What Trade War? Tom Lee Says the S&P 500 Could Return 23% This Year

Perma-bull Tom Lee expects the S&P 500 still has more runway for gains because most of the companies reporting earnings are insulated from the trade war. | Source: YouTube/Upfront Ventures

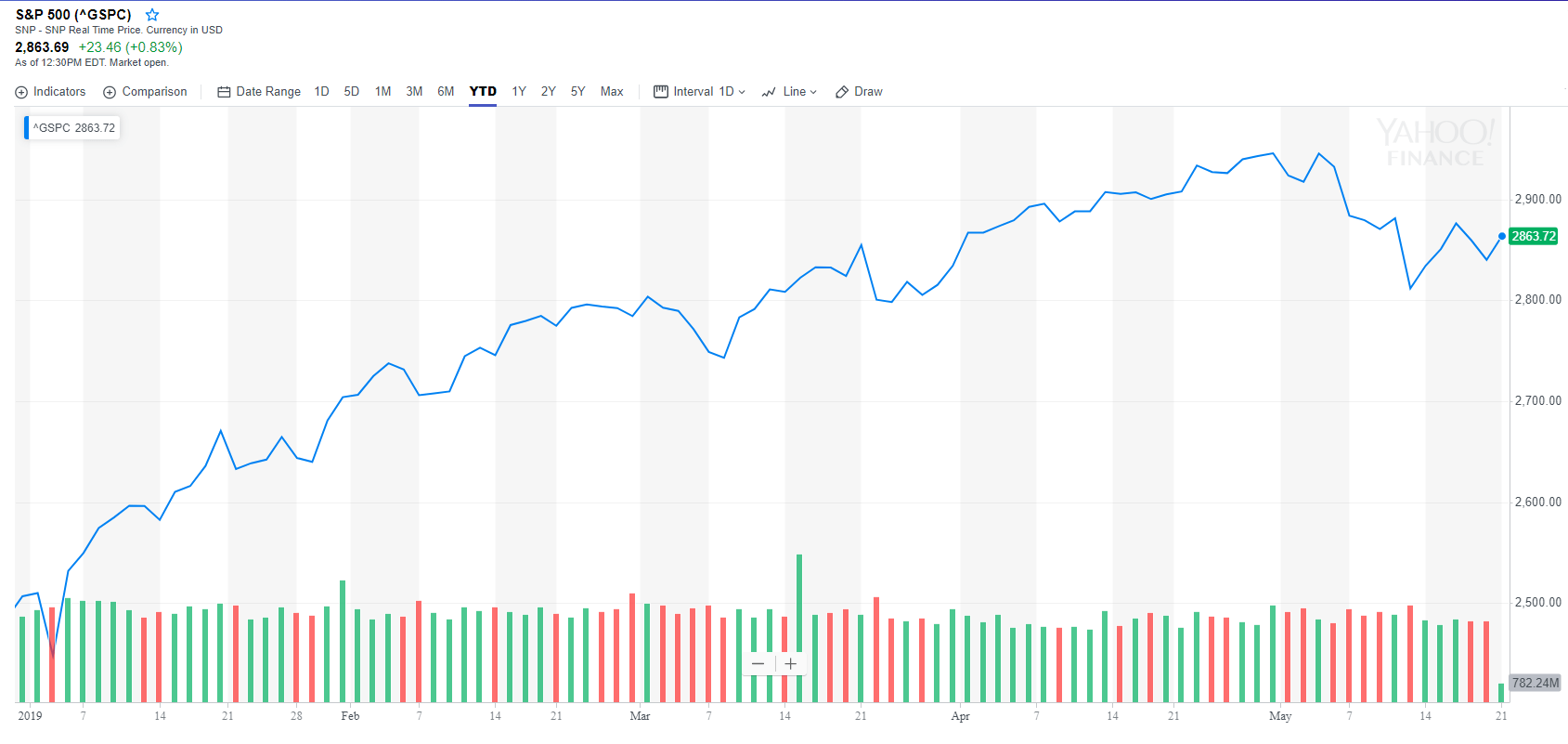

By CCN.com: The stock market still has more runway for gains despite the trade war. Fundstrat Co-Founder Thomas Lee is doubling down on his year-end target of 3,100 for the S&P 500, which reflects gains of 9% from where the index hovers today. The S&P 500 has already climbed 14% higher year-to-date, and but the mood in the market has felt more like “doom-and-gloom” than “to the moon” as a result of the trade war tensions with China. Nonetheless, perma-bull Lee is confident that most stocks won’t feel the heat from the geopolitical fire.

S&P Stocks Are Safe

According to Lee, more than half, or approximately 60% of earnings in the S&P 500, are not cyclical in nature and therefore are insulated from the trade war. Instead, these companies are more sensitive to the U.S. jobs market, which fortunately for investors has been operating on all cylinders. The U.S. unemployment rate of 3.6% is currently at its strongest level in decades as employers continue to hire at a feverish pace. As a result, the earnings outlook for the remainder of the year remains cheery, which is expected to bolster the value of the S&P 500.

Stocks Live to Fight Another Day

That’s not to say that the S&P is a slam dunk. If trade tensions between the U.S and China were to worsen, the “external shock” could throw the economy into a recession. For now, stocks live to fight another day.

Stop Kicking Tesla While It’s Down

Enough talk, which stocks are the ones that Fundstrat’s Tom Lee likes? According to CNBC, he’s focused on what he calls “granny shot” stocks, including Alphabet, Apple, Tesla, Amgen, Nike, Amazon, and Disney. These companies earn the label because they are included in multiple Fundstrat baskets of stocks. According to Barron’s , Fundstrat boasts half-a-dozen baskets across “Style Tilt; Seasonality; FANG; Millennials; Labor Shortage; and Asset Intensity Reversal.” Earlier this month, Lee stated that granny-shot stocks have “outpaced the S&P by an average of nearly 6%.”

Granny-shot is also a basketball term for a player who takes a foul shot underhanded, or the easy way. Tesla has never been accused of being an easy stock to own. In Fact, Morgan Stanley has issued a report that Tesla’s stock, which is currently trading at $200 per share, could fall as low as $10 per share if the bottom were to fall out. While that hasn’t happened, the stock has fallen nearly 40% year-to-date.

https://www.youtube.com/watch?v=8iARFoc9NpM

Nonetheless, Tesla fits into at least a couple of Fundstrat’s baskets including Millennials and FANG.

True to his perma-bull nature, Fundstrat’s Tom Lee also believes that there is a lot of “dry capital” on the sidelines in the stock market that will make its way into equities once there is greater clarity on the trade-war front.