Why Does Crypto Giant Coinbase Keep Shooting Itself in the Foot?

Coinbase CEO Brian Armstrong has ambitious plans for the crypto unicorn. | Source: TechCrunch/Flickr

Coinbase is the most popular U.S.-based cryptocurrency exchange. The company boasts more accounts than the likes of Charles Schwab.

Coinbase CEO Brian Armstrong has the ambitious goal for Coinbase to become the “Google of crypto,” suggesting that its relevance to Web 3.0 could rival that of the internet search giant’s stamp on the early version of the internet. Armstrong himself was named among Fortune’s 40 under 40 list and has influenced Americans for bitcoin.

Unfortunately, rather than being celebrated, Coinbase increasingly resembles a victim of its own success. Despite having more to lose than many of its peers, Coinbase at times appears to be sabotaging its own reputation, making some wonder if the growth has come too soon, too fast.

Clearly, Armstrong and his team have a vision in mind to take the company in the direction they want it to go. At times, however, their decision-making process appears haphazard, almost like shoot first and ask questions later in their quest for adoption among big investors. Let’s reflect on a few of those decisions, shall we?

Last year’s botched Bitcoin Cash (BCH) rollout, which seemingly sent the BCH price soaring prior to the exchange’s announced listing. This year’s controversial Neutrino acquisition, which led to the #deletecoinbase movement. And most recently, Coinbase’s decision to overhaul the fee structure on its professional platform, Coinbase Pro. The latter changes involve lifting combined fees for smaller customers by one-third while slashing fees for bigger clients, as economist and trader Alex Kruger noted in a tweet.

Fee Overhaul

Coinbase has good intentions for the fee overhaul, saying it will “further optimize the market health of our platform.” They further expect it to bolster liquidity, improve price discovery, and create “smoother” price movements. The unintended consequences, however, suggest that it might not be worth it.

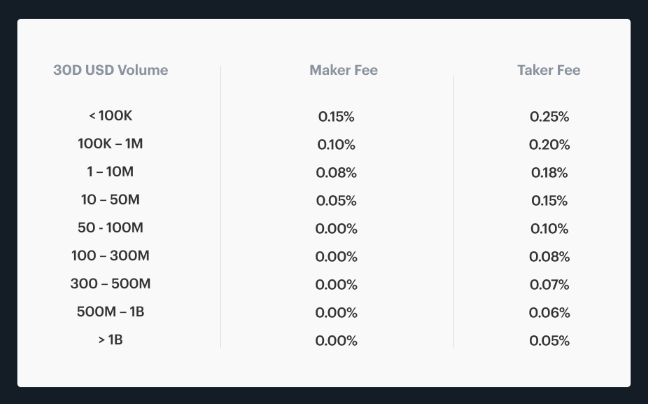

Here’s a glimpse into the new tiered fee structure, reflecting the addition of maker fees for the first four tiers versus zero maker fees in the current model.

If Kruger is right, the majority of Coinbase’s customers will fall within the first tier of trading less than $100,000, which as he describes is “subsidizing larger clients.” What’s to stop smaller traders from exiting Coinbase Pro and moving to a cheaper exchange boasting even more trading pairs, such as Binance, where the top tier (<$100-$400,000) combined fees are half that of Coinbase?

If the higher fees don’t send traders packing, this next change might. Coinbase has made the puzzling decision turn off stop market orders, effective March 22, which many traders were a fan of . While traders can use stop limits, Kruger noted these orders could “fail to execute due to slippage,” which is especially risky in a volatile market like crypto. He offers traders some advice, which is to set “far off limits,” which will “turn stop-limits into defacto stop-market orders.”

In the glass-half-full view, the changes could still result in Coinbase’s desired outcome of greater liquidity if the largest-tier of investors increase their trading volumes. Coinbase has also lowered taker fees, which is a plus. Traders are comparing Coinbase’s new fee structure to that of Kraken. Incidentally, Kraken exchange showed much greater foresight compared to Coinbase on the matter of M&A.

Neutri-No

By now, the entire crypto community and possibly beyond has heard about Coinbase’s questionable decision to purchase blockchain intelligence company Neutrino. The management team behind Neutrino similarly led Milan-based IT startup Hacking Team, which was infamously selling spyware to authoritarian governments. Did Coinbase forget its roots or worse, the social good that the blockchain was designed to provide that is also the mission of many of the projects on its trading platform?

The worst part of the Coinbase deal is that crypto exchange Kraken similarly had Neutrino on their radar but ultimately ruled them out on account of a poorly ranked product and inherent risks. If the Kraken team was able to reach this conclusion, why was Coinbase on the opposite end of the spectrum?

Coinbase has since made an attempt to right its decision by parting ways with the original members of Hacking Team, who are in the process of “transitioning out of Coinbase.” Nonetheless, the exchange’s judgment casts a bit of a shadow on their instincts, vetting process, or both.

Coinbase Is an $8 Billion Unicorn

Coinbase remains one of the largest tech startups, having been on pace to generate an estimated $1.3 billion in revenue last year despite the crypto winter. Trading commissions have a lot to do with its performance. The company has raised capital with an estimated $8 billion valuation attached, which according to Bloomberg is more than five times what the company was worth two years ago.

Coinbase isn’t going anywhere. Nonetheless, they could stand to consider that every action has a reaction, and they are not making decisions in a vacuum. In doing so, they might just be able to preempt the next #deletecoinbase movement before it gets a chance to see the light of day.