Howdy Arabia! U.S. to Overtake Saudi Arabia as World’s Biggest Oil Exporter by 2025

A document seen by Reuters suggests that six American companies have been authorized to sell nuclear data to Saudi Arabia. | Source: REUTERS/Marcos Brindicci

For much of the past 75 years or thereabouts, the status of Saudi Arabia as the world’s undisputed energy hegemon has been taken for granted, with the kingdom exporting roughly 7 million barrels of oil per day, making it by far the world’s largest oil producer and one of the wealthiest countries on the planet. With this wealth has come huge foreign heft, availing the autocracy of an extremely close relationship with the U.S. and the unrestricted opportunity to expand its influence across the Middle East and North Africa.

Now, however, Saudi Arabia’s comfortable world of global energy market domination is drawing to a close and with it, nearly a century’s worth of Middle Eastern status quo. The International Energy Agency (IEA) on Monday released a report showing that within the next six years, the U.S. will overtake Saudi Arabia as the world’s top oil exporter.

Driven by the shale oil boom and encouraged by a marked shift in American monetary policy, the U.S. has pumped oil in record numbers over the past few years, recently overtaking Saudi Arabia as the world’s top oil producer. Its impending domination of the oil export market however, heralds the start of something totally unprecedented in one of the world’s most important albeit unstable regions.

This unfolding event has significant implications for everything from global markets to Middle Eastern geopolitics to terror financing in weak African states. So let’s begin with the boring stuff.

What Happens to Oil Prices?

In the interim, oil prices are unlikely to deviate very much from their current trends. According to IEA data, demand growth for oil will continue on its steady trajectory over that period, driven principally by marine and airline demand. Significantly, the demand for petrol will slow as consumers in more developed markets switch to electric vehicles and vehicles with increased fuel efficiency.

The long-mooted “Peak Oil” scenario continues to be something of a chimera as the IEA’s data shows no slowing demand growth over the next six years. In other words, oil prices are unlikely to fall off a cliff in the near future, which is perhaps good news for a number of poor countries that are major oil exporters like Nigeria and Angola. They have effectively been assured of a six-year window of generally stable oil prices, giving them what amounts to at least another half decade of runway to make sorely needed investment in key physical and social infrastructure ahead of the expected oil decline sometime within the next two decades.

The major implication for oil prices though is that Saudi Arabia and Russia, which often collude to fix oil prices in the so-called OPEC+ arrangement will be significantly less powerful within energy markets. This is good news for net energy importers that are American allies like much of Western Europe, but not so much for China, which may find its energy prices effectively being controlled by its principal economic and geopolitical rival.

All of this, however, pales into insignificance compared to the impact that American domination of oil export markets will have on Saudi Arabia in the near to medium term.

The Saudi Oil Conundrum

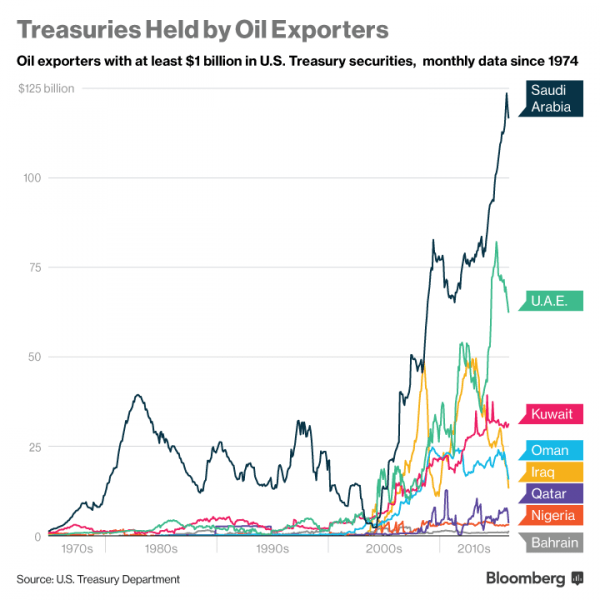

To understand just how much of a massive shift this is for the kingdom, one needs to go back to 1974 when a Faustian pact was signed between the U.S. and Saudi Arabia, effectively guaranteeing the safety and longevity of King Faisal’s hold on power in exchange for large scale Saudi purchases of American sovereign debt. Hatched by President Richard Nixon’s administration, the deal saw the U.S. purchase Saudi oil and funnel vast amounts of military hardware, training and intelligence to the Saudis on the condition that they purchase U.S. bonds.

This deal gave birth to what became known as the Petrodollar, which became the gold standard for international trade over the next few decades. It ensured that successive American governments could open the debt tap and run up a deficit which would always be funded by Saudi bond purchases. No matter how poor its underlying economic fundamentals were, the U.S. was always able to outsource poor economic performance and avoid inflationary pressure through this genius instrument of statecraft-cum-economic-doping.

The Saudis on their part got to take their pick of America’s world-leading military export technology, building up their military into by far the most equipped war machine in the Middle East which has been used as both a threat and a blunt force instrument as in Yemen. Very few countries in the vicinity of Saudi Arabia dare to contradict Riyadh on anything, with the kingdom only too happy to use its soft power as the headquarters of Islam in conjunction with its military power and financial heft to bully its neighbours from Lebanon to Cairo.

This has created several problems for everyone affected because – surprisingly enough – gifting a terrifying war machine and an inexhaustible pile of cash to a repressive dictatorship that believes it was appointed by God to rule the entire Middle East has led to uncountable human rights abuses, war crimes , and attempts to destabilise governments it does not like.

Secure in the knowledge that the Americans would never touch them lest they call in their debts and spark an economic crisis, the Saudis have also attempted to interfere with U.S. internal democracy , led a farcical international blockade of Qatar and even carried out the scarcely-believable abduction of the head of state of a neighbouring country who was then forced to resign live on air.

From an American perspective, the height of it all probably came last year when Saudi dissident and American green card holder Jamal Khashoggi was sadistically murdered inside the Saudi consulate in Istanbul, with Turkish intelligence reports indicating that he was physically hacked into bits using a bone saw while he was still alive and conscious. Donald Trump may have refused to even countenance talk of holding the Saudis to account, but clearly, actions are about to speak louder than words in this case.

Riyadh We Have a Problem

The major thing that American domination of oil export markets will do is that it will remove the halo of invincibility that has existed for the best part of 45 years around the House of Saud. The U.S. for the first time in a century will be going toe to toe with the Saudis in an economic conflict that the relatively poorly run kingdom does not stand a realistic chance of winning,

The petrodollar is much less of a thing now because it has been replaced by well, the dollar. Whereas oil-backed purchase of U.S. sovereign debt was once used to maintain the value of the dollar and keep it in use as the world’s de-facto trading currency, the dollar has now become an important commodity in itself, with American sovereign debt in huge demand from everyone, which makes Saudi money considerably less important.

For the first time, the world may start hearing serious noises about holding Saudi Arabia to account for its numerous and well documented war crimes in Yemen as well as its bronze-age social strictures including extreme repression of women, absence of religious freedom, state sanctioned use of flogging as a criminal punishment and a disturbing obsession with capital punishment.

In this brave new world that Saudi Arabia is about to enter, its conflict with Qatar could well turn into a major headache as the tiny Emirate has embarked on a shrewd campaign of international diplomacy and influence buying. In the event of any Saudi military aggression toward Qatar, they can expect a significant retaliation from Turkey and France whom Qatar has signed various bilateral agreements and defence pacts with. Turkey on its part, makes up one half of Saudi Arabia’s regional rival headache, with Prime Minister Erdogan willing to use the Qatari problem as a means to expand Turkey’s influence in the Gulf.

Iran, Israel and a Pesky American Law

The other half of the kingdom’s regional headache is, of course, Iran, Saudi Arabia’s eternal rival whose oil reserves, population and technology make it the kingdom’s most formidable foe in the entire Gulf region. Under Obama, the U.S. made a series of conciliatory moves toward Iran which despite opposition from Donald Trump may be a sign that a realignment of American loyalties in the region may not be too far fetched.

And then there is Israel, Saudi Arabia’s external ally and internal bogeyman. Never shy of a confrontation as it is, Israel will likely see any increased militarisation in the region caused by American actions as a reason to ramp up its military actions further, which could range from annexing more of Syria to expanding further into Palestinian territory. The domino effect that this could set off is extremely difficult to predict.

In the event that the U.S. adopts a neutral or hostile position toward the Saudis, they will be caught between a rock and a hard place because the continued functioning of their formidable military force – their air force in particular – is wholly dependent on American spares, repairs and servicing. In other words, the U.S. State Department’s interpretation of the Leahy Law could at least, in theory, leave the Saudis with little to no air defences.

Not even Saudi purchases of American military hardware will be enough to sufficiently swing the balance of power their way because in 2018 for example, while the U.S. exported a total of $192.3 billion worth of arms, the total value of confirmed Saudi military hardware orders is just $14 billion, which comes to about 7.2 percent of the total. That is hardly enough to give the State Department pause in the event that America embarks on a wholesale review of its Middle East policy, and it just further underlines the fact that the Americans have the Saudis exactly where they want them .

None of this is to say that Saudi Arabia or its ruling family are facing any kind of existential crisis. Regardless of whatever happens over the next six years, Saudi Arabia will clearly remain a very important country with a significant amount of soft and hard power. They just might however, have to come to terms with being part of a world that does not exempt them from the rules.