The Feds Are Coming for Amazon but Not for the Reason You Think

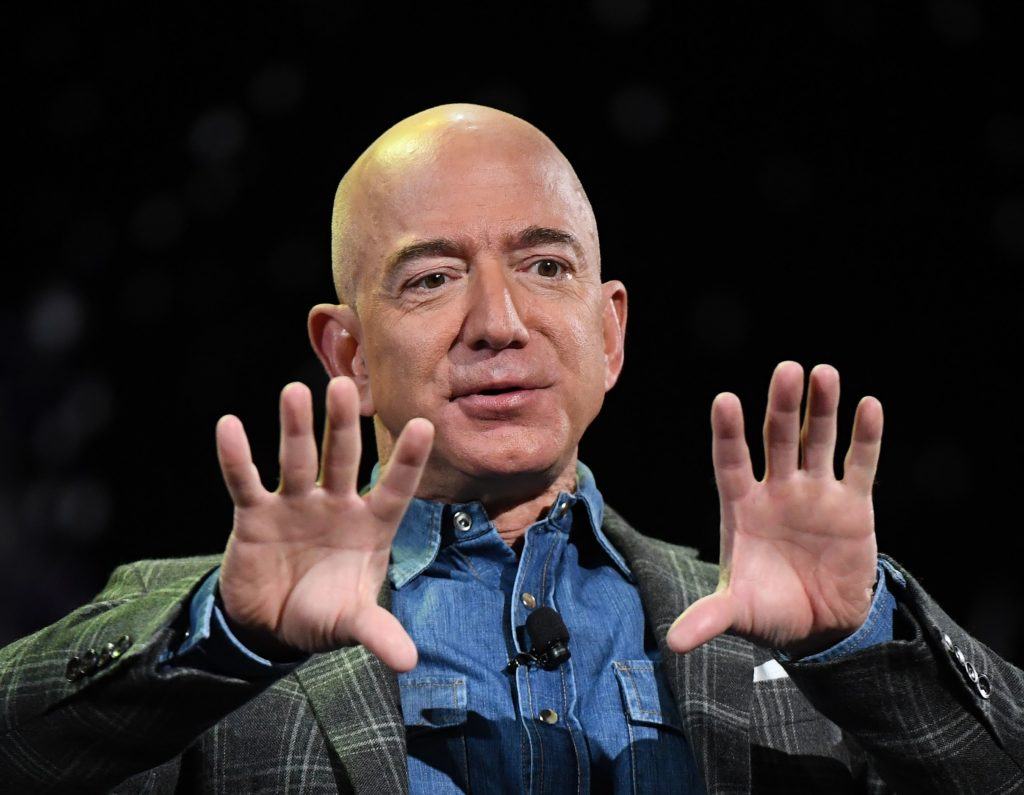

The last thing that Jeff Bezos needs is to anger the federal government through the Federal Reserve while the company is being examined for antitrust violations. | Photo by Mark RALSTON / AFP

While the Department of Justice launches investigations into giant technology companies for anticompetitive practices, one might think Amazon would be deserving of additional scrutiny.

After all, Amazon has put countless companies out of business and has been crushing the competition, as its revenue is now half that of Walmart’s. Its ability to undercut pricing on virtually every product it sells is unquestionably harming its competitors.

Yet now the Federal Reserve has been looking into Amazon thanks to the new frontier that is cloud computing technology.

The Cloud Is Now the Center of Everything

The Wall Street Journal reports that the Federal Reserve paid Amazon a little visit this spring to look into how the company’s cloud computing business interfaces with the nation’s banking system.

As the amount of required computing power and storage grows exponentially, tickling financial services, banks have turned to companies like Amazon and Microsoft for their cloud capabilities.

The cloud now controls databases that provide risk analysis for banks and brokerage traders and processes millions of payments each day. If you have mobile access to your bank account or securities brokerage, all of that information and processing occurs in the cloud, along with numerous other processes.

The Federal Reserve is apparently concerned about how robust Amazon’s systems are, including how thoroughly they are backed up, and their resiliency in the face of hacking assaults.

The conditions under which the Federal Reserve examiners conducted their scrutiny were apparently very stringent. There were always accompanied by an Amazon employee and were allowed to examine certain documents on Amazon laptops but were not permitted to leave the facility with any documentation.

Amazon Had It Easy

This is an unusually lenient approach by federal examiners.

When the Consumer Financial Protection Bureau examined various types of businesses, such as payday lenders, they would swoop in, take over entire conference rooms, and remain there for weeks scrutinizing every last little bit of data.

The approach by the CFPB in these examinations was one of thinly veiled bullying. They knew they had the right to do what they were doing, and while they were polite about it, everyone knew that they could do whatever they wanted.

This is also the case with SEC and DOJ enforcement actions. They have the power of federal law behind them, and they scare the wits out of everyone because they can litigate for fines and prison time.

The Fed Has Tons of Power Over Amazon

The Federal Reserve has no less power. As has been explained repeatedly since the mortgage crisis, the very top managers in the federal government will not permit the U.S. banking system to be undermined in any circumstance.

With all the hacking going on, from credit bureaus like Equifax to the Capital One breach, the Federal Reserve will want to make sure that Amazon and its competitors have systems that are completely buttoned up.

So while Amazon may think it can throw its weight around right now, that is likely to change over time as the Federal Reserve continues to press its influence. If it senses it is getting any form of unreasonable pushback from Amazon or Jeff Bezos, these examinations will get ugly.

Amazon doesn’t have a lot of maneuvering room. Big tech is getting a lot of criticism and scrutiny these days, and the DOJ’s antitrust investigation adds to this. The last thing that Jeff Bezos needs is to anger the federal government through the Federal Reserve while the company is being examined for antitrust violations.