Tesla’s Stock Could Hit the Skids as Analyst Presses the Brakes

Tesla's stock could take a beating next week because Elon Musk's strategy of lowering prices will erode the company's earnings power. | Source: Shutterstock

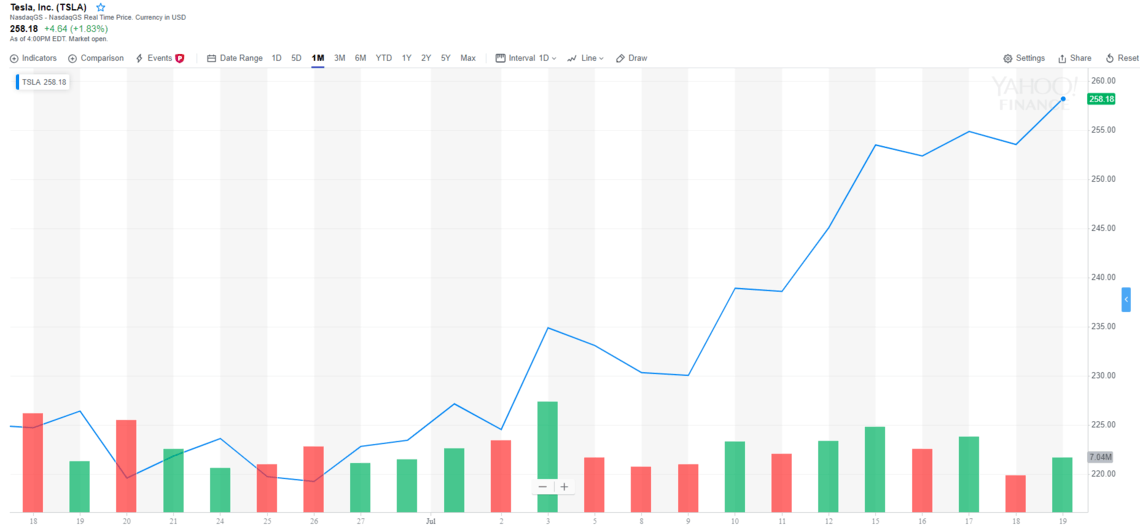

Tesla’s stock had a terrific June and has managed to sustain that momentum this month. But don’t be surprised if it takes a hit and heads lower once the company releases its fiscal second-quarter results on July 24.

Elon Musk has propped up expectations by revealing Tesla’s second-quarter delivery numbers already, which smashed estimates and gave the tech entrepreneur’s ego a nice massage.

But Musk’s lap of honor might be shortened by Tesla’s tepid guidance and weak bottom-line numbers, which could send the stock spiraling.

Wall Street Worried About Tesla’s Margins

Needham Analyst Rajvindra Gill, who holds an underperform rating on Tesla’s stock, predicts that the company’s margins will take a beating to achieve Musk’s ambition of delivering 360,000 to 400,000 cars this year. According to Gill cited in Barron’s :

“To meet these aggressive targets, we anticipate further price cuts and aggressive leasing plans. Furthermore, we expect gross and net profit margins to remain ongoing issues for the auto maker. We believe the auto maker will continue to take steps to boost its deliveries at the expense of its bottom line.”

Gill adds that Tesla will suffer from “negative earnings throughout 2019 and limited earnings power in 2020.”

The analyst has a solid point here, as Tesla has reduced the price of its vehicles both stealthily and explicitly. The price of its cheapest offering, the Tesla Model 3, has been slashed by $1,000. Meanwhile, the company has eliminated the standard range versions of the Model X and Model S from its lineup.

In this way, Tesla has raised the entry point for a potential consumer looking to buy those two vehicles. Elon Musk has probably made this move to offset the losses the company would incur by reducing the price of the Model 3.

But that might not be enough to save Tesla’s margins, as the Model 3 accounted for more than 81% of its total deliveries in the second quarter. So don’t be surprised to see Tesla’s earnings falling below estimates, and this could have a negative impact on the stock price.

However, Tesla’s stock could take an even bigger beating later in the year as the company chases its extremely ambitious delivery target.

Elon Musk Faces Herculean Task

Tesla has never delivered more than 100,000 vehicles in a single quarter. The company came close to that number in the second quarter of 2019 at 95,200. But even if it maintains that run rate, it won’t ship more than 200,000 vehicles in the second half of the year.

Assuming that Tesla somehow manages to ship 200,000 vehicles during the second half, it will still fall short of its annual target given that the company moved an estimated 158,000 vehicles in the first half of the year. Gill believes that Tesla will resort to price cuts in order to achieve those record deliveries it needs.

That might be a necessity as it is believed that demand for Tesla’s vehicles is waning, and weak sales guidance will affirm that thinking.

Given that Tesla’s stock and Elon Musk’s face hinge on the sort of guidance the electric vehicle maker delivers, further price cuts could be on the way. This will erode the company’s earnings power and could dent investor confidence, putting an end to the stock rally we have seen over the past month or so.

Wall Street expects Tesla to report a profit of $0.31 per share on revenue of $7.35 billion in the third quarter.