Trump Border Wall Deal May Have Just Rescued Dow Jones From Further Decline

The agreement between Donald Trump and senior lawmakers to fund border security to avoid another government shutdown could have a telling impact on US markets. | Source: Nicholas Kamm / AFP

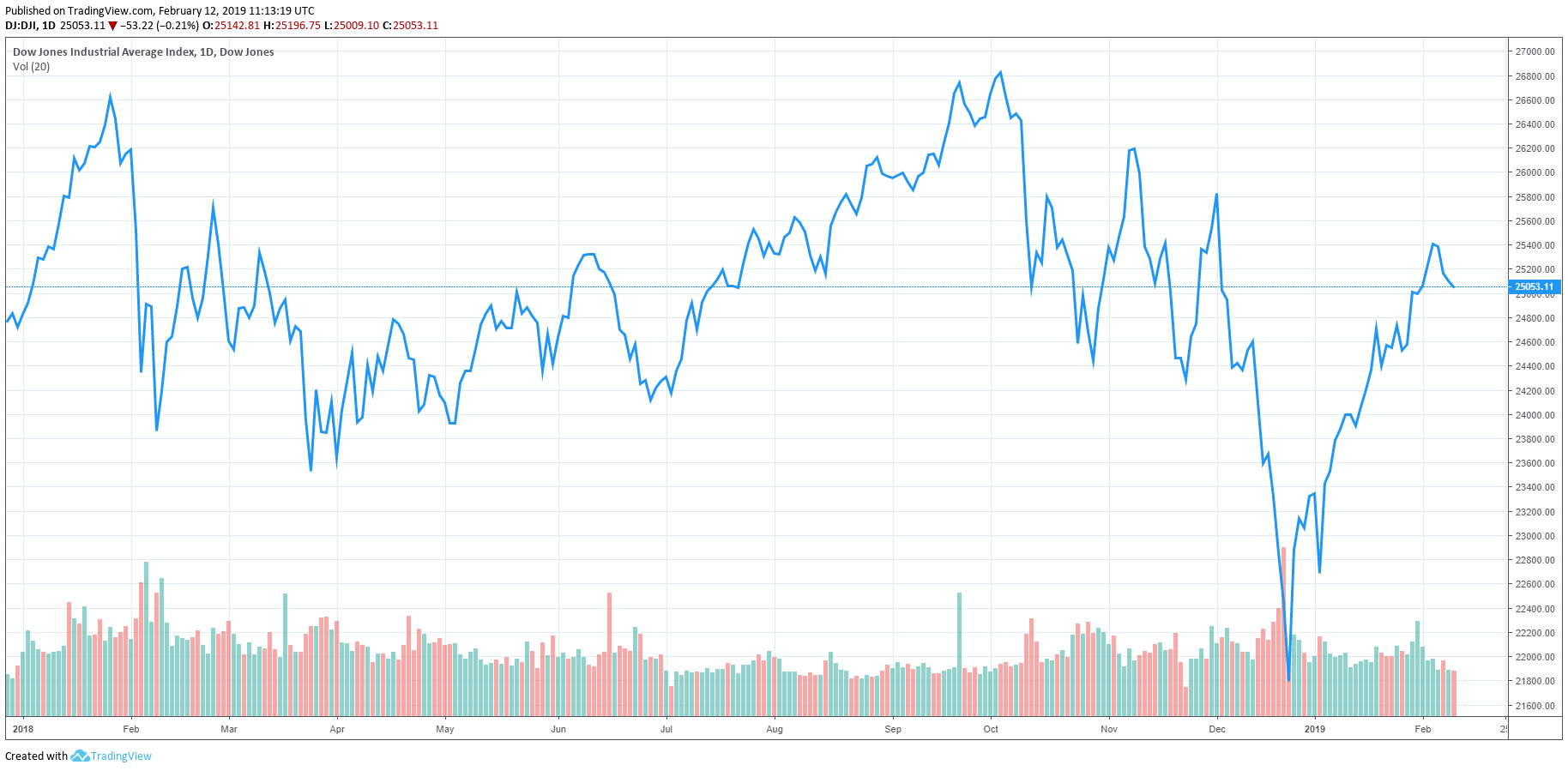

The Dow Jones has demonstrated an underwhelming performance in the last seven days, deleting nearly 400 points in less than four days during which the market was open.

On February 12, senior lawmakers on the House and Senate Appropriations Committees achieved a deal to build 55 miles of the southern border wall with a budget of $1.38 billion.

The deal prevented a government shutdown from occurring by the month’s end and it is expected to ease the tension in domestic politics, which could fuel the appetite of both investors and companies to move the U.S. stock market forward.

On Monday, George Maris, the co-head of equities of Americas at Janus Henderson, an asset manager with $370 billion in AUM, stated that the dispute on border wall funding and other issues have slowed down the U.S. economy.

“Given the political issues in the United States, there seems to be very little appetite to anything done, so it will be hard to get fiscal expansions, whether it is infrastructure-based or otherwise; tax cuts, etc. to happen is going to be unlikely,” Maris said.

Border Wall Funding Deal Could Fuel Strong Recovery

Following the end of the first government shutdown in 2019 on January 25, U.S. President Donald Trump said that the government could initiate another shutdown if no deal is reached between the Democrats and the Republicans on border wall funding.

The shutdown of the U.S. government in January led 800,000 federal employees to miss two paychecks, causing serious problems pertaining to mortgage payments and other day-to-day expenses.

While the 35-day period had virtually no impact on the jobs growth of the U.S., analysts expressed concerns over a new government shutdown that could affect employment rates.

The agreement reached by both parties may just have prevented the Dow Jones from further declining below 25,000 points, which was at risk due to the decline in momentum in the U.S. stock market in recent weeks.

The U.S. Senator Richard Shelby said :

We reached an agreement in principle between us on Homeland Security and the other six bills. Our staffs are going to be working feverishly to put all of the particulars together.”

He told me more than once that if you can work out a legislative solution to this, do it. We believe from our dealings with them and the latitude they’ve given us, they will support it.

Previously, analysts feared that if a deal is not reached by the first half of February, a new government shutdown could occur, which may derail the trade talks with China.

In the upcoming weeks, until the month’s end, the Trump administration is expected to focus on establishing a comprehensive trade deal with China to ensure no additional tariffs are imposed.

Currently, the fundamentals of the U.S. stock market remain strong. The job growth of the U.S. is at a record high with 304,000 new jobs added in January and household balance sheets remain relatively high.

https://twitter.com/seanhannity/status/1093690958275928064

As Direxion Investments managing director Paul Brigandi said, the key factor in the short-term performance of the U.S. stock market and the Dow Jones is momentum. If momentum can be sustained, analysts foresee the stock market continuing its rally throughout the upcoming months.

“Momentum is a key component right now. A lot of people are jumping in to get on board,” he said.

What are the Uncertainties?

The two major variables investors are actively observing are the outcome of the U.S.-China trade talks and the earnings reports of U.S. conglomerates.

Apart from several key industries such as oil, most sectors have failed to meet the expectations of Wall Street.

With strong fundamentals, the deal for border wall funding established, and the risk of another government shutdown in the near-term eliminated, the U.S.-China trade deal remains as the only catalyst that could result in a full-fledged trend reversal.