These 3 Marijuana Stocks Are Flailing Strong Buy Signals

Organigram Holdings Inc. (OGI), HEXO Corp. (HEXO), and Charlotte's Web Holdings (CWBHF) are marijuana stocks that are showing bullish signals. | Source: Shutterstock

There are some who would claim that the boom in the marijuana industry is over. There’s no more money to be made because most of the fundamentally sound companies have meteorically risen and there’s very little room left for growth.

However, we looked at the stocks in the cannabis sector and we’re surprised to see that the gold rush is far from over. To prove our point, we found three stocks that are printing multiple bullish signals. Here are three marijuana stocks you may want to consider for the portfolio.

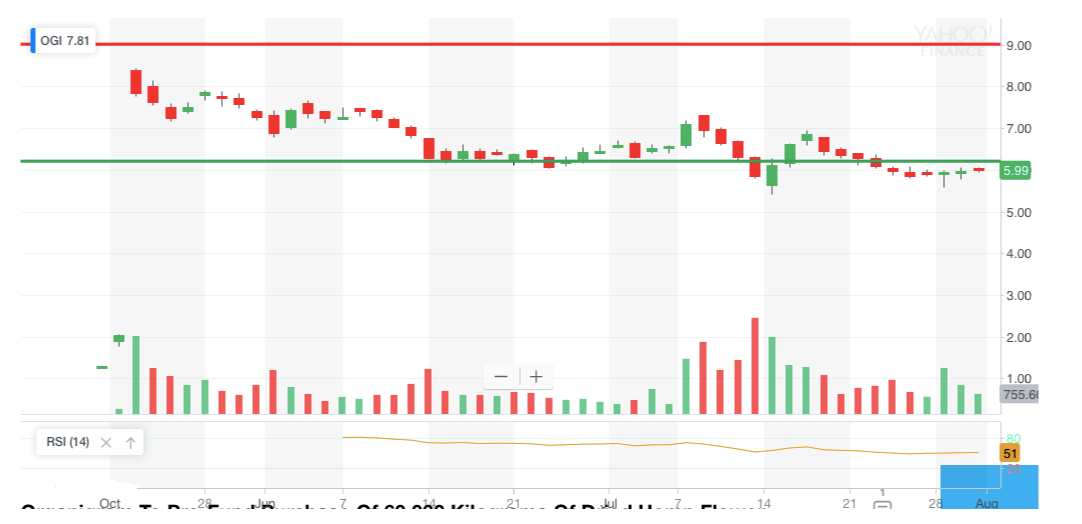

Organigram Holdings Inc. (OGI) Is in a Strong Uptrend

Organigram is a Canadian producer of medical and recreational cannabis. The company’s stock has been in a strong uptrend ever since it breached resistance of $0.50 in October 2015.

Many doubted the stock’s ability to sustain its uptrend, especially after OGI printed a lower low of $2.97 on Dec. 26, 2018. Those who panic sold then must be scratching their heads because the lower low served as the head of a massive inverse head-and-shoulders pattern on the daily chart.

A look at the daily chart shows that OGI took out the neckline of the pattern at $6.00 on Feb. 26, 2019. This triggered a strong breakout rally to an all-time high of $8.44 on May 21. Since then, the market has been pulling back. However, the good news is it appears that bulls are eager to convert resistance of $6.00 into support.

Investors interested in buying this marijuana stock might want to buy once the price stabilizes above $6.00. Based on the height of the pattern, the target is $9.00.

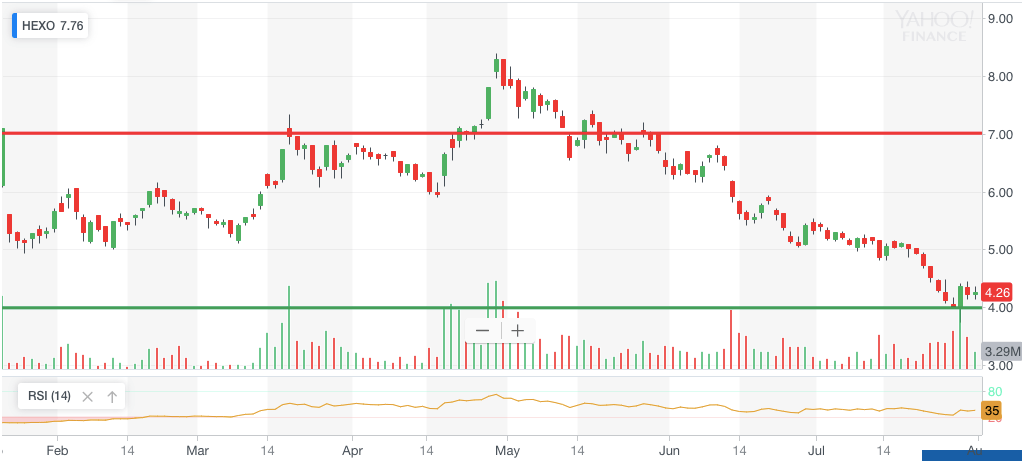

HEXO Corp. (HEXO) Is a Strong Buy-on-Dips Candidate

HEXO looks exciting for bottom pickers because it is the epitome of a marijuana stock that’s being protected by a large entity. We have this view because when the security dropped below $4.00 on July 29, bulls rushed in and absorbed the selling pressure. You can see this on the tremendous volume posted on that day.

Also, the stock appears to be undervalued because it is flashing oversold readings on the daily RSI. Therefore, we have a situation where we can expect some selling relief due to oversold conditions while this cannabis stock trades at a heavy demand level. This is a solid formula for a bounce.

As long as HEXO stays above $4.00, the initial target is $5.50. Take that out and $7.00 is next.

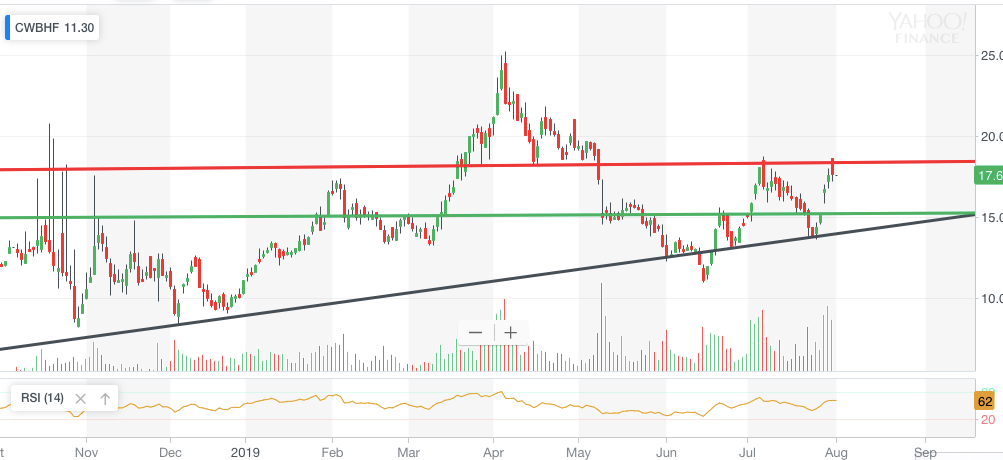

Charlotte’s Web Holdings Regains Its Bullish Composure

The Colorado-based producer of hemp-derived cannabidiol (CBD) offerings for wellness has just ended its corrective period. The retracement saw Charlotte’s Web Holdings (CWBHF) plunge from an all-time high of $25.25 in April 2019 to $10.92 in June. That’s a mind-blowing drop of over 56 percent in a couple of months.

Nevertheless, bulls struggled to recover the uptrend line and push the price higher. As a result, this marijuana stock has closed above resistance of $17.50 for the month of July. This is key because a successful breach of this resistance triggers the breakout from the cup and handle pattern on the daily chart. The breakout would mark the resumption of the stock’s uptrend.

If you’re looking to buy, consider doing so once the CWBHF cements $17.50 as support. The target is $24.00.

Bottom Line: Buy Marijuana Stocks That Refuse to Give Up Their Uptrends

OGI, HEXO, and CWBHF serve as evidence that the marijuana boom is not yet over. We’ve mapped out the key levels for you. Be safe and place tight stops. Consider taking profits quickly once the price hits the targets as these stocks are extremely volatile.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.