U.S. Fed Ramps Up Scrutiny of Deutsche Bank Over $230 Billion Danske Bank Money Laundering Scandal

Image: Shutterstock

By CCN.com: German lender Deutsche Bank is under investigation by U.S. authorities over suspicions of aiding money laundering for a correspondent bank.

According to Bloomberg , the U.S. Federal Reserve is scrutinizing how Germany’s largest banking institution handled suspicious transactions from Danish lender Danske Bank. Alongside other regulators, the Fed has a duty to ensure financial institutions under its purview follow anti-money laundering regulations.

Did Deutsche Bank Conduct Adequate Due Diligence?

Per the report, the Fed’s focus is on whether Deutsche Bank, as a correspondent bank of Danske, undertook adequate monitoring of funds transfers it performed at the request of the Danish lender.

This was specifically in relation to transactions carried out on behalf of Danske bank’s Estonian branch. Already, Danske has confessed that a large part of the $230 billion that flowed through its Estonian operation was tainted.

Deutsche Bank has in the meantime denied that it is being probed by the Federal Reserve. The German lender has however admitted that law enforcement agencies and regulators across the world have made various information requests:

There are no probes but we have received several requests for information from regulators and law enforcement agencies around the world.

Second Internal Investigation Already Underway

This comes a little over a week since Deutsche Bank indicated that it had started a second probe regarding the Danske Bank money-laundering scandal. The bank’s CEO, Christian Sewing, revealed this at an event in Berlin, according to the Financial Times :

We do have a big interest in continuing to get to the bottom. Hence in the case of Danske, we started another internal investigation.

During the same event Sewing also indicated that preliminary findings had not revealed any evidence of Deutsche Bank being at fault.

Since the scandal came to light, the German lender has stopped clearing dollars for the Danske Bank’s Estonian operations.

Not DB’s First Time to Come Under Fire Over Money Laundering

This is not the first time that Deutsche Bank is attracting regulatory attention over money laundering concerns. Two years ago the German lender was fined nearly $0.7 billion for possessing inadequate anti-money laundering controls. Specifically, this allowed Russian individuals and entities to launder money through the bank.

Last year in November Deutsche Bank’s Frankfurt offices were raided by around 170 police officers, tax inspectors and prosecutors. This was in connection with money laundering allegations as detailed in the Panama Papers which were published in 2016.

Just two months earlier, Germany’s Federal Financial Supervisory Authority (BaFin) had demanded that Deutsche Bank institute stricter anti-money laundering measures.

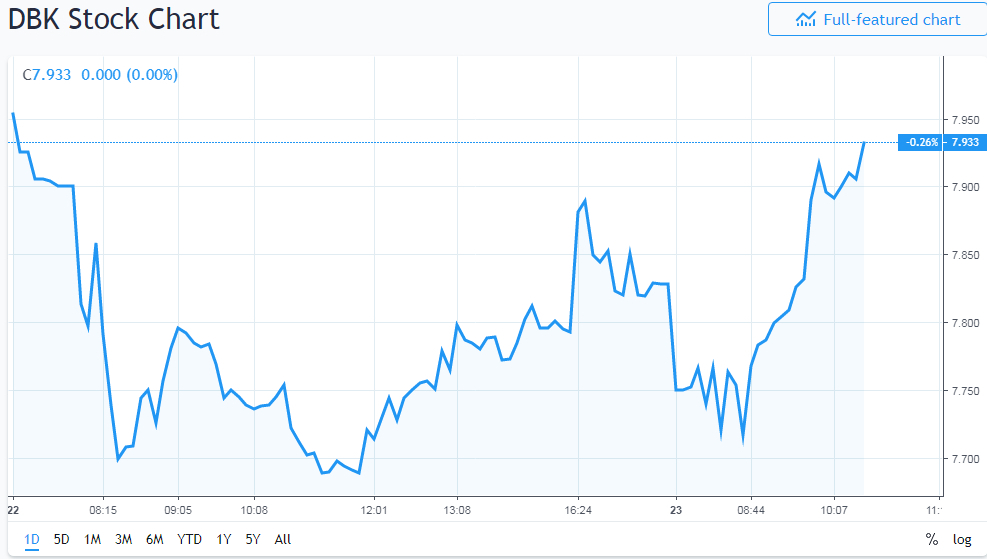

Immediately after the reports that the Fed was probing Deutsche Bank emerged, shares slid by over 1% in early trading. Deutsche Bank’s shares have since then recovered and are currently trading above yesterday’s intra-day high.