U.S. Stock Futures are Ignoring BofA’s Official Recession Declaration

The recession is already here and it's a d'deep plunge', Bank of America told clients on Thursday. | Source: AP Photo/Mark Lennihan

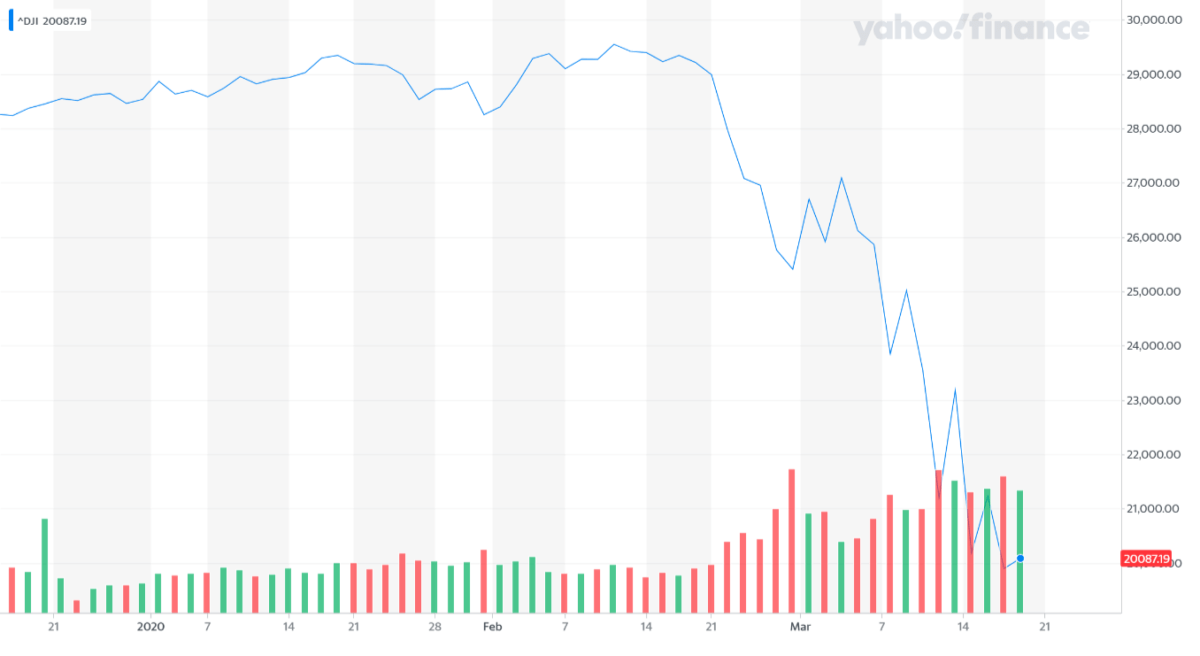

- A Bank of America economist declared recession in the U.S., as the stock market plunges to major support levels.

- The U.S. stock market is up 2% on the day, with Dow Futures climbing by 400 points.

- The government’s improved efforts in tackling coronavirus can raise confidence in the market.

The U.S. stock market futures indicate a 2% upsurge at the day’s open, primarily triggered by the strong rebound of equities in China and South Korea.

The 400-point surge of the Dow Jones Industrial Average (DJIA) mini comes after Bank of America (BofA) officially declared recession in the U.S. economy.

U.S. stock market jumps as optimism surrounds Asia

In Asia, particularly in South Korea, Singapore, Vietnam, and China, health officials and scientists have said that the peak of coronavirus is likely to have passed .

China recorded no new coronavirus cases on March 19 , for the first time since the virus outbreak started. South Korea has also seen a substantial drop-off in new cases with large-scale coronavirus testing that includes drive-thru tests.

As strategists like Chantico Global founder Gina Sanchez said, the recent downtrend of the U.S. stock market cannot be slowed down or prevented with monetary policies.

The steep correction of U.S. stocks began due to a massive spike in coronavirus cases, and the selling pressure on equities is only likely to drop when the number of new cases starts to slow down.

South Korea, for instance, saw its stock market spike by 7.4% on the day due to a noticeable decline in new coronavirus cases and the unchanged loan prime rate of China .

The U.S. sentiment is starting to improve

This week, major banks Goldman Sachs and Morgan Stanley said recession is imminent , citing negative data in regards to earnings and the short-term trend of the stock market.

On March 20, Bank of America said that the U.S. economy is likely to “collapse” by the 2nd quarter of 2020, adding that it has already officially entered a recession.

BofA economist Michelle Meyer said :

We are officially declaring that the economy has fallen into a recession … joining the rest of the world, and it is a deep plunge. Jobs will be lost, wealth 3will be destroyed and confidence depressed.

Such a dire prediction disregards the progress in China and South Korea. 90% of factories in China have already started to resume operations and the sentiment in South Korea has increased significantly in recent weeks because of strong efforts in containment.

In the weeks ahead, the U.S. is anticipated to see improved strategies in handling the coronavirus pandemic.

James Todaro, Blocktown Capital managing partner with medical background at Columbia University, said U.S. President Donald Trump’s decision to remove red tape on the use of hydroxychloroquine is “huge” in treating coronavirus patients.

He said :

President Trump just cut the red tape to approve and make the use of hydroxychloroquine widely available in the treatment of coronavirus. This is huge and the regulatory action we have been calling for this past week.

Fewer restrictions and the full support of the federal government in terms of monetary policies and financial resources to focus on containing coronavirus could lead to an overall improved sentiment in the U.S. stock market in the near-term.