people had wanted to execute at the close on Friday. The overall impact was less than 25 cents. Then the buying frenzy picked back up, and SNAP is back on its way to $10 and beyond.

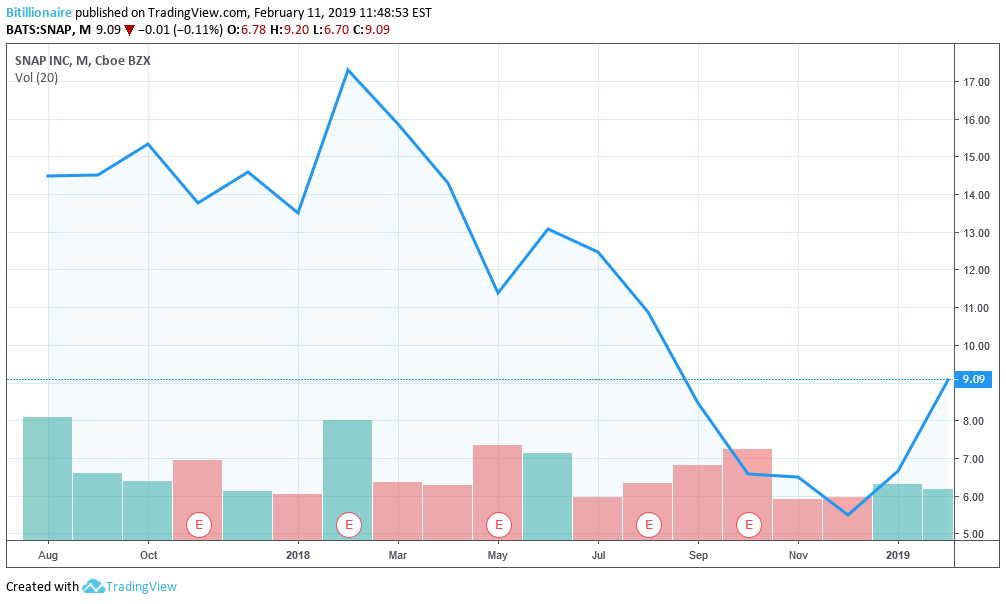

There is still a lot of room for improvement. Its post-IPO price was around $24. The stock has never gone much higher than $30. However, zooming out, it does look like the worst is behind it.

Snap’s User Base – and Profits – are Growing

Snapchat has a big hold on the demographic that advertisers are most interested in – high school and college kids. This means the company has no lack of advertisers . While their user base hasn’t grown as fast as some competitors like Facebook, the social media application is preferred by a growing subset of youth .

Snap, Inc. brought in $100 million more in the fourth quarter of 2018 than it had in the same quarter of last year. The favorable earnings call last week was a big driver of the stock’s growth, but volume seemed to be pushing it in that direction already.

Increasingly, it seems possible we’re entering a new era of social media. The concept of “privacy” has entered the user’s consciousness. Social dating apps like Bumble, which offer users a lot more control over their data and usage, are on the rise. Bumble, interestingly, was founded with money from a lawsuit brought by Tinder co-founder Whitney Wolfe .

Facebook’s recent dabbling in the cryptocurrency space may be seen as a hopeful effort to revive its future prospects. They’re not hurting (yet). They managed to make billions in China despite being banned. Instagram is a huge saving grace for the big blue F, and a future where Instagram has more active users than Facebook itself isn’t hard to imagine.

Snapchat’s prospects are high, but its model isn’t perfect. Facebook can put a price tag on its hundreds of millions of users. Snapchat is not at that point, yet, which keeps them in start-up mode. An acquisition by a larger company is still a possibility. Strong market performance wouldn’t hurt in such a pursuit.

Yet, the future’s unwritten on Snap. While it’s gaining momentum, the technology industry forever disrupts itself. An app that could replicate the usability of Snapchat, Instagram, and WeChat might take off unspeakably fast.

https://youtu.be/0f64u_AdLf4

Short-term prospects are good for Snapchat, though, as investment opportunities go. They’re sustaining these prices with less than half a billion in quarterly revenue. Once their user base grows large enough and they’ve learned new methods of making money from users, much higher prices are possible.

What we’ll be watching for in the coming weeks and months is whether Snapchat continues a slow-moving bull run or not. Last October, they changed the interface, which caused a lot of confusion. The company has a lot of growing pains left to go through. Yet there’s plenty of money in the social media space. Investors dumping Facebook in the future will be looking at Snap first thing.

Featured Image from Shutterstock