Trump’s Stock Market Blunder Could Cost Him the 2020 Election

If re-election is the aim of Donald Trump, then owning the stock market rally of 2017 may be his biggest blunder yet. Here's why. | Source: REUTERS / Jonathan Ernst

If re-election is the aim of Donald Trump, then owning the stock market rally of 2017 may be his biggest blunder yet.

Historically, presidents of all persuasions have avoided taking credit for Wall Street’s gains because they don’t want to be weighed down by its declines. For Donald Trump, the opportunity to distance himself from the stock market has already passed.

The so-called ‘Trump bump’ is now a bumpy ride. If bond markets are a sign of things to come, the U.S. president may soon be anchored down by recession. And that’s not good for any re-election bid.

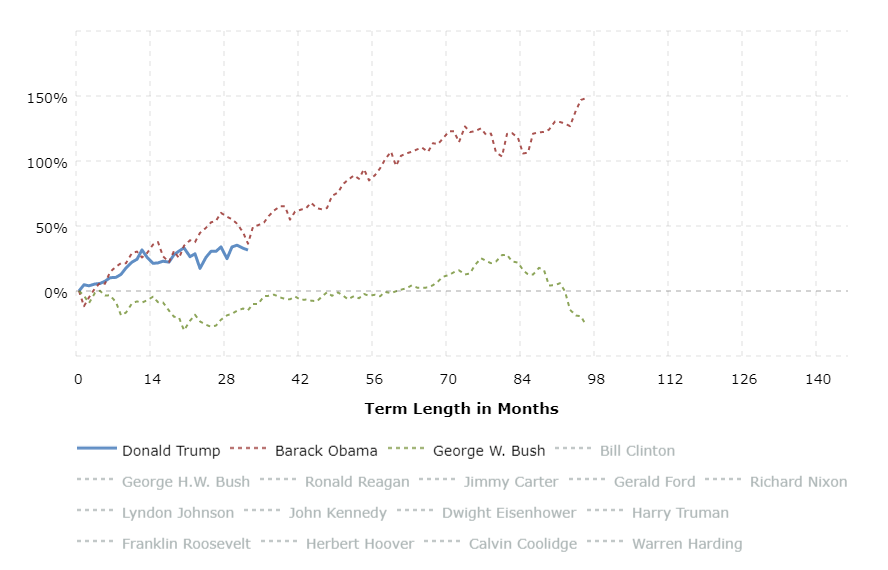

Stock Market’s Performance Under Trump

The U.S. stock market has performed exceptionally well since Trump was elected, with the Dow Jones Industrial Average (DJIA) rallying nearly 40% between November 2016 and the present. But the Dow index has lost more than 1,000 points from its most recent high and is no longer shattering records at the same pace as before.

In fact, the so-called Trump reflation trade has been dead for at least a year. The Dow is barely up on an annual basis, and the gains it accrued in 2019 are largely on the back of rate-cut expectations.

Under Trump’s watch, stocks experienced their biggest correction since the 2008-09 financial crisis, with the S&P 500, Nasdaq and small-cap Russell 2000 officially entering bear markets in late 2018. The Dow narrowly escaped that fate, but only technically. Bear markets are declines of 20% or more from a recent high, and the Dow was off by about 19% on Boxing Day.

Whether Trump was the cause of market volatility is immaterial at this point. What matters is he already attached his name to the rally, which means he will be blamed when it falls (and fall spectacularly it will).

Recession Under Trump’s Watch?

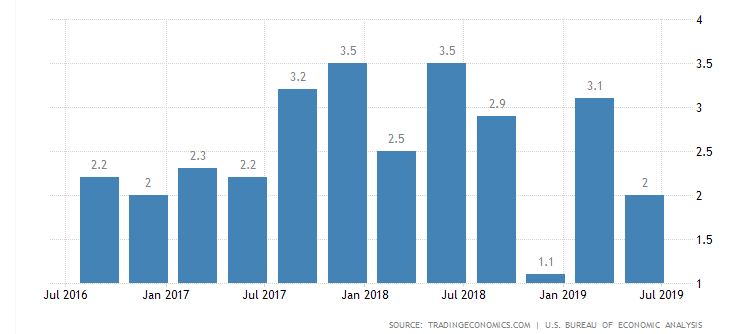

The U.S. economy is holding up much better than most of its advanced industrialized peers, but the pace of growth has slowed significantly since Trump’s tax cuts went into effect. U.S. GDP growth was revised down to 2% annually in the second quarter, the second-weakest in three years.

Usually, economies don’t know they’re in recession until after the fact. For example, it took seven months for the Bureau of Economic Analysis to confirm that the U.S. economy contracted in 2007’s fourth quarter. It took another huge downward revision to the Q1 2008 GDP figures before anyone knew the United States was in a recession.

Although revised numbers are unlikely to show that the U.S. is currently in a recession, certain sectors are already heading there. On Tuesday, the Institute for Supply Management reported that manufacturing activity contracted in August for the first time in three years. Manufacturing accounts for roughly 12% of U.S. GDP, so the threat of spillover looms large.

Timothy Fiore, who chairs ISM’s manufacturing survey, said:

“Respondents expressed slightly more concern about U.S.-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders. Respondents continued to note supply chain adjustments as a result of moving manufacturing from China. Overall, sentiment this month declined and reached its lowest level in 2019.”

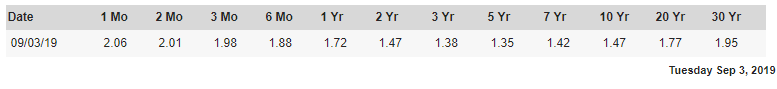

The market for government bonds, distorted as it is, suggests the U.S. economy will enter recession in less than two years’ time. That’s because inverted yield curves are extremely accurate in predicting market cycles.

Inversions have been the norm in recent months, with the 10-year yield sliding below the 2-year and 3-month interest rates. (The latter has a 100% success rate in predicting recession).

2020 Presidential Election

With the Democratic party in a constant state of disarray, Donald Trump might not have much competition in 2020. But if any of the aforementioned risks do materialize – i.e., another stock market meltdown, economic contraction or downright recession – then not even Democratic incompetence will save him.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.