This Dow Jones Stock Has Wind at Its Back, Leads the Index

Coca-Cola is the best performer in the Dow Jones index today because it has more tailwinds than headwinds despite a slowing economy. | Source: Shutterstock

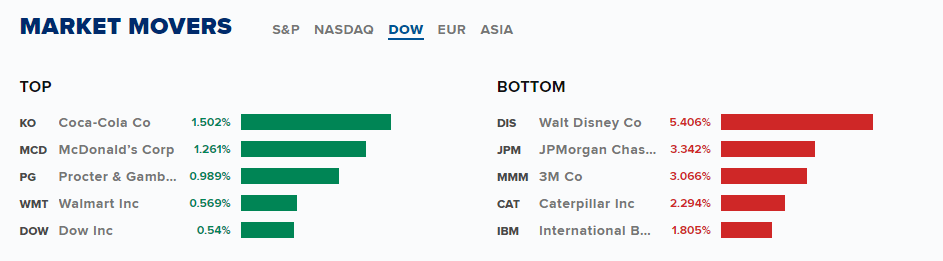

Coca-Cola is trading in the green today, which is more than we can say for most of the 30 Dow Jones components. The stock is up roughly 1.5 percent, making it the top performer among its Dow Jones index peers.

Coca-Cola is a way to play the U.S./China trade war because it’s more of a defensive play in the stock market and doesn’t expose investors to the same amount of risk as some other sectors of the economy, from gaming to big tech. The stock is also benefiting from a recent Wall Street analyst upgrade, not to mention the Warren Buffett effect.

Dow Stock Has More Tailwinds than Headwinds

So what sets Coca-Cola apart from the Dow Jones pack? Even if the global economy continues to slow, people still have to eat and drink. Besides, demand for food and beverage stocks is only heating up thanks to heightened competition in the food-delivery space.

In a major coup for the Dow Jones component, Wall Street firm Morgan Stanley in recent days attached a “fresh money buy” label on Coca-Cola’s stock. The firm reportedly said in a note that it expects Coca-Cola to report earnings growth while the broader stock market suffers earnings declines. Meanwhile, Wells Fargo Securities’ Christopher Harvey is similarly bullish on the Dow Jones stock, reportedly saying :

“With everyone running for cash and canned goods in this downdraft, we think Food, Beverage & Tobacco names are a solid lower risk play. In our model portfolio, we hold Mondelez (MDLZ), Altria (MO) and Coca-Cola (KO).”

Warren Buffett’s No. 1 Drink

Something else to consider is that Coca-Cola is the go-to drink of billionaire investor Warren Buffett.

His company, Berkshire Hathaway, reportedly owns more than $19 billion worth of shares in the Dow Jones component. Buffett recently told Business Insider :

“Berkshire owns a little over 8 percent of Coke, so we get the profit on one out of 12 cans. I don’t care whether you drink it, but just open the cans, if you will.”

Buffett’s firm is reportedly sitting on more than $120 billion in cash . No word on whether he plans on using any of that hoard to buy more Coca-Cola stock.