This is a submitted sponsored story. CCN urges readers to conduct their own research with due diligence into the company, product or service mentioned in the content below.

The article is penned by Yousuf Ikram, Advisor, Risk Management, Hada DBank.

We are living in the age of technology and in an era of extreme innovation; with every passing day, we are harnessing new possibilities and existing opportunities using technology. Nowadays, one of the most talked-about topics in the financial services industry is to enable banks to process payments more quickly and more accurately while reducing the costs of processing transactions.

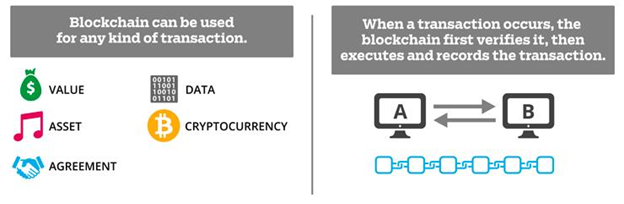

Banks are seeking to use Blockchain technology to transform sizable chunks of their business. This technology’s aim is to change the normal conventional banking by making it easier and simpler for everyone to perform banking activities from anywhere regardless of their social status. The blockchain is a disruptive technology that will fundamentally change banking as well as many other industries.

Why will Blockchain become popular?

With Blockchain, we can imagine a world in which contracts are embedded in digital code and stored in transparent, shared databases, where they are protected from deletion, tampering, and revision. Currently, the global financial market is huge, but transferring money, especially worldwide, is a hassle. While you can send an SMS or email to anyone around the world in seconds, transferring money can take days to arrive at its destination. Blockchain will reduce the number of middlemen while increasing security, both of which will reduce costs.

RelatedNews

Blockchain combines the security of cryptography , the storage, and transmission of data in coded form, with peer-to-peer networks to create a shared database of transactions that is trusted. The beauty of Blockchain is that something can be unique and stored digitally with ease, without needing an equivalent in the real world. If Blockchain finds uses in various industries, we could see a more digitally integrated global economy; something that could enhance economic growth and decrease poverty.

What does Blockchain mean for banks?

Billions of individuals and businesses are served and trillions of dollars are moved around the antiquated global financial system each day. Still heavily reliant on paper, albeit dressed up with a digital façade, there are many issues with this system that cause added expense and delays as well as making it easier for crime and fraud to cripple it. Despite the financial industry’s resistance to change, Blockchain and its expected benefits make it worthwhile.

A Blockchain is a ledger of records arranged in data batches called blocks that uses cryptographic validation to link themselves together. Put simply, each block references and identifies the previous block by a hashing function, forming an unbroken chain.

The blockchain looks complex but the idea behind it is quite simple. Essentially, blockchain is a distributed ledger rather than having the records exists in one single location. It shares among the computers all around the world. And built into that ledger, is the consensus mechanism that allows anybody to transact or do business with each other and to trust each other without having to go through a central intermediate.

Blockchain presents a two-fold solution for banks. One, it could potentially save banks billions in cash by dramatically reducing processing and transaction costs; and two, the reduction in the amount of time and the amount of paper that they process. Implementing Blockchain would make banks increasingly profitable and valuable.

What’s the connection between cryptocurrencies and Blockchain?

In the current situation, we are discussing too much of the following terms to the world of finance: Cryptocurrencies, Blockchain, Bitcoin, and Ethereum. But what do they mean? And why cryptocurrencies and blockchain suddenly became so hot. Cryptocurrencies are the digital asset (currency), Blockchain is the technology that cryptocurrencies is built on. Therefore, it is dependent on Blockchain technology. Without Blockchain, it would not be valuable because there would be no secure method of transacting in it.

Originally, Blockchain was invented to release the payment digitally between two parties without needing a third party to verify the transaction. It was initially designed to facilitate with authorizing and recording transactions of cryptocurrencies.

What is Ethereum?

Ether is the second most valuable form of digital money after Bitcoin as well as the second highest in market value. The technology it runs on is called the Ethereum Blockchain, which was first described by the then 19-year-old Bitcoin programmer Vitalik Buterin in 2013. Ethereum Blockchain focuses on running the programming code of any decentralized application; it is also used by application developers to pay for transaction fees and services on the Ethereum network.

Ethereum makes the process of creating Blockchain applications much easier and efficient than ever before. Instead of having to build an entirely original Blockchain for each new application, Ethereum enables the development of potentially thousands of different applications all on one platform.

The ether cryptocurrencies have rocketed in popularity and price in recent months. The total value of all the ether in circulation is now 98.3 million ether with the market capitalization $52.627 billion at $535.34 per ether. (As per etherscan.io, 20 March 2018)

Islamic Banking views

The Islamic financial sector has experienced substantial developments in the new century and has grown very rapidly both in size and number of an institution. With this requirement, Islamic banking has been continuously developing new Shariah-compliant products that both alter their ability to compete with conventional banks and alter their risk taking and risk mitigation profile. An Islamic banking refers to a system of banking or banking activity that includes borrowing and lending without interest that is consistent with the principles of the Shari’ah. An Islamic economic principle offers a balance between extreme capitalism and communism.

It has the same purpose as conventional banking except that it operates in accordance with the rules of Shari’ah. The Islamic banking is a design on two main basic principles; one is collection and payment of Interest (Riba) are not allowed, which means their model is based on sharing of profit and loss concept; and the second, the bank cannot create any debt without goods and services to back it. Hence savings, deposits, and investments mostly with the Islamic Bank will be backed by physical assets.

The global financial crisis has failed to have more impact on Islamic banking as compared to the conventional banking system, and they remain stable at the early phases of the global financial crisis. The main reason is their banking principles, its transparency and assets back lending, which did not permit speculative economic activity.

Application of Blockchain in Islamic Finance

The use of Blockchain technology holds great potential across the Islamic finance industry. One of the key principles of Islamic Banking is based on having enforceable contracts which are fair, transparent and agreeable between the parties that engage in a banking transaction. One of the basic differences between Islamic Banking and conventional banking is the contractual relationship.

The contract between a customer and a conventional bank is simple; a loan where interest is charged upon. But an Islamic contract is more complex and leverages on a wide range of contracts such as profit-sharing agreements, partnerships and agency arrangements. For example, an average Islamic financing arrangement requires 3 or more contracts involving multiple parties (agency contracts and multiple sales contracts)all in the pursuit of avoiding interest, speculation, and uncertainty, whereas, in contrast, a conventional loan agreement requires only a contract between the bank and the borrower. Hence, the need for more contractual arrangements in Islamic finance transactions equates to higher administrative and legal considerations.

This may ultimately increase costs for the end user. Currently, Islamic financial institutions are exploring several interesting opportunities. First movers to apply Blockchain technology to Islamic finance are entrepreneurs and startups.

An exciting technology from Blockchain called smart contracts aims to redefine how contracts work. ‘Smart contract’ is a term used to describe computer program code that is capable of facilitating, executing, and enforcing the negotiation or performance of an agreement (i.e. contract) using Blockchain technology. A Smart contract contains whole processes that are automated and are essentially self-executing digital contracts.

The terms of the contract are electronically coded and will execute only if the conditions are met. This automates the entire contractual process for Islamic institutions, alleviating the additional administrative and legal complexities and redundancies. Not only that, smart contracts are easy to verify, immutable and secure. They naturally mitigate operational risks arising from settlement and counterparty risks. All in all, smart contracts would streamline the operations of Islamic financial institutions and automate the entire contractual process.

Conclusion

The Blockchain is a revolutionary technology that the Islamic finance ecosystem could leverage to exponentially enhance business processes and streamline operations. Blockchain creates the possibility of coordinating institutions’ transactional activities within a strong mechanism of trust and transparency.

It is apparent that the characteristics and conditions of Blockchain are in alignment with the principles of Islamic Finance. In addition, its usage would open the ecosystem to a raft of interesting opportunities. More importantly, Blockchain is a perfect medium to incorporate and operationalize Islamic values of justice, equality, trust and fairness into finance which embodies the spirit of the Shariah. In Islamic bank, Coin and saving are backed by the valuable assets such as precious metal & insured according to Islamic Banking Principles for our peace of mind.

So in conclusion, Ethereum and other cryptocurrencies underpinning Blockchain developments do appear to have very favorable conditions geared towards Islamic finance given their lack of reliance upon debt, the lack of investor/borrower control and the mutually aligned profit and loss sharing of the funding process of crowd sales.

With careful consideration, this could potentially open up a raft of opportunities. With so many Islamic communities being based in developing and poorer countries that lack basic infrastructure, the use of the Blockchain and mobile technologies — such as that seen with m-pesa out of Kenya — could be the future of low cost technology that by virtue of its support from Islamic scholars could gain ready adoption from its local communities through its positive Sharia components.

More importantly, Blockchain is a perfect medium to incorporate and operationalize Islamic values of justice, equality, trust and fairness into finance which embodies the spirit of the Shariah.

About Hada DBank

Set to revolutionize the world of banking, Hada DBank determines to fuse blockchain technology with Islamic Banking Module . Having recognized the challenges for customers in the current banking state, blockchain technology will ensure security and transparency, while Islamic Banking module will ensure ethical banking and investment.

Hada DBank believes in benefiting and putting customers’ interest first, rather than profiting without limit and ethics. Thus – Caring & Personal will be the two words that will be embedded in every aspect of Hada DBank’s corporate culture, product, and services. Hada DBank’s Pre-ICO is currently live, with an ongoing flash sale for the 1st one million tokens going up for sale at 1ETH = 4,000 HADACoin.