The $120 Billion Uber IPO & A Government Conspiracy to Stop It?

Uber, the flag-bearer of the 'gig economy', is gearing up for a massive IPO in 2019. } So

The US government and GM may have conspired against Uber to promote Lyft. As Uber feels the heat in the run-up to a would-be record-shattering $120 billion IPO, the ride-hailing tech giant will have to take on Lyft, a Mercedes-BMW alliance, and possibly the U.S. government.

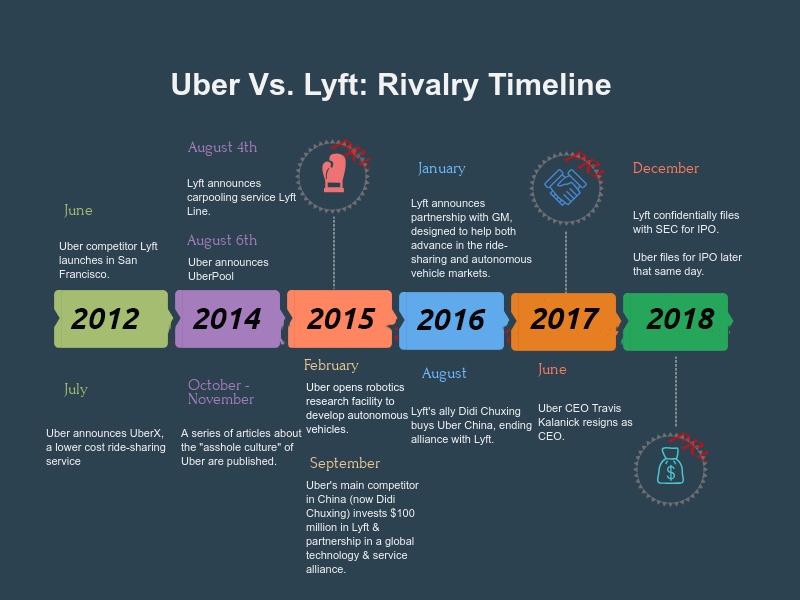

Uber vs. Lyft: The Competition Heats Up

In 2014, the Wall Street Journal reported that the rivalry between Uber and Lyft was the fiercest battle in tech. Today, as the two companies race to IPO, that battle continues in Japan. That’s because both SoftBank and Rakuten – the largest investors in Uber and Lyft, respectively – are headquartered in Tokyo.

Lyft Wins Race to IPO Finish Line

Although Lyft is much smaller than Uber – with a projected IPO valuation of a measly $20-25 billion – recent reports indicate that Lyft’s public offering will take place March 18th.

Lyft’s co-founder John Zimmer recently claimed that he isn’t worried about beating Uber to an IPO . Maybe that’s because he knew that Lyft’s victory in the rivals’ race to debut on the stock market was guaranteed.

If Lyft can gain first-mover advantage in the public trading sector, they could loosen Uber’s stranglehold on the U.S. market. But the behemoth transportation tech company – whose name is synonymous with hailing a ride – faces bigger hurdles than beating its smaller, lesser-known competitor to IPO.

Daimler, BMW Announce $1.13 Billion Plans to Take on Uber

In February , Daimler and BMW announced their additional $1.13 billion investment in their joint venture to compete with ride-hailing companies. The luxury vehicle firm detailed a 5-prong plan to offer services ranging from ride-hailing and vehicle charging to parking and car-sharing. BMW CEO Harald Krueger stated that their five services will eventually merge:

“[T]o form a single mobility service portfolio with an all-electric, self-driving fleet of vehicles that charge and park autonomously.”

While Daimler and BMW may have a leg up in car manufacturing, Uber commands an incredible market share in the U.S. ride-hailing industry. And at least one CCN.com journalist believes that Uber’s self-driving car platform will be “galactically profitable” when it reaches maturity.

UberEats Trims the Fat

To boost the image of their financial health and improve valuation, Uber has been shutting-down and selling-off less profitable extensions of the company. In February Uber announced the sale of the Indian arm of UberEats to foodtech competitor Swiggy in a share-swap arrangement. The equity exchange deal will give Uber a 10 percent stake in Swiggy while cutting monthly losses of $15-$20 million. Uber and Swiggy will complete their share-swap in March.

While Uber has fared well with previous equity exchanges, Didi Chuxing’s recent $1.6 Billion loss will affect Uber’s bottom line. In 2016, Uber exchanged its losing battle for China’s riders for a 17.7 percent stake in Didi. Regardless of their recent loss, Didi’s valuation has increased as much as 90 percent – from $36 billion to between $68-$70 billion in late 2018. That’s an overall win of at least $5.66 billion for Uber with the potential for even higher returns if Didi is able to IPO this year.

FUD, FUD, & More FUD

Fear, Uncertainty, and Doubt (FUD) abound over Uber’s projected $120 billion valuation and the company’s growth prospects.

In addition to bad press about the company’s image, concerns over passenger safety, and the fatal accident that one of Uber’s self-driving cars caused last year, is Uber also facing a government conspiracy?

Government Conspiracy to Promote Lyft, GM

GM’s 9% ownership of Lyft could provide cause to suspect a government conspiracy to promote FUD about Uber.

Although the U.S. Treasury sold the last of taxpayers’ GM shares in 2013 , the government’s 2009 bailout of GM – and the entire US auto industry – could be evidence of the government’s perpetual interest in the auto maker’s ongoing profitability. They don’t want to have to bail GM out again.

How far would the U.S. go to secure GM’s financial stability? How far would GM go to ensure the value of their market share? No one can say for sure. Still, both the government and the big three auto maker have been linked to enough conspiracies to warrant the possibility.

A Crazy History of Conspiracy Theories That Turned Out to Be True

Sources have linked both the government and GM to many conspiracy theories that remain just that: theories. However, GM has actually been indicted and convicted on charges that have stemmed from such theories.

General Motors Conspiracies

General Motors Street Car Conspiracy

In the 1940s, GM conspired to kill electric streetcars and keep populations dependent on gasoline. After buying most of the streetcar operations in the US and killing them off, GM replaced the streetcars with buses. In 1947, the Federal District Court of Southern California indicted GM, along with eight additional corporations and seven individuals, on two counts. In 1949, after changing venues twice, the United States Supreme Court convicted GM – along with Firestone Tire, Standard Oil of California, Phillips Petroleum, and Mack trucks – on the charge of

“conspiring to monopolize sales of buses and supplies to companies owned by National City Lines”.

however, the court acquitted them of the second charge of

“conspiring to acquire control of a number of transit companies, forming a transportation monopoly”

Although the appeal judge upheld the convictions, he fined GM only $5,000 and GM’s treasurer HC Grossman only $1. He stated that he issued such low fines because he may not have convicted at all in a bench trial . This instance may point to early collusion between the US government and GM.

Nader v. General Motors Corp.

In 1966, author Ralph Nader published his best-selling book Unsafe at Any Speed. Nader accused car manufacturers (most notably GM) of resisting to introduce vehicle safety features and spend money on improving safety. In his 1970 court case, Nader accused General Motors of harassment and intimidation in attempt to prevent his book’s release. Nader insisted that GM had gone so far as to hire private investigators to follow him and even sent in prostitutes to try and get pictures of Nader in compromising positions.

The court judge ruled in Nader’s favor, stating that GM’s actions did constitute an unreasonable intrusion of privacy and intentionally inflicted emotional distress upon the author. The judge ordered GM to pay Nader $425,ooo. Today, that sum would be worth almost $3 million, but even $3 million is just a drop in the bucket for the Big Three automaker whose market cap is $53.659 billion.

GM owns 9 percent of Lyft. If Lyft is worth the projected valuation of $25 billion (which is on the high-end of the range in which Lyft is likely to IPO), GM’s stake would be worth $2.25 billion. That’s 4 percent of GM’s entire market cap. Given GM’s history of employing intimidation and harassment tactics to protect their image (and therefore profitability), it is not unreasonable to conclude that GM would go to great lengths to protect their money.

How far outside the box is it to wonder if GM would promote FUD about Uber to hype Lyft (and therefore, themselves)? How much farther outside would it be to wonder if the US government would get involved in the conspiracy?

US Government Conspiracies

The United States government is no stranger to conspiracy theories. Vast conspiracy theories abound about the world’s largest economic powerhouse and those who run it. While some may find many of these conspiracy theories silly, unfounded, and ridiculous, there is no question that the government has a history of doing whatever it takes.

MK-Ultra

In 1975, President Gerald Ford instigated a commission to investigate CIA activities. As a result, the commission uncovered MK-Ultra. MK-Ultra was a CIA mind-control program, which ran from the 1950s-1970s (and some believe continues to this day ). In the program, the CIA tested a variety of psychotropic drugs (particularly LSD) on human beings. Some of the test subjects were not willing participants. The program’s intent was to identify and develop drugs and procedures that they could use in interrogations to weaken individuals and force confessions through mind control.

Operation Mockingbird

Also in the 1950s-1970s, Operation Mockingbird ran. Operation Mockingbird was a large-scale program aimed at manipulating the media to spread propaganda. In 1975, Ford’s commission uncovered that the CIA paid a number of big-name media outlet journalists to publish CIA propoganda. The CIA also funded at least one movie: “Animal Farm” – adapted from George Orwell’s book.

It’s All About the Benjamins

The list of conspiracy theories about the US government could go on for days. But why would they conspire to create Uber FUD and promote Lyft? — It’s all about the money of course.

After GM filed for bankruptcy in 2009, the US government bailed GM out with $49.5 billion . GM later converted this “investment” into a 61 percent stake in the company. For $49.5 billion, the US government had purchased 61 percent of GM. In 2013, the treasury sold its remaining GM shares for a total of $39 billion. Even though the government lost $11.5 billion of US taxpayer money, the Center for Automotive Research reported that GM’s bailout saved 1.2 million jobs and $129.2 billion in personal income loss between 2009-10. So for $11.5 billion, did the government just buy taxes for the coming years? And if so, how much did they make or lose on that $11.5 billion investment?

Breakdown of Government ROI

In 2009, the average GM employee made $75/hour (including benefits), or $150 thousand annually. The $129.2 billion in personal income that the GM bailout afforded then splits to 861,333 annual salaries of $150k. In 2009, except for those who were married and filing separately, everyone who earned $150,000 paid 28% federal income tax . After taking out the standard deduction and personal exemption, a single person would have paid $34,735 federal income tax. Whereas a married person with two dependent children would have paid $28,053.

For argument’s sake, let’s assume that half of GM’s employees were single and half were married with two children. In 2009, GM’s employees whose jobs the bailout saved would have paid a total of over $26 billion in federal income tax. That’s a profit of over $14.5 billion for the government. Of course, the income disparity isn’t that black and white, and there’s no real way to know exactly how much GM employees paid in taxes that year.

What we do know for sure is that the government deems GM vital to the country’s economy. Historically, both GM and the government have proven that they will do whatever it takes to protect themselves and spread their desired messages. Is it so far off to think that to protect their 9% stake in Lyft, GM would spread a smear campaign about Uber? Is it so far off to believe that the government would bribe journalists and spread propaganda to back GM’s crusade, thereby protecting their key asset?

Evidence to support this conspiracy is anecdotal at best. Nonetheless, if Uber is facing secret government opposition, it may be the biggest hurdle standing between them and $120 billion.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.