Trump Trade Tussle Squeezes China to Add a 100-Ton Gold Hedge

The U.S.-China trade war is fueling a gold buying spree in Beijing. | Source: Shutterstock

Growing fears of a full-blown trade war with the U.S. has sent China on a gold-buying spree in a bid to increase its reserves of the yellow metal.

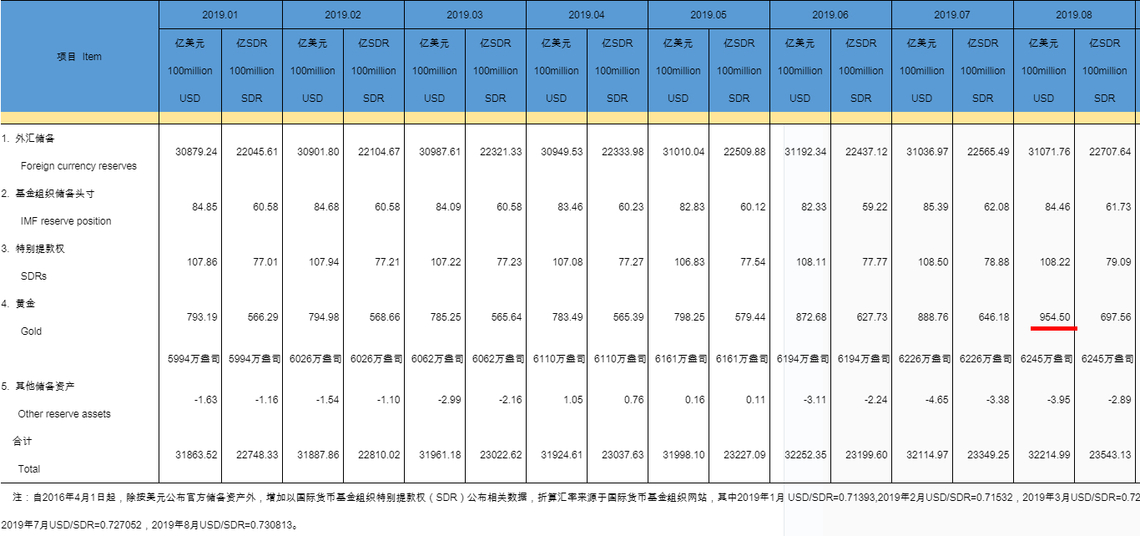

According to Bloomberg , the world’s second-largest economy increased its bullion holdings by 0.19 million ounces in August. Using a price of $1,475 a troy ounce – the median price point for bullion through August – the value of China’s new bullion reserves was $280.25 million.

Per China’s State Administration of Foreign Exchange (SAFE), the country’s total gold reserves are now valued at $95.45 billion.

China raises foreign currency holdings too

Since December 2018, China has added nearly 100 tons to its gold reserves, per Bloomberg. According to SAFE, China has acquired gold worth slightly over $16 billion since the year began. In January, the country’s gold reserves were valued at $79.32 billion.

Besides the shiny metal, China also raised its foreign currency reserves in August by approximately $3.5 billion. In July China’s foreign currency reserves were valued at $3.1037 trillion; they increased again in August to $3.1072 trillion, per SAFE.

This comes despite the fact that the Chinese yuan posted the largest monthly drop in two and a half decades as Sino-U.S. trade tensions escalated.

The accumulation of gold is not limited to China though. According to research conducted by the World Gold Council, demand for the precious metal increased by 8% year-on-year in the second quarter. This was attributed largely to buying from central banks.

Interest Rates Fall, Gold Goes Up

In Q2 2019, central banks purchased 224.4 tons of gold. Central bank purchases of gold in Q1 2019 amounted to 149.7 tons. Combined, the first half of the year saw 374 tons of the shiny metal being bought by central banks, a 19-year record.

The increased demand has seen the price of gold rally to a more than six-year high. The gold purchases are expected to remain strong, per the World Gold Council.

Some assets managers such as Mark Mobius have also warned that with central banks increasingly cutting interest rates, gold will become attractive as a store of value. Besides the increased money supply, Mobius has also claimed that any attempts by Washington to weaken the U.S. dollar will further increase the demand for the yellow metal:

They are certainly going to try to weaken the dollar against other currencies and of course, it’s a race to the bottom. Because, as soon as they do that, other currencies will also weaken. People are going to finally realize that you got to have gold, because all the currencies will be losing value.