Warren Buffett’s Portfolio Lifted by Fintech Stocks. Is Bitcoin the Reason?

Warren Buffett may not be a fan of crypto, but he might have bitcoin to thank for his top three performing stocks in 2019. | Source: (i) AP Photo/Nati Harnik, File (ii) Shutterstock; Edited by CCN.com

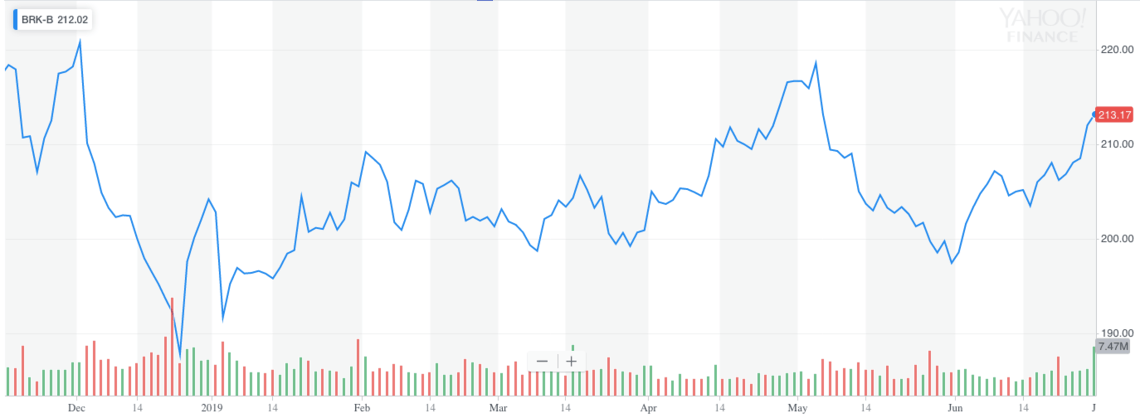

As Berkshire Hathaway finishes out Q2 2019, its top 10 performing stocks were dominated by fintech companies that are making innovations in digital payments. Warren Buffett may have bitcoin and crypto to thank.

They may be what’s keeping Berkshire buoyant despite the $3 billion Kraft Heinz writedown in Q1. That resulted in a $4.3 billion stock crash. Worse, Berkshire took heavy damage in May losses from the global equities rout on trade-war and recession fears.

Berkshire shares will, however, still finish out the first half of 2019 with a profit. They’re riding a wave of investor interest in financial technology innovation. All signs point to a bitcoin ripple effect.

Bitcoin has been the best performing asset of the last decade, as pointed out by Morgan Creek Digital Partner Anthony Pompliano. Facebook isn’t the only company making a major splash into the space with the upcoming launch of Libra coin. Investors fearing equities doldrums ahead are piling their cash into companies that promise big returns on fintech innovations.

Warren Buffett’s Top 3 Stock Market Performers

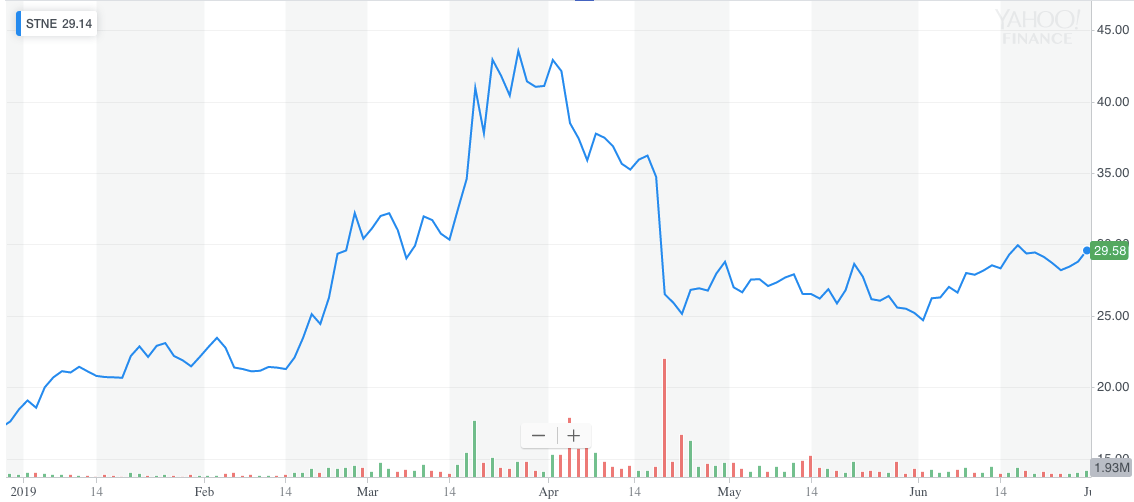

StoneCo Ltd. – The best performer in Warren Buffett’s portfolio for 2019 thus far was an odd pick for the Oracle of Omaha. Applying his value investing philosophy, Berkshire usually goes for large-cap stocks in older, more stable companies. And Buffett almost never buys at the IPO. But when this Brazilian payments startup went public in 2018, Berkshire grabbed 14 million shares at the IPO price.

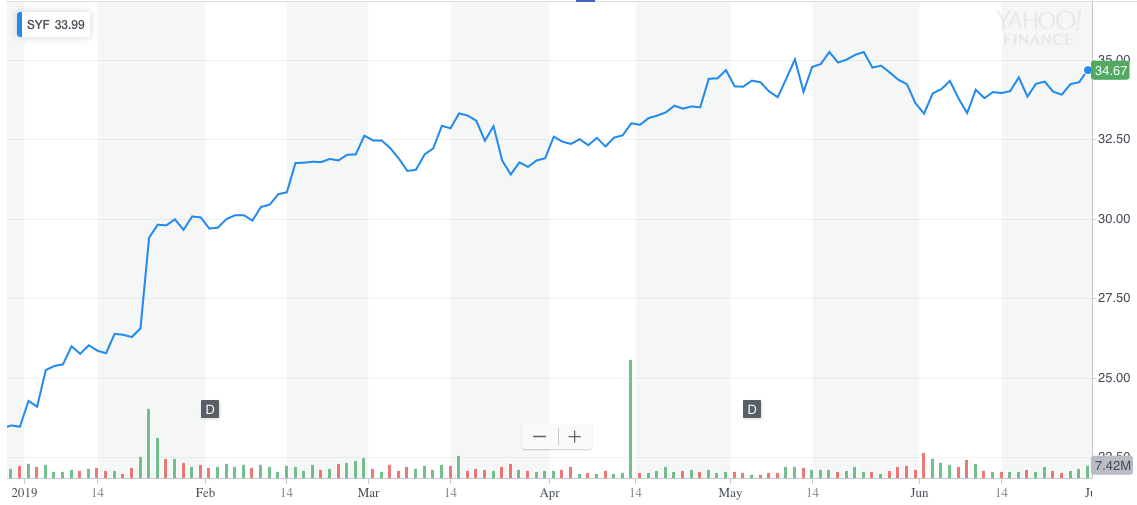

Synchrony Financial – Synchrony Financial is the No. 1 supplier of private label credit cards in America. Berkshire Hathaway is its largest shareholder, “with a stake worth $663.6 million reported as of the end of March.” The credit card company was Warren Buffett’s No. 2 stock market performer over Q1 and Q2. Zacks Equity Research says “you must retain Synchrony in your portfolio,” making special mention of its retail card products. Furthermore, in 2018 Synchrony launched a voice app for Alexa which allows customers to manage their Amazon store cards via voice.

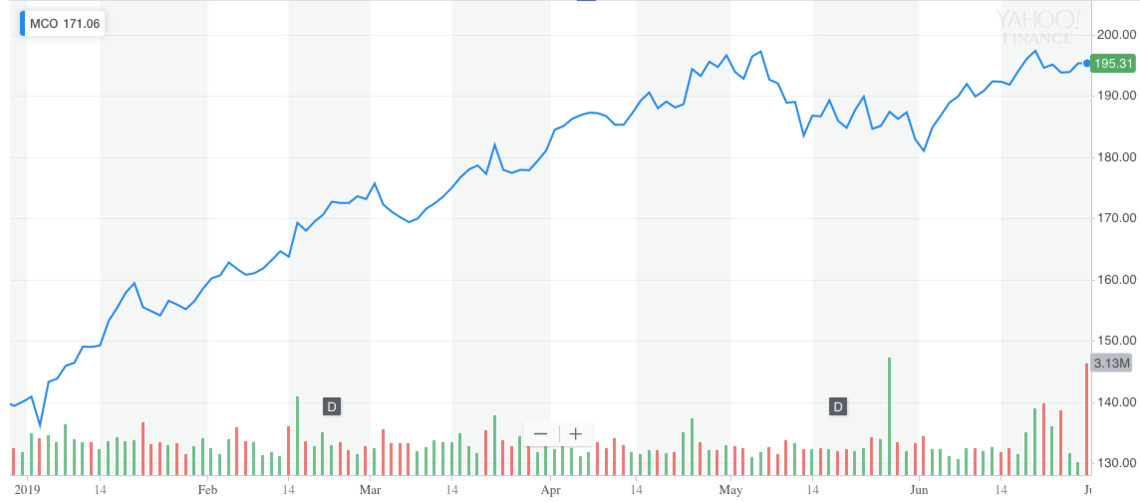

Moody’s Corporation – Warren Buffett first bought Moody’s stock in Q1 2001. Today Berkshire Hathaway holds over 24.7 million Moody’s shares currently valued around $4.47 billion. Moody’s is Buffett’s third-best stock in 2019 so far. It isn’t developing any new payment technology. But bitcoin and the cryptocurrency industry pose an existential threat to financial services companies. Therefore Moody’s financial intelligence services are more vital than ever. It shows in the stock price. Its award-winning bank application lifecycle management (ALM) system is very valuable. Finance businesses are using it to refine their funds transfer pricing and liquidity management in this new landscape.

Warren Buffett, who has voiced his disdain for crypto, is meeting up with Tron Founder Justin Sun in July where they are expected to discuss bitcoin.