Toronto Bitcoin Trader Tempts Fate, Loses $75,000 as QuadrigaCX Collapses

Canada has a high density of Bitcoin ATMs, making them a target for scammers. | Source: Shutterstock

The QuadrigaCX failure has claimed another victim. More than 100,000 investors lost a combined $190 million in crypto as a result of the exchange’s comedy of errors that were exposed by the death of CEO Gerald Cotten. Investors were left grasping at straws for any hope of recovering the lost crypto funds, which were stored offline in cold wallets. One bitcoin trader, however, might just be kicking himself harder than anyone else.

Greed Drove Trader to Gamble on QuadrigaCX

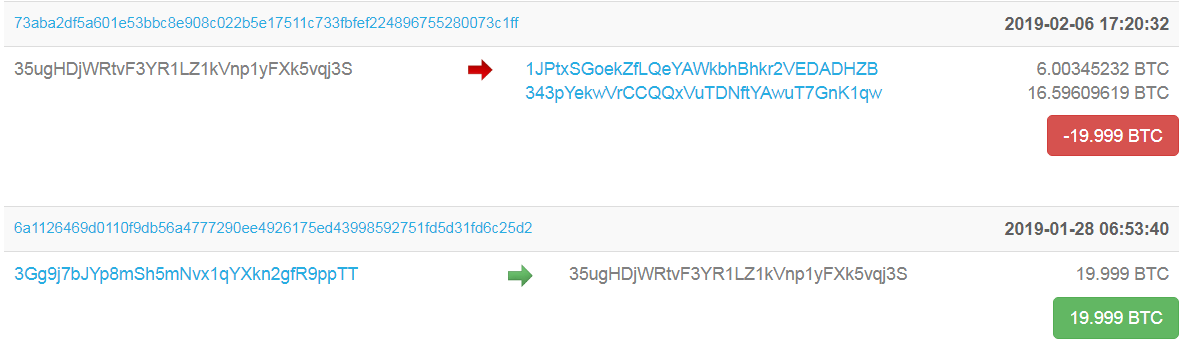

On Jan. 28, Toronto-based cryptocurrency trader Bill Tsao moved $75,000 worth of BTC to QuadrigaCX, and his timing couldn’t have been worse. After attempting to sell, he has yet to see a dime of the funds. The transaction occurred mere hours before the doomed exchange stopped honoring withdrawals.

Tsao explained his plight to MarketWatch , saying:

“I needed the cash so I just looked for the best price and thought this is the best place to sell. It was just over one hundred thousand dollars ($74,800 U.S. dollars) to pay down some mortgage and cover some other personal items.”

Tsao sold nearly 20 bitcoins on QuadrigaCX in the wee hours of that fateful day. Hours later, the exchange’s website went dark, which Quadriga chalked up to a software upgrade. The trader didn’t think he had any reason to be worried considering he had completed transactions on Quadriga before and also experienced delays. When he woke up, however, the website was offline, and it became clear that things were much worse than they seemed.

Tsao, who said he had filed a police report, has been reduced to turning to online forum Reddit for updates on the fate of Quadriga customers. He said:

“Yes, I regret it ever since, literally the next day I woke up [and] the website was down. And I have no idea how to get in contact with them other than sending a ‘package.'”

Incidentally, in his pursuit of the best price, Tsao admitted that he overlooked the fact that bitcoin was trading at almost a $600 premium when he clicked the sell button. Instead of serving as a warning for lack of liquidity, it only pours salt on the fresh wound.

“I felt so stupid not really looking into the site further before I [did] that,” he bemoaned.

Crypto Trader Tsao Down Millions in Bear Market

Tsao was not new to crypto, and his experience should serve as an eye opener to other investors who think they know enough not to get burned. He was drawn to bitcoin by the “hype” in mid-2017 leading up to the bull run and found an entry position at $8,000.

QuadrigaCX isn’t the only crypto loss he suffered. Tsao is reportedly “down millions” from the market downturn. This one, however, stings the most.

“Right now I can’t do anything until the investigation is over. I have sent emails, filled out tickets but I have got nothing back,” he told MarketWatch.

QuadrigaCX remains under bankruptcy protection, and Ernst & Young has been named the court-appointed monitor of the case. Cotten’s widow Jennifer Robertson recently made waves by requesting to be reimbursed $225,000 that she doled out to help Quadriga score creditor protection.