Trump Twitter Tantrum Could Trigger 20% Stock Market Crash

Trump's frequent Twitter tantrums will trigger the next stock market crash. | Source: AP Photo / Alex Brandon

By CCN.com: The Obama administration pioneered the use of social media to engage directly with the American public, but President Trump’s unprecedented Twitter antics have proven that social media can manipulate the stock market just as much as it can be used to sway the mythical undecided voter.

Since taking office in 2017, Donald Trump has frequently used Twitter to fuel stock market rallies and stunt painful corrections. However, one Wall Street strategist warns that the president’s social media addiction threatens to catalyze a full-blown bear market.

Trump’s Social Media Addiction Will Take Investors on a Bad Trip

Vincent Deluard, a macro strategist at INTL FCStone, predicts that it’s only a matter of time until one of Trump’s Twitter tantrums ignites a 20% stock market crash.

“It is not difficult to envision a scenario where this Twitter tantrum turns into a fully-fledged bear market,” Deluard wrote in a note to clients, according to Business Insider .

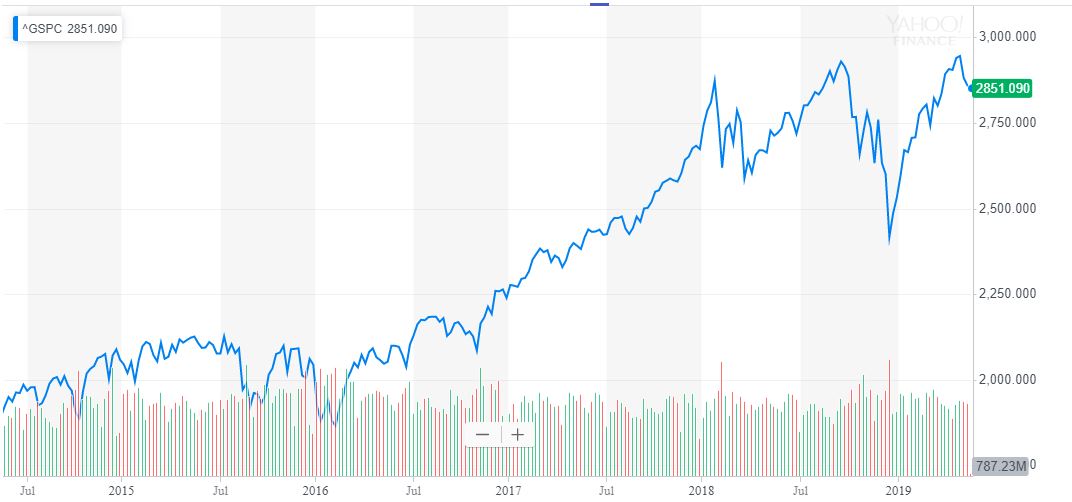

Here’s what that crash would look like. The S&P 500 would careen below the 2,000 level, potentially creating significant psychological resistance at that mark. The Dow Jones Industrial Average would slide back to 20,500, placing it dangerously close to a key milestone of its own. The Nasdaq, meanwhile, would slide to 6,200, perhaps reviving uncomfortable memories about the dotcom bust.

However, a tantrum alone won’t be enough to pummel equities. Otherwise, the picture would already look far bleaker on Wall Street.

Instead, Deluard anticipates that one or more black swan events will weaken the red-hot stock market, rendering it less able to absorb the fallout when Trump unleashes a scorched-earth tweetstorm that rattles investors.

3 Black Swan Events That Could Pummel Stock Market

One potential black swan event is a global spike in oil prices triggered by Venezuela or Iran, rogue nations that hold tremendous sway over the global oil market. The Trump administration has already had run-ins with both governments, most recently Iran.

Just yesterday, President Trump responded to alleged Iranian provocations in Saudi Arabia and Iraq by threatening to usher in the “official end of Iran,” which prompted Iran’s foreign minister to label him a “genocidal” economic terrorist.

In the domestic sphere, the abysmal performance of highly-touted tech IPOs like Uber could result in investor disillusion. This would likely trigger reduced private-market valuations, cooling the ability of would-be tech unicorns to secure the massive fundraising rounds to which they have grown accustomed.

“Skeletons may come out of the closet of many a once-highly valued tech unicorn,” Deluard warned in the ominous note.

Finally, the INTL FCStone strategist identified the 2020 US presidential election as a potential harbinger of doom. Most Wall Street analysts expect President Trump to win a second term, and it’s reasonable to expect that equities valuations reflect confidence that the economy will benefit from at least four more years of a market-friendly White House – trade war volatility notwithstanding.

Consequently, Deluard predicts that the stock market could suffer if the socialist-leaning policies introduced into the Democratic mainstream by Bernie Sanders find their way onto the party nominee’s campaign platform – even more so if that nominee stuns Wall Street by achieving an electoral college victory.

Don’t Expect the Federal Reserve to Save You

The last time equities flirted with bear market territory, the Federal Reserve swooped in to save the day by abruptly abandoning its plan to continue raising interest rates.

Even now, after the stock market has achieved a historic recovery from its December 2018 lows, many investors expect the Fed to go a step further and adopt a rate cut.

However, Deluard warns, inflation won’t remain low indefinitely, and when it begins to spike the Fed will suddenly find itself trapped between a rock and a hard place.

“Despite the current euphoria about ‘the death of inflation’ and the ‘goldilocks economy,’ it is still possible for the Federal Reserve to find itself in the 1970s dilemma: accelerating inflation and a slowing economy,” he wrote.

In other words, when the stock market does crash, don’t expect the Fed to save you.