Victory: Eddie Lampert’s $5.2 Billion Bid Rescues Sears from Bankruptcy

Eddie Lampert's $5.2 billion bid rescued Sears from liquidation. | Source: AP Photo/Gregory Bull, File

ESL Investments CEO Eddie Lampert has emerged victorious in the Sears Holding Corporation bankruptcy auction with a $5.2 billion bid that potentially saves tens of thousands of jobs and keeps 425 Sears stores open across the United States.

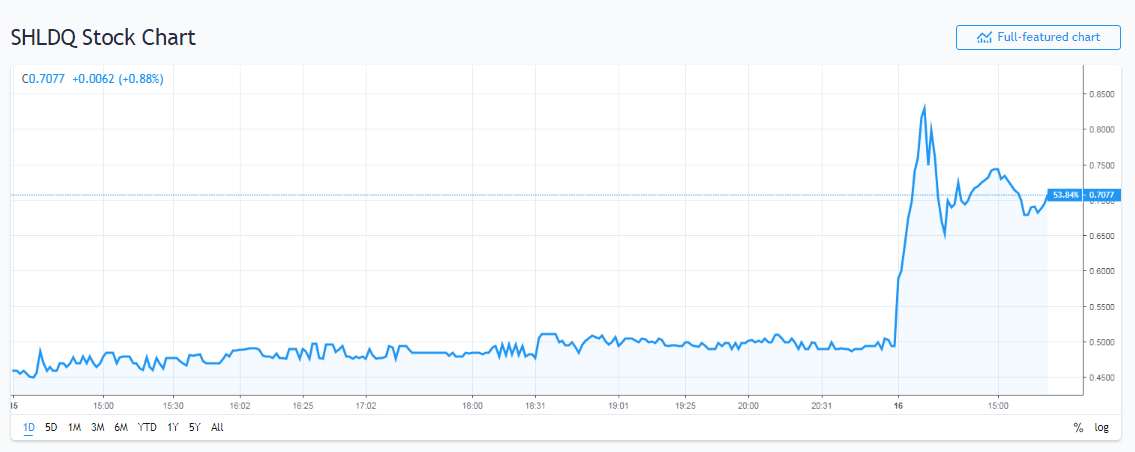

Sears Shares Leap after Lampert Wins Bankruptcy Auction

Earlier in January, CCN.com reported that Lampert was granted more time by a judge to up his rejected $4.4 billion bid to take over the ailing retailer. While the deal comes as a relief to the estimated 45,000 people whose jobs still remain technically at risk, it still needs to be ratified by a judge.

At the time, it was also reported that creditors preferred a liquidation to the prospect of Lampert taking over the iconic retailer, owing to several controversial decision made during Lampert’s tenure as CEO of Sears where he still holds the position of chairman.

Coming after weeks of negotiations and legal tussles, news of the deal sent the 126-year-old retailer’s share price up 68 percent to a 3-month high of $.084.

Bankruptcy Controversy Amid Amazon’s Prolonged Retail Disruption

According to sources quoted by Reuters, Lampert’s bid went through in the early hours of Wednesday after he put in additional cash and liabilities to improve the previous bid. The successful conclusion of the auction is only the first part of any prospective recovery for Sears, as the deal must be documented and is still subject to regulatory approval by a U.S. bankruptcy judge.

In addition, a group of creditors is still opposed to the deal, claiming that they stand to recover more from a total wind-down and from civil lawsuits against ESL Investments over controversial deals carried out with Sears – which Lampert insists were above board – during his tenure as CEO. His sole challenger during the auction process was Sears itself, whose concern was that Lampert’s previous bids would not cover the bills incurred by the retailer since it went into administration. The new bid is expected to fully cover these liabilities, which is a key requirement for bankruptcy protection.

The retailer’s woes tell a wider story of disruption and falling fortunes in the physical retail sector which has been devastated by the growth of Amazon and other online shopping platforms. Despite merging with Kmart in an $11 billion deal in 2005, Sears eventually succumbed to the same circumstances that have befallen a number of big-box retailers including Toys R Us Inc., J.C. Penney and Bon-Ton Stores Inc., among others.

Eddie Lampert Image from AP Photo/Gregory Bull, File