Inflamed Trade War Tensions Threaten to Send the Dow Reeling

The Dow remained relatively stable in recent weeks, keeping the 25,500 point level intact amidst rising tension between the U.S. and China. But can it last? | Source: (i) Shutterstock (ii) REUTERS/Brendan McDermi; Edited by CCN.com

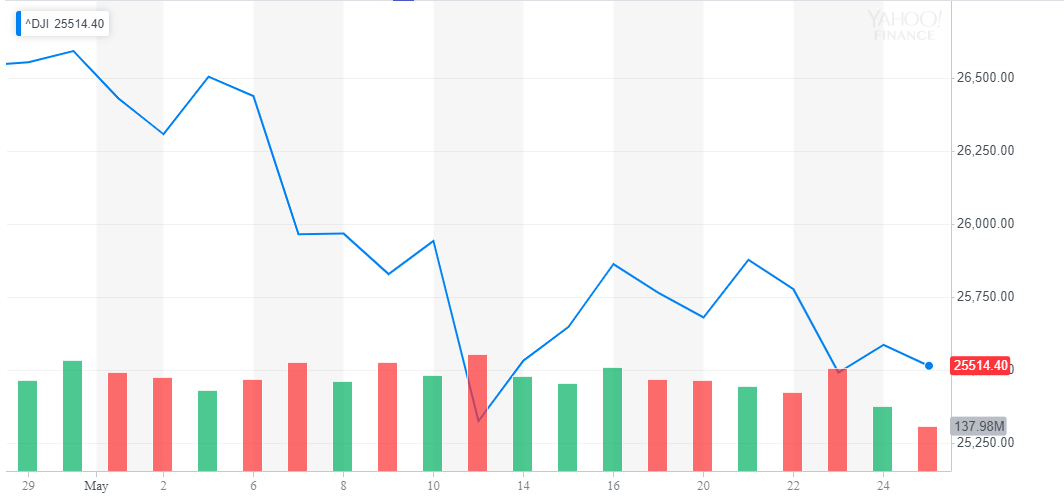

By CCN.com: The Dow Jones has remained relatively stable throughout recent weeks, keeping the 25,500 point level intact amidst rising tension between the U.S. and China.

With analysts in both the U.S. and China such as the Center for a New American Security CEO Richard Fontaine and Global Times Chinese and English editions editor-in-chief Hu Xijin foreseeing a long-lasting trade war, the Dow Jones could struggle to maintain its stability in the near-term.

Why a deal in short-term is not likely, keeping Dow’s Future uncertain

Both sides were left pondering the motive of one another as the latest round of trade talks fell apart earlier this month.

According to Xijin, a growing portion of China’s population considers the reason behind the lack of progress in the trade talks as the intent of the U.S. to slow down the growth of China’s economy.

“More and more Chinese now believe the U.S. wants to sabotage China’s economic development, not so-called fair trade with China. [The] Huawei issue has greatly strengthened such an understanding among Chinese. Are we misreading U.S. intentions? The U.S. side should explain it seriously,” he said.

Many local analysts based in China have said quite consistently in recent weeks that the current structure of the deal in which the U.S. is requesting major changes to China’s industrial policies is simply not compelling to the domestic audience.

In the U.S., President Donald Trump has also received bipartisan support for his approach in dealing with the trade dispute with China, with Democratic leaders siding with the president’s decision to push for a better deal that meets the demands of the U.S.

The trade war is at a stalemate wherein the deal presented by the U.S. is not being accepted by the domestic audience of China and the Trump administration, with bipartisan support, is unwilling to compromise in its requests for industrial policy changes.

Whether the uncertainty in a deal would lead to a Dow Jones slump and a slowdown for the entire equities market would largely depend on the progress made by either side in the upcoming months.

The Center for a New American Security CEO Richard Fontaine wrote in a column:

“An indication that this conflict is here to stay is the striking bipartisan support for President Trump’s approach. Unlike every other aspect of the president’s foreign policy—toward Iran, for instance, or North Korea, Saudi Arabia, or Russia—Washington’s Democrats and Republicans largely agree that the time for a reckoning with China has come.”

Based on the intensifying conflict between the two sides, a comprehensive trade deal in the near-term has become seemingly unlikely.

ChinaDaily, the most widely read English newspaper in China with a readership of 150 million, said in an op-ed that even if President Xi and President Trump meet at the G20 summit next month, it could only result in a partial deal that limits the damage inflicted on farms, which are likely to suffer the most from the trade deal fall out.

“If Donald Trump and Xi Jinping strike a deal—perhaps at their planned meeting during next month’s G20 summit—it will be partial at best. Perhaps Beijing will commit to buy more American farm products, natural gas and autos,” the publication said .

Is a Slump Imminent?

At this point, the lack of progress in the trade talks is said to be priced into the market. Evidently, the conflict between the U.S. and China has nearly reached its peak and some foresee a scenario in which both governments become exhausted from the tariffs and the impact of the tariffs on the global economy, pushing for a deal.

If a deal does come into fruition, it would highly likely lead the Dow Jones and the SSE Composite rebound, raising the sentiment around the global economy. If a deal is not reached following the G20 summit, a decline in confidence from investors is a possibility to consider.