Wall Street Bashes Elon Musk’s ‘Twilight Zone Act’ in Tesla’s Meltdown

Wall Street is pounding on Tesla on the heels of the missed estimates. | Source: REUTERS/Joe Skipper/File Photo

By CCN.com: Everyone is running out of patience with Elon Musk and his antics as the CEO of Tesla. Following the company’s spectacularly disappointing earnings report, Goldman Sachs and Wedbush downgraded Tesla’s stock on Thursday.

The downgrades weren’t a surprise given the dismal numbers Tesla reported. However, the scathing lashing given out by the Wedbush analyst did take some aback.

The Research Note That Could Make History

Clearly frustrated with Musk, Wedbush analyst Daniel Ives’ note to investors was part venting, mostly true, and should be a scream to Musk to get it together.

“In our 20 years of covering tech stocks on the Street we view this quarter as one of top debacles we have ever seen while Musk & Co. in an episode out of the Twilight Zone act as if demand and profitability will magically return to the Tesla story.”

The analyst went on to describe a “demand story at Tesla” that is evolving. Unfortunately, the company has not been able to adjust.

“We no longer can look investors in the eye and recommend buying this stock at current levels until Tesla starts to take its medicine and focus on reality around demand issues which is the core focus of investors.”

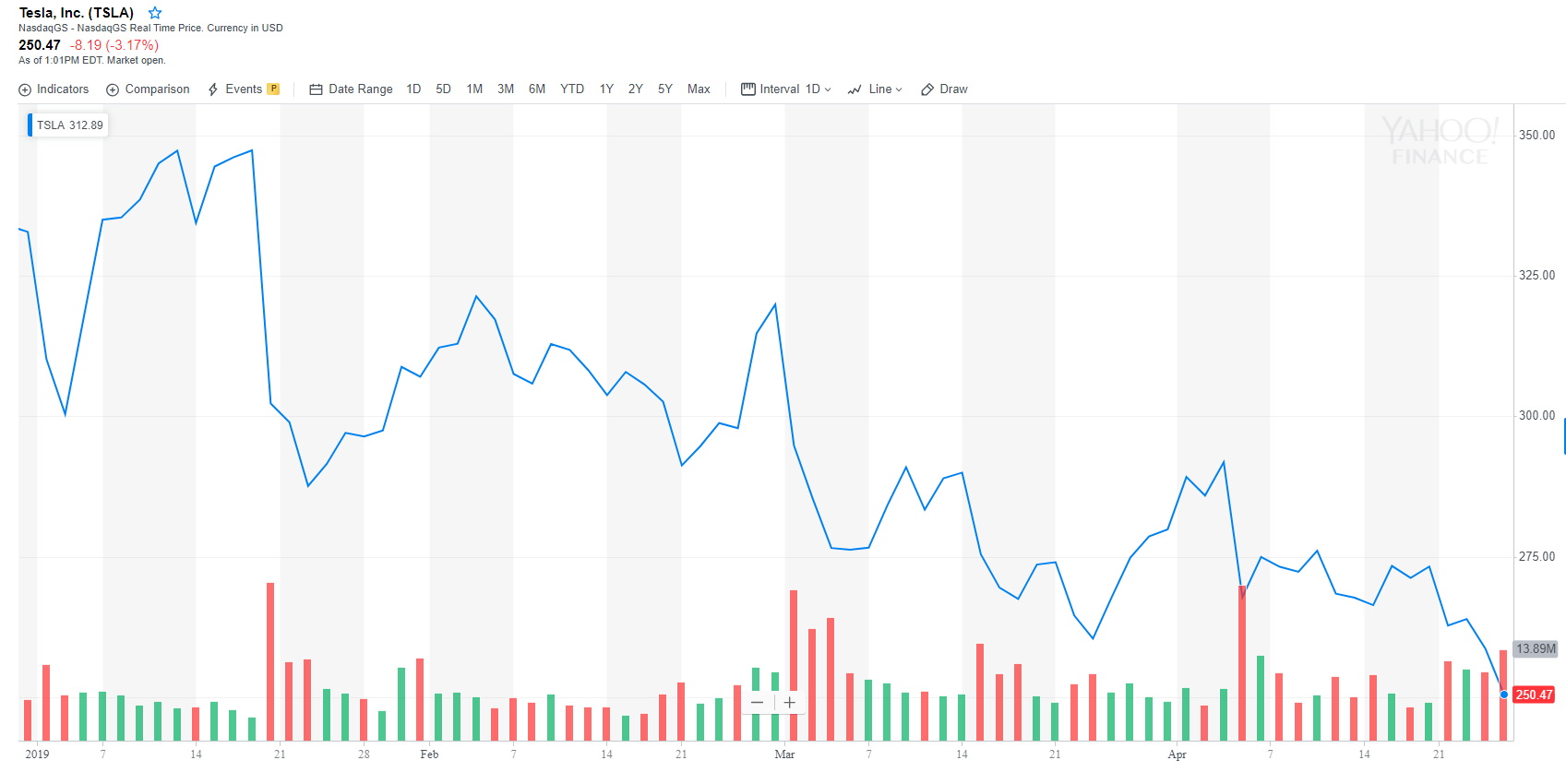

With that said, the firm lowered its rating to neutral from outperform. It smashed the price target to $275 from $365. While it had been comfortable with its price targets, this last quarter was too much.

Tesla’s Funny Math

Goldman Sachs cut its price target to $200 from $210. It maintained its sell rating.

In its note, Goldman Sachs analyst David Tamberrino raised concerns about the Tesla’s guidance numbers.

“Ultimately, we believe the company’s ‘if we build it, they will come’ mantra likely requires incremental incentives (or some form of this) in order to entice incremental sales – which also will weigh on gross margins.”

Worst Quarter Ever

Tesla reported a loss of $702 million in the quarter. Its loss per share was $2.90, which was far more than the $0.69 analysts had expected.

Musk heads back to court Thursday over tweeting. It’s that tweeting over guidance that landed him in trouble with the SEC.

Still, this week, he tweeted some very odd things.

This may be funny to Musk, but more observers are saying even if the SEC fails to rein in Musk, Tesla’s board should step in and do so. While he’s been stripped of his title as chairman, it’s time to remove him as CEO too, some say .

For example, Jeffrey Sonnenfeld, senior associate dean at the Yale School of Management, took a swipe at Tesla’s highly touted autopilot feature in speaking negatively of Tesla’s board. On CNBC Thursday, he said:

“When is the board going to wake up? You know what they are? They do understand cruise control better than anybody else. The board is on ‘cruise control.”

https://www.youtube.com/watch?v=3D_h0zyZ0_w

Shareholders have shown resistance to removing Musk as CEO.