43% of ‘Clueless’ Millennials Trust Crypto Exchanges Over Stock Market: Survey

US millennials trust crypto exchanges more than the stock market, but one analyst says they're clueless. Source: Shutterstock

Almost half of millennial bitcoin traders in the US trust crypto exchanges more than the traditional stock market, according to a survey by cryptocurrency trading platform eToro.

A nationwide survey of 1,000 online traders indicates that 43% of millennials trust crypto exchanges more than the US stock exchanges. In contrast, a whopping 77% of Generation X traders who participated in the survey trust stock exchanges more.

Crypto’s Generational Divide

Guy Hirsch, the managing director of eToro US, says the research spotlights the schism between the younger generation’s embrace of crypto versus the skepticism of their older cohorts.

“We’re seeing the beginning of a generational shift in trust from traditional stock exchanges to crypto exchanges. Younger investors’ experience with the stock market has seen a great deal of loss of trust, with the fall of Lehman Brothers because of irresponsible practices followed by the worst recession since the Great Depression.”

“Immutability is native to blockchain, and that makes real-time audit sensible and cost-effective. And that is why Millennials and Gen X perceive crypto exchanges as less likely to be subject to manipulation and less likely to be a place where bad actors get rewarded with taxpayer money.”

Here’s the generational breakdown:

- Millennials (individuals born from 1981 to 1996)

- Generation X (people born between 1965 and 1979)

- Baby boomers (birth years: 1946 to 1964).

Institutional Investors Would Pump Crypto Market

Despite their skepticism toward traditional financial institutions, the eToro survey indicates that 93% of millennial crypto traders would invest more in cryptocurrencies if they were offered by established institutions such as TD Ameritrade, Fidelity, or Charles Schwab.

“While both crypto enthusiasts and Millennials alike seem to distrust monolithic institutions like traditional exchanges and the largest investment banks that play in them, there’s a great deal of demand from younger investors for offerings from firms that are more recognizable, aren’t perceived to be bad actors and have an infrastructure that can provide personalized and tailored advice.”

Bitwise Exec: Millennials View Bitcoin Favorably

The eToro survey echoed the sentiments of Matt Hougan, the head of research at Bitwise, creator of the world’s first crypto index fund.

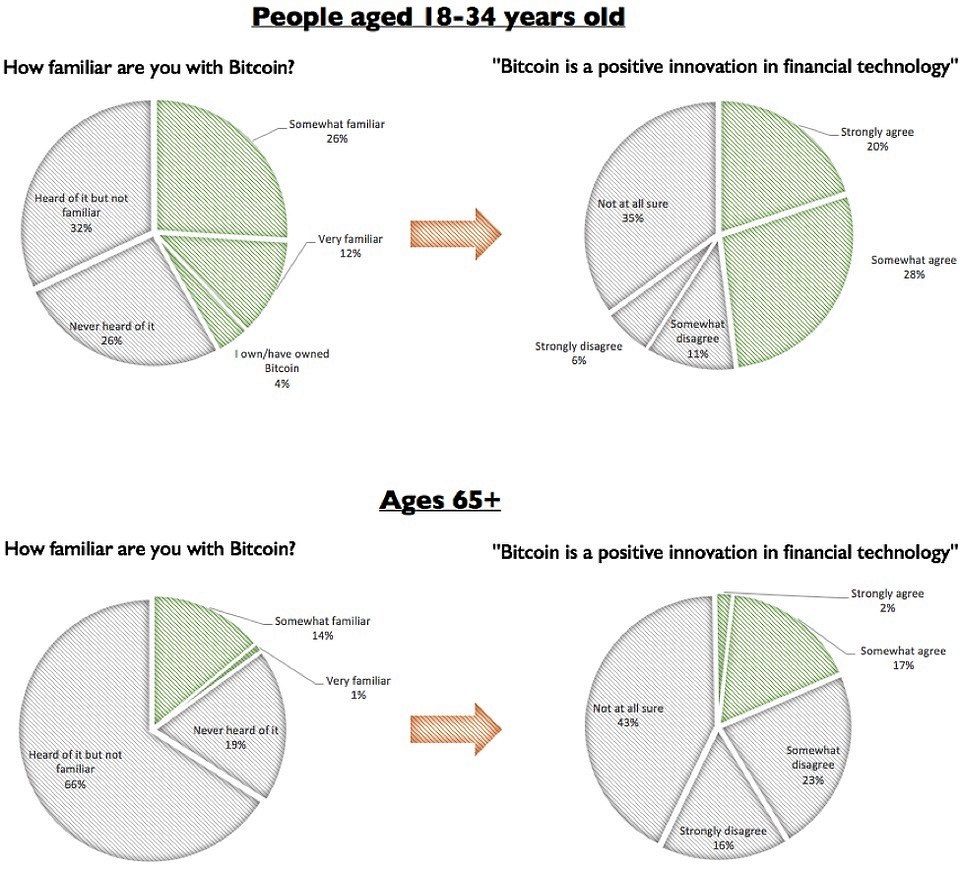

As CCN.com reported, Hougan believes bitcoin is the millennial generation’s answer to gold. He pointed to recent surveys showing that millennials have a more favorable view of cryptocurrencies compared to baby boomers.

“Every generation has an asset that they love or a way of getting exposure that they love. The Greatest Generation love gold, then people loved active mutual funds. Gen X loved hedge funds. Millennials love crypto.”

Hougan attributes this to the decentralized nature of crypto, which cuts out the middle man. He believes that’s particularly appealing to the younger generation.

CNBC Analyst: Millennials Are Clueless

Matt Hougan’s positive view of millennials contrasts sharply with that of CNBC’s anti-bitcoin analyst Scott Nations.

Nations says pro-crypto millennials are too stupid to understand that bitcoin is a sham bubble they should avoid like the plague. Nations said:

“If you are in your 20s, you have never seen an asset bubble. You were a teenager during the housing bubble. You were not even a teenager during the dotcom bubble. Well, baby, this is a bubble!”

“I hope that [young] people don’t lose too much money on bitcoin, but that they do learn the lesson: This is a bubble, and this is how it unwinds. Unfortunately, it’s a bit painful, but we have not reached the bottom yet.”

Related: Over 50% of U.S. Retirees Refuse to Invest in Bitcoin