Treasury Yields Hit Six-Week Highs as Markets Shrug Off Trump Impeachment Witch Hunt

Democrats are pushing hard to get Donald Trump impeached. Markets don't seem bothered in the least. | Image: AP Photo/Matt Rourke

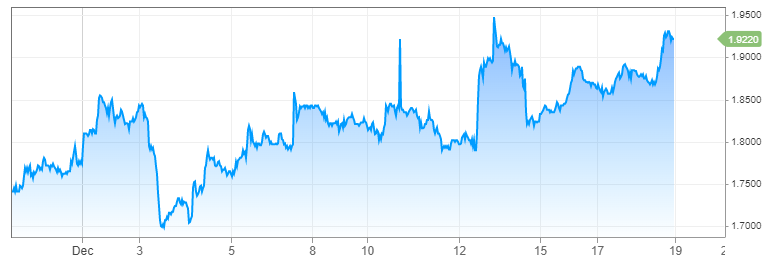

- 10-year U.S. Treasury yield hits 1.93%, the highest since Nov. 9.

- Party-line Democrats move to impeach Donald Trump in Wednesday House vote.

- Demand for risk assets remains elevated, signaling impeachment process is a non-event for Wall Street.

U.S. government debt yields held near six-week highs on Wednesday, as investors pivoted to riskier assets and shrugged off a Democratic push to impeach Donald Trump.

Treasury Yields Climb

The yield on the benchmark 10-year Treasury bond reached a high of 1.93%, while the yield on the 30-year Treasury note hit 2.36%, according to CNBC data. Yields move inversely to bond prices.

Yields have recovered sharply since September, when an inversion between long-dated and short-dated bonds triggered a rare recession warning on Wall Street. Under normal circumstances, an inverted yield curve predicts recession about two years later.

Democrats Push for Impeachment

The House of Representatives is on the verge of a historic vote on Wednesday to impeach President Trump. The vote comes mere days after the House Judiciary Committee agreed to send two articles of impeachment to the House floor.

President Trump faces allegations of abuse of power and obstruction of Congress stemming from a phone conversation with the Ukrainian head of state. Democrats allege that Trump pressured Ukraine to investigate former Vice President Joe Biden and his son Hunter in exchange for withheld military aid. Unfortunately for the Democrats, the transcript of Trump’s phone conversation with Ukrainian President Volodymyr Zelensky evidences no quid pro quo.

The market’s muted response to the articles of impeachment suggest investors view it as a non-event. That’s because strategists see no way the impeachment process will clear the Republican-controlled Senate. So even if House Democrats voted along party lines, GOP Senators are expected to acquit him in a trial next year .

Stocks touched new all-time highs on Wednesday amid calm market conditions. The CBOE Volatility Index, commonly known as the VIX, continues to trade at more than three-week lows.

The Dow Jones Industrial Average (DJIA) and S&P 500 Index eventually gave back gains to settle slightly lower. The technology-focused Nasdaq Composite Index rose 0.1% to finish at new highs.

Equities had rallied for five straight sessions on the back of U.S.-China trade optimism. That optimism was vindicated on Friday after President Trump and Chinese officials announced the conclusion of a ‘phase one’ trade deal. Under the agreement, the U.S. will rollback some tariffs on Chinese goods in exchange for more agricultural purchases from Beijing.