Trader: Bitcoin and Ethereum’s Block Reward Halving Will Create Bullish Momentum

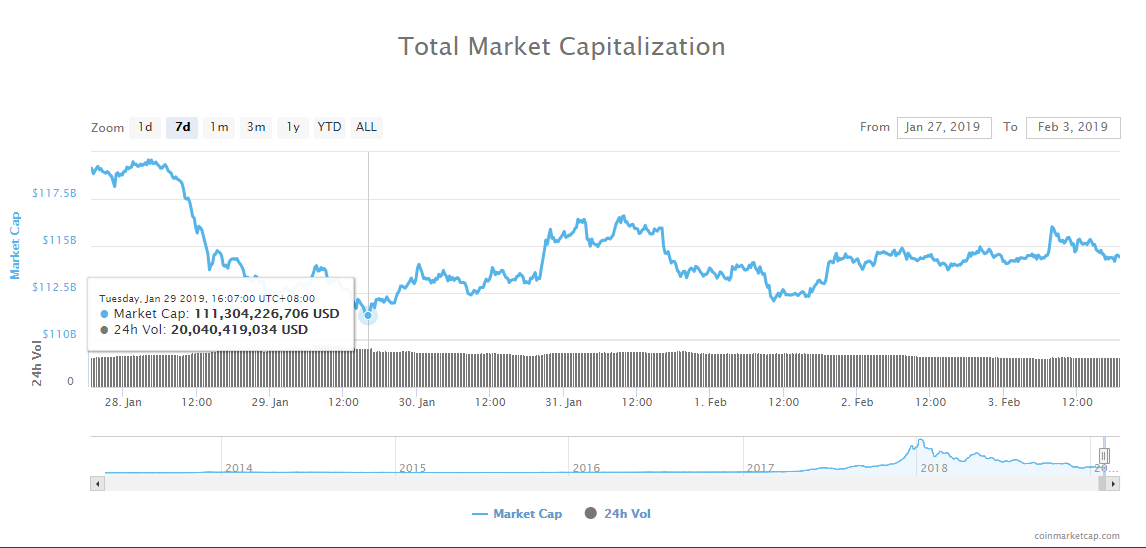

In the past 72 hours, the valuation of the crypto market increased by $3 billion to $114 billion as Bitcoin and Ethereum slightly recovered.

Both Bitcoin and Ethereum rebounded by around 3 percent since January 29 and currently remain volatile in a tight price range.

A trader with an online alias “Moon Overlord” suggested that given the historical performance of major cryptocurrencies, the block reward halving of Bitcoin, Litecoin, and Ethereum could allow the three digital assets to recover strongly in the mid-term.

Why Halving Could Affect the Bitcoin Price

Due to the fixed supply of Bitcoin, only 1 percent could ever have more than 0.28 BTC.

A former Google Product Director Steve Lee explained :

If you own 0.28 BTC and HODL, you can be certain no more than 1% of the current world’s population can ever own more BTC than you. A modest investment of $1,830 today can ensure you are a 1%er in a future Bitcoin world.

As BTC approaches its 21 million supply, the block reward provided to miners that verify transactions on the network drops to decrease the amount of BTC generated by the network.

Many analysts believe that the halving is already priced in because it is anticipated by investors years ahead before it actually happens.

But, a trader said that the halving of Bitcoin and Litecoin’s block reward and the decrease of Ethereum’s block reward by 33 percent could create a bullish momentum in the crypto market.

“LTC is halving in august of this year ETH is reducing it’s block reward by 33% in February BTC is halving in a little over a year Block reward reductions and halvings are the most bullish events in crypto history, it’s time to pay attention and start accumulating,” the trader added.

Previously, the trader suggested that historically, the price of BTC has increased around 12 months in before the halving occurred.

https://twitter.com/MoonOverlord/status/1088166671234334722

Bitcoin is expected to see its block reward decline by 50 percent by May 2020, which will decrease the rate in which new BTC are mined by miners.

The block reward halving will limit the circulating supply of BTC. If the demand for the asset remains the same or increases, it could have an impact on its price trend.

In November 2017, Chainalysis senior economist Kim Grauer said it is complex to conclude whether the decline in the circulating supply of Bitcoin is already priced in.

“That is a very complex question. On the one hand, direct calculations about market cap do not take lost coins into consideration. Considering how highly speculative this field is, those market cap calculations may make it into economic models of the market that impact spending activity,” Grauer said .

Generally, especially for investors that consider cryptocurrencies as long-term investments, the block reward halving is considered a positive catalyst that may fuel the recovery or the rally of the market.

How Will the Crypto Market Perform Until Then

If the halving begins to have an impact on the price of BTC beginning May 2019 as some traders expect, the time frame will coincide with the predictions of analysts like Willy Woo who foresee the cryptocurrency market recovering by the latter half of 2019.

Throughout the past three months, apart from some exceptions like Binance Coin and TRON, most major crypto assets and small market cap tokens have performed poorly against both BTC and USD.

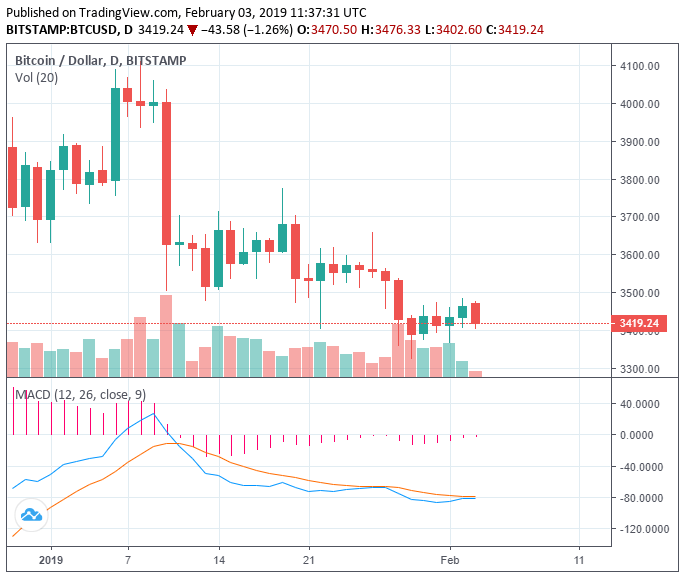

But, BTC still remains vulnerable to a drop below the $3,000 region if it cannot hold its momentum in the mid-$3,000 area.

BTC has been successful in defending the $3,000 support level in the past three weeks after achieving a 12-month low at $3,122.

In the short-term, to prevent a further drop down below key support levels, it is crucial for major crypto assets to remain stable in tight price ranges.

Click here for a real-time bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView .