Tether Exec Refutes Bloomberg, Reassures Investors Crypto Isn’t Manipulated

Facebook's cryptocurrency combines the best of Bitcoin and Tether. | Source: Shutterstock

Leonardo Real, the chief compliance officer of Tether LLC, believes an organized campaign established by many publications is targeting crypto token Tether (USDT) and its partner banks.

In an interview with Cryptonews, the Tether executive reaffirmed that its stablecoin known as USDT is fully backed by the US dollar, citing the attestation reports released by Friedman LLP and Freeh Sporkin & Sullivan, two US-based accounting firms based in New York and Washington.

Crypto is Not Manipulated

Throughout the past six months, Bloomberg and independent researchers have reported that Tether was used by traders in the market to manipulate the price of Bitcoin (BTC).

In June, the University of Texas professor John Griffin released a study that claimed that Tether is used to stabilize and increase the price of BTC. At the time, Griffin said, “Tether seems to be used both to stabilize and manipulate Bitcoin prices.”

On November 20, a report published by Bloomberg stated that the Department of Justice (DoJ) is exploring the possible usage of Tether to artificially increase the value of BTC in the bull market of 2017.

Referencing Bloomberg’s report, Tether executive Leonardo Real firmly said that Tether could have only been used to manipulate the price of Bitcoin if it was unbacked by the US dollar. He noted that claims around a lack of demand for USDT are flawed as the token has consistently secured the position as the most widely utilized stablecoin in the market.

Real explained:

“The story put forth by Bloomberg cites an unbacked, independent study which claims that, if USDT were to be unbacked it could indicate manipulation of the Bitcoin price. The entire study relies on the assumption that USDT is unbacked and therefore not sufficiently driven by trader demand. This is flawed, and claims which suggest that USDT transactions aren’t driven by demand when it is consistently in the top 2 of traded cryptocurrencies in the space with regards to volume, are simply ridiculous by now.”

The latest controversy surrounding Tether is the question on the integrity of its partner bank, Deltec. On November 6, Deltec, a bank based in the Bahamas, was suspected of being involved in a Venezuelan money laundering case.

Two days after the report was released, Deltec denied any involvement in the incident, noting that Abraham Edgardo Ortega, the executive director of financial planning at Venezuela’s state-owned oil company, PDVSA, was never a client of Deltec.

“This is more misinformation that is now targeting our bankers as part of an organized campaign against us. We are proud to be working with Deltec. Their compliance and operational standards are second to none. Their compliance functions have not been compromised and they are not involved in any case that could cast doubt on their integrity,” the Tether executive said.

Tether Demand Still Strong

In spite of several controversial cases pertaining to Tether, Leonardo Real emphasized that the demand for the stablecoin remains strong.

“Demand for Tether remains steady and strong. It is the dominant stablecoin in the space because it is useful to people transacting business among exchanges.”

However, there still exists skepticism towards the stablecoin, especially regarding its unregulated nature. Unlike stablecoins based in the US that are insured, regulated, and audited, Tether is not compliant with US regulations.

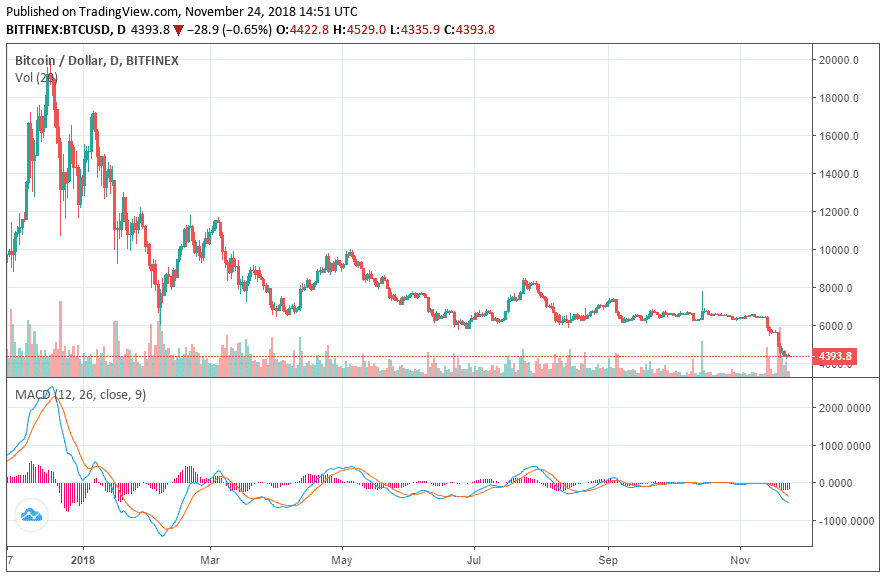

Featured Image from Shutterstock. Charts from TradingView.